Full year 2023 and Q4 2023 Results

Press Release

Haaksbergen, the Netherlands

5 Mar 2024

TKH delivers well on outlook

Highlights 2023

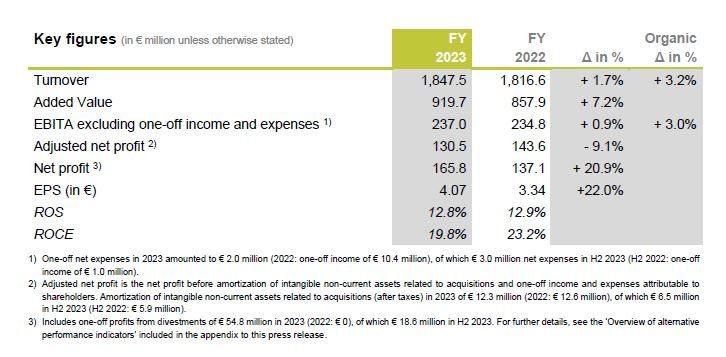

- Turnover increased by 3.2% organically to € 1,847.5 million, mainly as a result of strong performance in Smart Manufacturing systems

- Substantial increase of added value to 49.8%, underlining the strength of our businesses

- EBITA excluding one-off income and expenses increased 3.0% organically to € 237.0 million, in line with the outlook of € 230 - € 240 million

- ROS at 12.8%

- Adjusted net profit of € 130.5 million within outlook; EPS up +22.0%

- Order intake of € 1,834.9 million resulting in order book of € 970.1 million

- Continued focus on megatrends in automation, digitalization and electrification with significant strategic developments:

- Strategic investment program of € 200 million nearing completion

- Divestments resulted in a total one-off net profit contribution of € 54.8 million

- Good progress on ESG targets, improved ratings, SDGs at 70% of turnover

- Innovation at 16.1% of turnover

- High shareholder returns with completed share buyback programs of € 50 million and a proposed 2023 dividend of € 1.70 (2022: € 1.65)

- For 2024, we anticipate organic growth in turnover and EBITA, with a weak Q1 2024

Highlights fourth quarter 2023

- Turnover increased 1.2% organically to € 441.4 million, with a strong performance of Smart Manufacturing systems partly offset by continued destocking headwinds within Smart Vision and Smart Connectivity systems

- EBITA excluding one-off income and expenses increased 6.7% organically to € 62.9 million

- ROS increased to 14.3%

Alexander van der Lof, CEO of technology company TKH: “We were able to present a better than expected result in Q4 due to an excellent performance in the Smart Manufacturing segment, where we saw an acceleration of deliveries in the last few months of the year due to a catch up of delayed deliveries related to earlier supply chain constraints. ROS in the fourth quarter was a strong 14.3%, despite the headwinds from continued destocking of Smart Vision and Smart Connectivity systems.

The supply chain issues in the first half of the year, along with the necessary costs related to the roll-out of the strategic investment program, compounded by the underutilization within Smart Vision and Smart Connectivity systems due to destocking in the second half of the year, had a strong temporary negative effect on ROS. We decided to maintain the cost level and capacity in Smart Vision and Smart Connectivity systems at higher turnover levels in anticipation of market opportunities when the destocking effects are over.

With passion and dedication, we have focused on the execution of our strategy and achievement of our targets. We made good progress in implementing the strategy and associated action plans. We are accelerating our divestment opportunities to be able to increase our focus as the core technologies continue to gain traction. Many milestones were reached, related to market positioning, the R&D roadmap, and the realization of our € 200 million strategic investment program. Additionally, we invested in our software expertise, with a strong focus on Artificial Intelligence (AI), for which we established a hub in Amsterdam to centrally develop AI software solutions for the TKH group entities.

