Full year 2019 Results

Press Release

Haaksbergen, the Netherlands

5 Mar 2020

TKH realizes increase in turnover and result in 2019 - Good progress ‘Simplify & Accelerate’-program

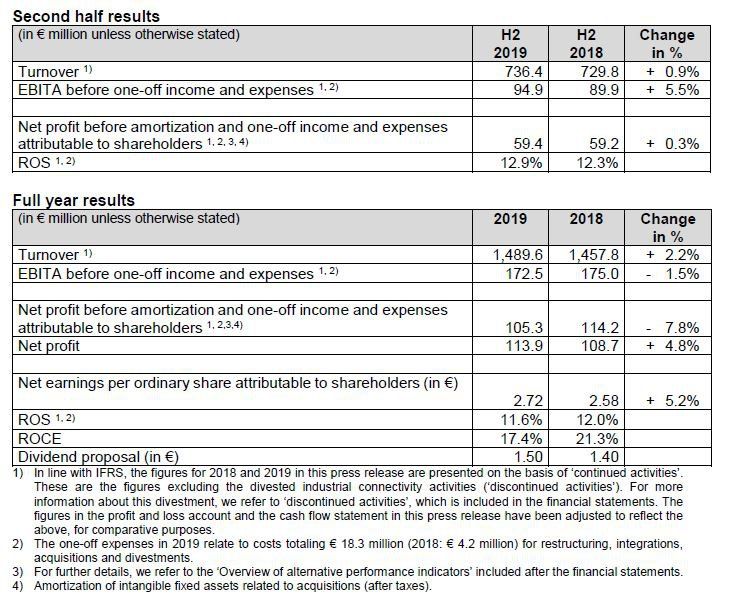

Highlights second half 2019

- Turnover increases by 0.9% to € 736.4 million, organic -3.9%

- EBITA before one-off income and expenses increases by 5.5%, driven by higher turnover and an improved product mix – particularly at Building Solutions.

- ROS increases to 12.9% due to an improved product mix and cost efficiencies.

- Net profit before amortization and one-off income and expenses rises slightly by 0.3%.

- One-off expenses and impairments totaling € 23.3 million due to costs related to restructuring, integrations, acquisitions and divestments.

- Divestments:

- Majority of industrial connectivity activities, recognized as ‘discontinued activities’ – book profit of € 38.9 million.

- ZTC (China), recognized as ‘assets held for sale’, closed beginning 2020.

Financial highlights 2019

- Turnover increases by 2.2% to € 1,489.6 million, organic -1.9%.

- EBITA before one-off income and expenses declines by 1.5% – decline in Industrial Solutions due to market conditions, increase in Telecom and Building Solutions.

- Net profit before amortization and one-off income and expenses attributable to shareholders declines by 7.8% to € 105.3 million – in line with the previously communicated bandwidth (€ 102 - € 108 million).

- Dividend proposal: € 1.50 per (depositary receipt of an) ordinary share (2018: € 1.40).

Strategic highlights 2019

- Good progress ‘Simplify & Accelerate’ program:

- Divestment activities on schedule: € 250 million turnover of the targeted € 300 to € 350 million in divestments already realized.

- Integration of vision and security businesses proceeds well.

- Growth in order book and outstanding quotations in subsea and Airfield Ground Lighting (AGL) activities.

- Turnover share from vertical growth markets > 60%.

- Acquisitions of innovative technology companies ParkEyes, Commend AG, SVS-Vistek and FocalSpec.

- Increase in existing committed credit facility to € 500 million, from € 350 million, with unchanged conditions and duration.

Alexander van der Lof, CEO of technology company TKH: “The past year was a turbulent one, due to geopolitical and social developments, which resulted in a reluctance to invest in a number of market segments. We booked good progress in our strategic transformation program 'Simplify & Accelerate'. We are now better positioned to take advantage of economies of scale and synergies. We are also well on track to achieve our return targets and to take our value creation to a higher level. TKH realized a ROS of 12.9% in the second half of the year, despite the headwinds we faced in a number of end markets, which means it is moving firmly in the direction of our ROS target of at least 15%, a target we raised mid-2019. Macroeconomic uncertainties have increased in recent months. So far, the impact of the coronavirus seems limited for TKH. This also applies to the nitrogen and PFAS crisis in the Netherlands and possible international trade barriers. It remains difficult to predict possible future consequences. The order book of the entire TKH Group provides a strong basis for further value creation, as a result of which TKH is well positioned for the medium term.”