We continue to see great opportunities for further growth and we are on the right track with our investments in these exciting segments. We are confident about the anticipated recovery of Smart Vision, the rebounding of the energy market conditions in the Netherlands and a good order book for Subsea cables, but due to the headwinds, in combination with the costs and the strategic investments to capture future growth, the 17% ROS target might take longer to realize. We expect further growth of revenues and EBITA for 2024, and are well positioned to benefit from the great opportunities that will arise from the megatrends automation, digitalization, and electrification.”

ESG

TKH continues to demonstrate a strong commitment to its ESG ambitions and has realized further progress in 2023 on its key sustainability targets as set out in the Accelerate 2025 strategic program. Our net carbon footprint for scopes 1 and 2 decreased by 64.3% in 2023 compared with the reference year 2019 (2022: 42.7%). This excludes acquired carbon offsets and was mainly driven by energy efficiency measures, a higher share of renewable energy and green certificates. During the year, we obtained improved ESG ratings, including a AA rating from MSCI and a B-score from CDP (the Carbon Disclosure Project). The percentage of turnover related to the Sustainable Development Goals (SDGs) was 70% (2022: 68%).

Share buyback programs

During 2023, TKH carried out two share buyback programs of € 25 million each. The first € 25 million share buyback program, repurchasing 556,859 (depository receipts of) shares at an average share price of € 44.90 was completed in September. On December 27, 2023, TKH completed the second € 25 million share buyback program, repurchasing 681,584 (depository receipts of) shares at an average share price of € 36.68. As of December 31, 2023, the total (depository receipt of) shares outstanding amounted to 42,198,429, of which 2,400,483 were treasury shares.

Dividend proposal

The 2024 General Meeting of Shareholders will be asked to approve the payment of a 2023 cash dividend of € 1.70 per (depositary receipt for a) share (2022: € 1.65), amounting to a payout ratio of 51.8% of the net profit before amortization and one-off income and expenses attributable to shareholders and 40.8% of the net profit attributable to shareholders. The dividend will be payable on May 14, 2024.

In the fourth quarter of 2023, turnover increased organically by 1.2% and EBITA by 6.7% compared to Q4 2022. Smart Manufacturing systems performed exceptionally well in this quarter with turnover growing at 35.9%, mainly as a result of the acceleration of deliveries in Tire Building machines following the easing of supply chain constraints. Smart Vision and Smart Connectivity systems continued to be impacted by destocking at customers and weakness in several markets. ROS reached 14.3% in the quarter.

Financial developments full year 2023

Turnover reached € 1,847.5 million in 2023, an increase of 1.7% (2022: € 1,816.6 million). Adjusted for acquisitions, divestments and currency effects, turnover grew organically by 3.2%, with price effects accounting for 2.9% of the turnover. Smart Manufacturing systems was the strongest contributor to this growth, with a turnover growth of 16.8%. The divestment of TKH France at the end of Q3 2023 had a negative 1.8% impact on turnover (in Q4 2022 TKH France turnover amounted to € 32 million).

The geographical distribution of turnover shifted in favor of Asia. The turnover share in the Netherlands remained at 25% of total turnover (2022: 25%), while the share in Europe, excluding the Netherlands, declined to 39% (2022: 44%). In Asia, the turnover share grew to 19% (2022: 15%), due to a larger share of tire building machines delivered to Asia, while in North America turnover remained stable at 13% (2022: 13%). The turnover share of the other geographic regions amounted to 4% (2022: 3%).

The added value increased to 49.8% in 2023 (2022: 47.2%). All segments reported an increase in added value. Most notably Smart Connectivity’s added value went from 37.8% in 2022 to 41.8% in 2023. The increase in added value was mostly attributable to higher operational costs being passed on to customers, a changed product mix, and the impact of acquisitions and divestments.

The order intake in 2023 amounted to € 1,834.9 million (2022: € 2,042.0 million), resulting in an order book at year-end of € 970.1 million, comparable level to the record year-end 2022 (€ 971.9). The order book at Smart Manufacturing systems reached € 631.3 million (2022: € 573.0 million). The order intake at Smart Manufacturing continues to be driven by Tire Building systems, which benefitted from the effects of reshoring and the capex programs of the tire manufacturers.

Operating expenses (excluding one-off income and expenses, amortization and impairments) increased by 9.6% compared to last year. Personnel expenses increased by 9.4% due to the expansion of the workforce, following the strategic investments, and payroll increases. Manufacturing and housing costs as well as general costs also increased, due to (energy) price increases and start-up costs for our new factories. Currency effects had a limited impact.

EBITA excluding one-off income and expenses increased by 3.0% organically to € 237.0 million in 2023, from € 234.8 million in 2022. The divestment of TKH France at the end of Q3 2023 had a negative 2.2% impact on EBITA (in Q4 2022 TKH France EBITA amounted to € 5.1 million). ROS remained relatively stable at 12.8% (2022: 12.9%). Inflationary effects, EU anti-dumping duties on fibre optic cables, destocking at customers and start-up costs of our new factories all had a dampening effect on ROS. The ROS at Smart Manufacturing systems increased markedly to 15.8% (2022: 14.1%) driven by the strong turnover growth and the gradual easing of the supply chain constraints during 2023.

In 2023, one-off net expenses on EBITA-level amounted to € 2.0 million (2022: one-off income of € 10.4 million) and included, among others, reorganization costs in Smart Connectivity systems due to the closure of fibre optic cable manufacturing activities in China in Q4 2023, Smart Vision systems and acquisition and divestment costs.

Amortization increased to € 56.9 million (2022: € 54.6 million) due to the higher amortization of capitalized R&D, as a result of increasing investment in previous years. Impairments amounted to € 3.7 million (2022: € 0.5 million) and were mostly related to discontinued R&D projects.

Net financial expenses increased to € 22.1 million (2022: € 9.7 million), due to the combination of higher debt levels and higher interest rates. The results from associates amounted to € 51.5 million (2022: € 3.1 million), and includes the one-off net profit contributions from the divestments of CCG and TKH France in 2023.

The normalized effective tax rate decreased slightly to 24.6% in 2023 from 24.8% in 2022. TKH benefitted from R&D tax facilities in several countries.

Net profit before amortization of intangible non-current assets related to acquisitions and one-off income and expenses attributable to shareholders decreased by 9.1% to € 130.5 million (2022: € 143.6 million). Net profit increased 20.9% to € 165.8 million (2022: € 137.1 million). Earnings per share before amortization, one-off income and expenses amounted to € 3.21 (2022: € 3.50). Ordinary earnings per share were € 4.07 (2022: € 3.34).

Net bank debt according to bank covenants increased by € 162.0 million from year-end 2022 to € 469.2 million at year-end 2023. The main items affecting the debt level include the increase in working capital (€ 71.3 million), net investments in property, plant, and equipment of € 177.0 million (of which € 134.2 million is related to the strategic investment program), dividends paid (€ 67.7 million), share buybacks (€ 50.0 million), acquisitions (net € 70.5 million), and investments in intangible assets (€ 53.1 million). Divestments amounted to € 130.5 million in 2023, including the € 54.8 million in one-off profits. At year-end 2023 € 18.0 million assets were held for sale (year-end 2022: € 75 million). Cash flow from operating activities amounted to € 152.9 million (2022: € 116.2 million), an improvement largely due to a lower working capital increase in 2023 compared to a year earlier. Working capital stood at 16.7% of turnover (2022: 12.9%). The net debt/EBITDA ratio, calculated according to TKH’s bank covenant, was 1.8, well within the financial ratio agreed with our banks. Solvency improved to 39.3% (2022: 38.0%).

At year-end 2023, TKH employed a total of 6,899 FTEs (2022: 6,607), of which 434 were temporary employees (2022: 409 FTEs).