Progress in realization of objectives and execution of strategy

In the year under review, we took an important step with the introduction of our 'Simplify & Accelerate' program. TKH sees the execution of the program as a high priority and it has broad support across the organization. The divestment of activities with limited organic growth potential is on track. We have already realized € 250 million of the intended € 300 to € 350 million turnover in divestments. In addition, TKH has reduced the number of operating companies through integration with a focus on economies of scale. This has resulted in a simplified organizational structure with fewer companies and a focus on activities with higher value creation potential.

The execution of the program resulted in one-off expenses of € 18.3 million in 2019 and an impairment of € 5.0 million. These expenses are related in particular to:

- The proposed decision to relocate the cable production in Ittervoort to Haaksbergen and the discontinuation of the poorly performing activities in the industrial connectivity portfolio.

- Integration of security activities and portfolio under the brand name TKH Security, the merger of the activities in Singapore, and the integration of our Parking activities and portfolio.

- Phasing out of the Dutch system integration activities.

- Integration of 2D vision activities and portfolio and increased commercial cooperation between 2D and 3D Vision.

- Implementation of cost-saving measures in the French and German Building connectivity activities.

- Integration of the TKH Airport Solutions organizations in the Netherlands, Germany and Denmark.

- Integration of Ognios (mission critical communication) in the Commend organization.

- Costs of the divestment of the Chinese operating company ZTC, manufacturer of copper data communications cables.

- Costs for the acquisition of Commend AG, ParkEyes, SVS-Vistek and FocalSpec.

The integration projects and improved returns will have an estimated positive impact of € 7 to € 8 million annually on the results from 2021 onwards. We expect to realize around € 5 million of this in 2020.

We also made good progress with our innovations in terms of both technology and market penetration. These now account for 20.5% of turnover. Key new developments include innovations in machine vision for 5G smartphone manufacturing systems, UNIXX tire building technology, subsea cable systems and CEDD/AGL connectivity technology. The new product launches and the contracts we acquired provide a strong basis for growth and continued value creation.

Financial developments second half of 2019

Turnover increased by € 6.6 million (0.9%) to € 736.4 million in the second half of 2019 (H2 2018: € 729.8 million). Acquisitions contributed 4.5%. Lower raw materials prices had a marginal impact of 0.1% on turnover, while exchange rates had a positive impact of 0.4%. On balance, we recorded an organic turnover decline of 3.9% compared with the second half of 2018. Industrial Solutions realized the largest organic decline (7,0%) as a result of disappointing market conditions. Building Solutions recorded an organic decline of 3.4% in turnover, while Telecom Solutions saw turnover increase by 2.8%.

The gross margin increased to 49.0% (H2 2018: 47.4%). However, operating expenses increased by 3.8% compared with the second half of 2018 as a result of acquisitions.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 5.5% to € 94.9 million in the second half of 2019 (H2 2018: € 89.9 million). Telecom and Building Solutions recorded particularly strong growth in EBITA compared to the second half of 2018, while EBITA at Industrial Solutions declined. The ROS for the TKH group was 12.9% in the second half of 2019 (H2 2018: 12.3%).

In the second half of 2019, financial expenses were € 3.1 million higher than the previous year. Interest expenses increased due to the application of IFRS 16 and a higher average outstanding bank debt. In addition, adverse currency effects had a negative impact of € 0.4 million (H2 2018: € 0.7 million gain).

The effective tax rate in the second half of 2019 was 23.2% and virtually unchanged from the first half of 2019, but higher than in the second half of 2018 (20.5%).

Net profit from continued activities before amortization and one-off income and expenses attributable to shareholders increased by 0.3% to € 59.4 million (H2 2018: € 59.2 million).

Financial developments full year 2019

Turnover increased by € 31.9 million (2.2%) to € 1.489,6 million in 2019 (2018: € 1,457.8 million). TKH recorded an organic decline in turnover of 1.9%. Acquisitions made a 3.9% contribution to turnover. Lower raw materials prices had a negative impact of 0.2% on turnover, while currency exchange rates had a positive impact of 0.4%.

At Telecom Solutions, organic turnover growth was 3.1% in 2019, while Building and Industrial Solutions saw declines of 2.7% and 2.8% respectively.