Developments per technology segment

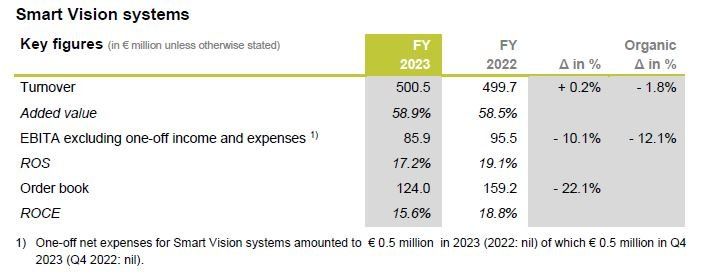

In 2023, turnover in Smart Vision systems increased marginally by 0.2% to € 500.5 million. Adjusted for acquisitions and currency effects, turnover decreased organically by 1.8%, with price effects accounting for a 3.2% increase of turnover. The order book decreased by 22.1% to € 124.0 million (2022: € 159.2 million). The added value increased slightly from 58.5% to 58.9%. Due to higher operating expenses combined with lower turnover growth, EBITA decreased to € 85.9 million (- 10.1%) and ROS reached 17.2%.

Vision Technology – Turnover in Security Vision achieved growth in 2023, due to winning a few larger projects for building applications and traffic monitoring security systems. The parking guidance systems showed an improved performance and a partial market recovery. The easing of supply chain shortages also supported the growth here. In Machine Vision, the performance at the start of the year was good, supported by the battery and solar market. In the second half of the year, Machine Vision experienced a large impact from destocking and in some areas a weaker demand due to reduced end user activity, mainly related to the factory automation market. Overall, the turnover for the Machine Vision declined throughout the year, for both 2D and 3D. During the year, we further strengthened our market positioning and cooperation within the group to take advantage of our one-stop-shop solutions and TKH Vision group’s position as the technology partner for our customers. Specific developments were initiated to offer plug and play system integration, facilitated by software including AI propositions.

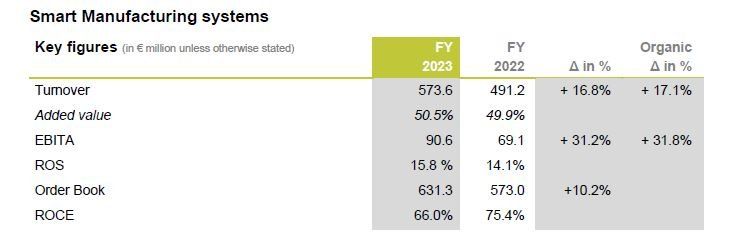

Smart Manufacturing systems showed strong turnover growth. Adjusted for currency effects, turnover grew organically by 17.1%, with price effects amounting to 1.8%. The order book grew by 10.2% compared to the previous year-end and peaked at € 631.3 million on December 31, 2023 (2022: € 573.0 million) with a significant contribution from Tire Building systems. The added value increased slightly from 49.9% to 50.5%. EBITA was up 31.8% organically at € 90.6 million. The ROS expanded to 15.8% (2022: 14.1%).

Tire Building systems – Tire Building systems benefitted from the easing of supply chain constraints in the second half of 2023. As a result, a large inventory of incomplete machines could be completed and delivered to customers, adding to the strong operating performance. Order intake for both passenger and truck tire systems in 2023 continued to be high. Drivers for these growing levels of intake are investments related to the production of more sustainable tires, the rise of electric vehicles and the need for more automation. Also, a high level of activities within the Tire Building industry related to reshoring has been an important driver for the high order intake. The expansion of the factory in Poland started production and capacity was successfully ramped up in the second half of 2023. A further expansion of these production facilities are due to come on stream in the first half of 2024. At the beginning of 2024, an order was booked for a UNIXX system, on the back of the large interest in the market, which proves the success of this advanced technology and is a major milestone for further growth in this segment.

Other – The activities related to industrial automation as well as the other industrial activities developed well. New orders were received for the Indivion and further interest in this exceptional system has been generated.