The gross margin rose to 48.2% in 2019, from 47.3% in 2018. This increase was partly due to a changed product mix, the normalization of start-up costs for new technologies and lower purchasing prices.

Operating expenses before one-off expenses increased by 6.0% compared with 2018, mainly due to acquisitions (+5.2%) and currency exchange effects (+0.6%). R&D expenses, 55.5% of which were capitalized as development expenses (2018: 49.6%), increased to € 63.2 million in 2019 (2018: € 60.8 million), due to the acquisition of technology companies. Operating expenses as a percentage of turnover increased to 36.6% in 2019, from 35.3% in 2018. This increase was mainly due to the expansion of production capacity in 2018 and lower production levels in 2019 for subsea and industrial cable systems. In the course of the year, we maintained capacity at a higher level than required in the short term, in view of the medium-term growth perspective. Depreciations amounted to € 45.3 million in 2019, up € 19.2 million when compared with 2018. This was due to the depreciation expense resulting from the capitalization of right-of-use assets as a result of the implementation of IFRS 16 Leases as of 1 January 2019 (+ € 16.1 million), as well as a higher investment levels than in previous years.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) amounted to € 172.5 million in 2019, down 1.5% from the € 175.0 million recorded the previous year. EBITA at Telecom and Building Solutions was up 9.5% and 8.5% respectively, while EBITA at Industrial Solutions declined by 11.8%. ROS dropped to 11.6% (2018: 12.0%).

The ‘Simplify & Accelerate’ program and the acquisition costs together resulted in one-off expenses of € 18.3 million (2018: € 4.2 million) for the full year 2019 and an impairment of € 5.0 million (2018: € 1.5 million).

Amortization costs were € 10.0 million higher at € 50.1 million, primarily due to acquisitions (+ € 6.8 million) and high R&D investments in recent years.

Financial expenses increased by € 3.8 million to € 10.1 million in 2019, due to the application of IFRS 16 and a higher average outstanding bank debt. Currency effects also had a negative impact of € 0.9 million (2018: negative impact of € 0.2 million). The result from other associates was € 1.5 million lower due to lower volumes and prices of preforms at associate and preform producer Shin-Etsu in China, while one-off expenses are still having a downward impact on the contribution from the new minority interest in Cable Connectivity Group.

The effective tax rate was 23.1% in 2019 (2018: 21.8%). Fiscal R&D facilities, such as the Dutch innovation box facility, had a downward impact on the overall tax rate. Non-deductible impairments increased the effective tax rate by 0.5% in 2019.

Net profit from continued activities before amortization and one-off income and expenses attributable to shareholders declined by 7.8% to € 105.3 million in 2019 (2018: € 114.2 million). The divestment of the majority of TKH’s industrial connectivity activities, recognized as ‘discontinued activities’, resulted in a gain of € 45.2 million (2018: € 10.8 million), including a net book profit of € 38.9 million.

Net profit for the full year 2019 amounted to € 113.9 million (2018: € 108.7 million). Earnings per share before amortization and one-off income and expenses amounted to € 2.51 (2018: € 2.72). The ordinary earnings per share amounted to € 2.72 (2018: € 2.58).

The cash flow from ordinary operations was € 182.2 million in 2019 (2018: € 126.7 million). In 2018, a significant increase in working capital had a negative impact on cash flow, while 2019 saw only a minor change in working capital. At year-end 2019, working capital as a percentage of turnover had declined to 13.0% (2018: 13.9%), and remained within the bandwidth set of 12-15%. Net investments in tangible fixed assets were lower than in previous years at € 30.6 million in 2019 (2018: € 40.0 million). A major part of this was related to investments in production facilities. Investments in intangible fixed assets for R&D, patents, licenses and software increased to € 40.4 million, largely due to the acquisition of the technology companies (2018: € 35.2 million). Total spending on acquisitions was € 65.5 million in 2019 (2018: € 116.2 million). The divestment of the majority of TKH’s industrial connectivity activities generated proceeds of € 83.5 million. On the other hand, TKH acquired a 41.5% minority interest in Cable Connectivity Group for € 16.4 million.

Solvency improved slightly to 43.7% in 2019 (2018: 42.4%). TKH’s net bank debt, calculated in accordance with the financial covenants, had declined to € 300.6 million at year-end 2019, down € 26.1 million compared to year-end 2018. The net debt/EBITDA ratio stood at 1.5, which means TKH was operating well within the financial ratio agreed with its banks.