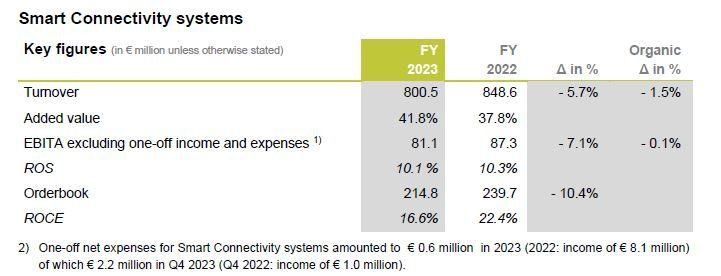

Turnover in Smart Connectivity systems decreased 5.7% to € 800.5 million in 2023 (2022: € 848.6 million). The effect of the divestment of TKH France on this segment’s turnover was a decrease of 3.8%. Adjusted for acquisitions, divestments and currency effects, turnover declined organically by 1.5%, with price effects amounting to + 3.2%. The order book decreased to € 214.8 million (2022: € 239.7 million). Added value as a percentage of turnover rose to 41.8% from 37.8% in 2022, mainly due to the effect of price increases to cover cost inflation and mix effects including the divestment. EBITA decreased marginally by 0.1% organically to € 81.1 million, mainly due to the divestment of TKH France and higher personnel and manufacturing expenses as a result of increased headcount in anticipation of the ramp-up in production capacities. In total, around 200 employees were hired for the ramp-up of the new production facilities. EU anti-dumping duties on fibre optic cables had a € 7.5 million negative impact on EBITA. Impacted by the divestment, lower volumes, and related underutilization in the second half of the year, ROS decreased to 10.1%.

Electrification – After a strong first half year, onshore energy cable turnover was impacted by destocking in the second half of 2023, due to delays encountered by the Dutch utility companies with the roll-out of their network infrastructure projects. The offshore Subsea cable capacity was underutilized in the second half of this year due to the postponement of an order. The new plant for Subsea cables in Eemshaven is on schedule to be operational during the second quarter of 2024. The production of prototype cables has already started in Q1 2024 and is running smoothly. We are excited to see the success of our innovative dry design technology in Subsea gaining traction, as evidenced by the framework agreement with Vattenfall, and the prospects for new orders in the coming quarters. The strategic investment program also prepared TKH for substantial additional capacity in medium and high voltage onshore energy cable in anticipation of substantial growth in the coming years. It is not expected that this capacity will be fully utilized before 2025.

Digitalization – In the second half of 2023, digitalization was impacted by the doubling of the EU anti-dumping duties and the implementation of anti-dumping duties on optical fibre cables from China to the United Kingdom. As a result, TKH decided to close the cable production activities in China and transferred the capacity to the new fibre optic plant in Poland during Q3. This new fibre optic plant was officially opened early September and is rapidly ramping up production. The transition of production from China to Poland temporarily impacted output and cost levels.

Other – Revenues were driven by the strong demand for specialized and customized connectivity systems for the machine-building, robotics, and medical industries. The new specialty cable factory in Poland was officially opened in early September.

Outlook

TKH has made strong progress in its strategic positioning in 2023. With over 15% of turnover from innovations and the completion of the € 200 million strategic investment program, TKH is well positioned for further growth.

For Q1 2024, we anticipate Smart Manufacturing systems to grow compared to Q1 2023. Smart Vision and Smart Connectivity systems will face continued weak market demand. Overall, turnover and EBITA are expected to decrease in Q1 2024 compared to Q1 2023.

For the full year, we expect Smart Manufacturing systems to return to more normalized growth when compared to last year. In Smart Vision systems, we expect growth to return in the second half of 2024, on the back of market recovery. Within Smart Connectivity systems, we anticipate the destocking of onshore energy cables in the Netherlands to continue throughout the year. Barring unforeseen circumstances, we anticipate organic growth in turnover and EBITA in 2024.

TKH will provide a more specific outlook for the full year of 2024 at the presentation of its interim results in August 2024.

You can follow the presentation of the full-year results on March 5, 2024 at 10:00 CET via video webcast (www.tkhgroup.com).

Haaksbergen, March 5, 2024

The complete press release can be downloaded in PDF