TKH had 5,980 employees (FTEs) at year-end 2019 (2018: 6,533 FTEs). Divestments reduced the total number of employees by 606 FTEs. Acquisitions accounted for an increase of 161 FTEs. The company also had 310 (FTEs) temporary employees (2018: 482 FTEs).

Development per solutions segment

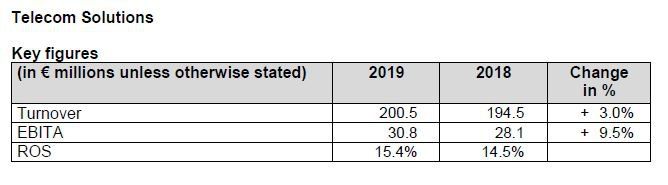

Telecom Solutions

Telecom Solutions represents the core technologies connectivity, vision & security and mission critical communication. TKH develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. Around 40% of the portfolio consists of hub-to-hub optical fibre and copper cable systems. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in network hubs.

Turnover in the Telecom Solutions segment was 3.0% higher at € 200.5 million. Organic turnover growth was 3.1%, while currency exchange rates had a negative impact of 0.1% on turnover. Growth was realized primarily in the sub-segment fibre network systems.

EBITA was up € 2.7 million. The ROS improved to 15.4% from 14.5%

Fibre network systems - optical fibre, optical fibre cables, connectivity systems and components, active peripherals – turnover share 8.8%

This sub-segment saw organic turnover growth of 4.7%. The slowdown in growth in China was offset by growth in turnover in optical fibre network systems in Europe. This growth was recorded mainly in France and Germany. We were able to compensate for pressure on prices in the Chinese market through the lower purchasing prices of raw materials for optical fibre and a higher contribution to turnover from the connectivity portfolio. This resulted in an improvement in gross margin. We completed the expansion of the optical fibre production capacity in the second half of 2019.

Indoor telecom & copper networks - home networking systems, broadband connectivity, IPTV software solutions, copper cable, connectivity systems and components, active peripherals – turnover share 4.7%

Turnover in this sub-segment saw organic growth of 0.1%. Growth stagnated in the second half of the year due to reduced demand for broadband connectivity and connectivity components.

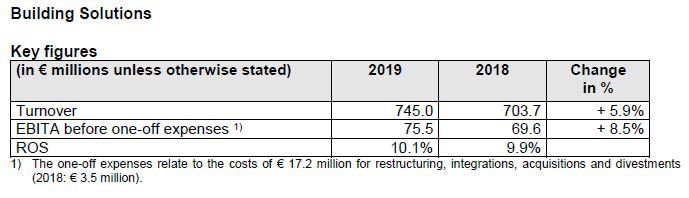

Building Solutions

Building Solutions connects the core technologies vision & security, mission critical communications and connectivity in comprehensive solutions for security and communications applications in and around buildings, as well as for industrial inspection, quality, product and process controls. Building Solutions also focuses on efficiency solutions to reduce throughput times for the realization of installations within buildings, and on intelligent video, mission critical communications, evacuations, access (control) and registration systems for a number of specific sectors, including healthcare, parking, marine and offshore, tunnels and airports.

Turnover at Building Solutions was 5.9% higher at € 745.0 million. The segment saw an organic turnover decline of 2.7%. Acquisitions contributed 8.0% to the growth. Currency exchange rates had a positive impact of 0.8% on turnover, while lower raw materials prices had a negative impact of 0.3% on turnover.

EBITA before one-off expenses increased by 8.5% to € 75.5 million. EBITA improved significantly in the second half of 2019, when compared with the first half of the year, due to increased turnover and a higher gross margin. ROS improved slightly, to 10.1% in 2019, from 9.9% in 2018, and increased to 12.2% in the second half of the year.

Vision & Security systems – vision technology based on 2D and 3D camera sensor technology and 3D laser technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration, healthcare systems – turnover share 27.6%

Turnover in this sub-segment increased by 5.8%, but declined organically by 10.2%. In 2019, Machine Vision was affected by a reluctance to invest among consumer electronics manufacturers. This reluctance was also noticeable in other segments, although the fourth quarter saw a slight increase in the sectors consumer electronics, industrial automation and inspection. The vision technology TKH has developed for new applications in the 5G network-related consumer electronics industry resulted in the first contracts and deliveries. We also noted strong interest in this industry for the FocalSpec sensors, a 3D technology TKH acquired in the fourth quarter. These technologies put TKH in a good position to respond to the expected strong increase in demand for these applications.

In Parking, TKH saw a decline in turnover from larger projects in the field of parking guidance systems. A key step was made with the acquisition of ParkEyes, which gives us access to smaller and mid-sized car parks. In late 2019, the ParkEyes portfolio also gained certification for the US market.

In Tunnel & Infra, growth was driven by the roll-out of our vision-based traffic management solutions in the US market.

In 2019, we combined the activities of the security-related companies in TKH Security, which we will also be marketing as a brand. We also decided to phase out the Dutch system integration activities. This meant organic turnover growth was limited.

The 'Simplify & Accelerate' program resulted in one-off expenses and impairments for restructuring and integration operations and the phasing out of a number of activities. These expenses were primarily related to the machine vision, mission-critical communication and security activities. We also incurred acquisition costs.

Connectivity systems – specialty cable (systems) for shipping, rail, infrastructure, wind energy, as well as installation and energy cable for niche markets, structured cabling systems and connectivity systems for wireless energy and data distribution – turnover share 22.4%

Turnover in this sub-segment increased organically by 6.6%. A considerable amount of this growth came from the vertical growth market Tunnel & Infra. We also saw healthy growth as a result of the increase in our market share in Airfield Ground Lighting (AGL). We are seeing a continued increase in the interest in our innovative CEDD technology for AGL, which integrates various TKH technologies and competencies. Turnover in energy cable systems also saw continued strong growth, driven by major investment requirements for energy networks.

In Marine & Offshore, we saw a decline in turnover due to lower turnover of subsea cable systems, due to the fact that we were unable to focus fully on acquiring new orders until the fourth quarter of 2018. As a result of this, no production was involved in the first half year. At the end of the fourth quarter of 2019, we started production for the delivery of the array connectivity systems for the 'Fryslân' wind park in the Netherlands. In addition, we closed a contract for a second wind farm and saw a further increase in our quotation portfolio, which underlines the substantial growth potential of these activities for the coming years.

The costs of our CEDD/AGL and subsea activities are still exceeding the income from these activities.

Turnover in structured data cable systems was higher in 2019. However, the Dutch construction and infrastructure sector was confronted with the nitrogen and PFAS problem, which had a negative impact on turnover growth, especially in the fourth quarter.

In the fourth quarter of last year, we announced the proposed decision to end cable production in Ittervoort and transfer the core business to Haaksbergen. We are also implementing restructuring measures in Germany and France to increase cost efficiency. We recorded a reorganization provision and recognized an impairment on machinery in connection with these measures.

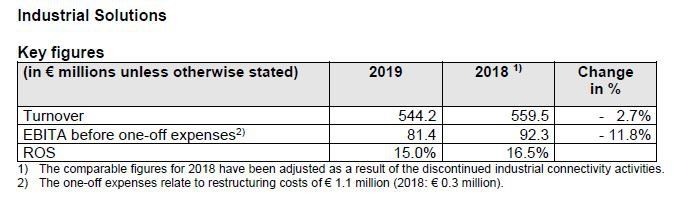

Industrial Solutions

Industrial Solutions represents the core technologies connectivity, vision & security and smart manufacturing. TKH develops, produces and delivers specialty cable and plug and play cable systems. TKH’s know-how in the automation of production processes and improvements in the reliability of production systems gives the company the differentiating potential it needs in a number of specialized industrial sectors, such as tire manufacturing, robot, medical and machine-building industries.

Turnover in the Industrial Solutions segment declined by 2.7% to € 544.2 million. Currency exchange rates had a marginally positive impact of 0.1%, which was offset by on average lower raw materials prices. The segment saw an organic turnover decline of 2.8%.

EBITA declined by 11.8% as a result of lower turnover and production capacity utilization. The ROS declined in line with this to 15.0% (2018: 16.5%).

Manufacturing systems – advanced manufacturing systems for the production of car and truck tires, can washers, test equipment, product handling systems for the medical industry, machine operating systems, specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 36.5%

TKH divested the majority of the industrial connectivity activities as of August 2019, since they were insufficiently aligned with our advanced technology strategy and continued focus on our vertical growth markets. The remaining industrial connectivity activities are limited in size and we have therefore integrated these in manufacturing systems. The demand for specialty cables and cable systems weakened in the automotive and robot industries in the fourth quarter.

Turnover in Tire Building was at a lower level in the fourth quarter, but for the year as a whole remained at the same level as the previous year. There was reluctance among the top-five tire manufacturers due to negative developments in the automotive industry. Nevertheless, the order book was higher at year-end 2019 than a year earlier, due to increased order intake from other customers. The development of the UNIXX integrated tire-building machine (new tire-building platform) is progressing well. The first UNIXX has been installed at a launching customer.

The renewed Indivion, a high-quality automated medicine dosing and distribution system, was delivered to a launching customer in the fourth quarter and is now available for active sales.

Dividend proposal

At its General Meeting, TKH will propose a dividend of € 1.50 per (depositary receipt of a) share (2018: € 1.40). Based on the number of outstanding shares at year-end 2019, this amounts to a pay-out ratio of 59.8% of the net profit before amortization and one-off income and expenses attributable to shareholders and 55.2% of the net profit attributable to shareholders. TKH will propose the payment of a cash dividend to be charged to the reserves. The dividend will be payable on 15 May 2020.

Nomination for appointment Supervisory Board

Mr. R.L. (Rokus) van Iperen will step down at the end of the General Meeting of 7 May 2020 in accordance with the current retirement schedule. Mr. Van Iperen is eligible for reappointment for a period of two years. The Supervisory Board nominates Mr. Van Iperen for reappointment by the General Meeting.

In view of the vacancy that will arise in 2021 for the position of Mr. P.P.F.C. Houben due to the expiration of his statutory term, the Supervisory Board has also decided, partly with a view to safeguarding the knowledge and thus the continuity of the Board, to propose to the General Meeting of 7 May 2020 that Mrs. M. (Marieke) Schöningh will be appointed as a member of the Supervisory Board. Mrs. Schöningh is Chief Operating Officer and Member of the Management Committee of SHV Energy, and has the Dutch nationality. Subject to the (re)appointment by the General Meeting, the number of members of the Supervisory Board will temporarily increase to six. Further information will be provided in the notice convening the General Meeting of Shareholders which will be published ultimately on 26 March 2020.

Outlook

Macroeconomic uncertainties have increased in recent months. The impact of the coronavirus on TKH seems limited so far, but is yet difficult to estimate. This also applies to the nitrogen and PFAS effects in the Netherlands and possible trade barriers. Barring unforeseen circumstances and an escalation in the aforementioned situations, we expect the following developments per business segment for the year 2020.

Telecom Solutions

We expect a further increase in investments in optical fibre networks in Europe. Since we have a good market position in Europe and have invested in capacity expansions, we expect to be able to realize growth. The current overcapacity in the Chinese market may translate into pressure on margins, but we expect this to be offset by a better product mix.

Building Solutions

In Machine Vision, we see continued reluctance to invest on the part of consumer electronics manufacturers and within the automotive sector due to macro-economic uncertainties. Nevertheless, we expect growth as a result of the continued roll-out of our new portfolio and the contribution from acquisition in 2019.

In addition, we expect growth in Parking due to a number of larger projects currently in the pipeline. In Marine & Offshore, we expect growth for subsea cable systems based on order intake and ongoing quotations and we intend to scale-up production. This will result in a higher coverage ratio and therefore an improvement of the result.

In Tunnel & Infra, we see continued growth in demand for cable systems from the energy sector, which will lead to further growth in turnover. We also expect to realize growth with the AGL portfolio for airports, with the share of our distinctive CEDD technology set to increase. In the other activities within Building Solutions, we expect an improvement in the result due to the effects of our 'Simplify & Accelerate' program.

Industrial Solutions

Within the industrial sector, there is a reluctance to invest, particularly among German machine manufacturers and in the robot industry, partly due to developments in the automotive industry. As a result, we expect a decline in turnover for industrial connectivity systems, partly due to a targeted discontinuation in part of the portfolio. Order intake in Tire Building declined in the second half of 2019, due to a reluctance to invest as a result of the difficult situation in the automotive industry. We expect a decline in both turnover and result in this segment.

As usual, TKH will give a more specific profit forecast for the full-year 2020 at the presentation of its interim results in August 2020.

The complete press release can be downloaded in PDF.