Full year 2020 Results

Press Release

Haaksbergen, the Netherlands

9 Mar 2021

Strong operational cash flow and good order intake in Q4 despite impact COVID-19 in 2020

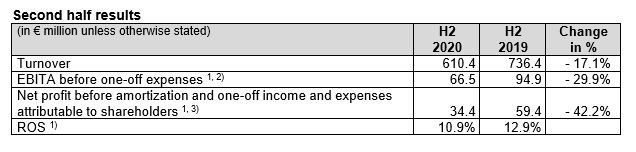

Highlights second half 2020

- Result exceeded indicated outlook bandwidth.

- Turnover declined by 17.1% to € 610.4 million, organic decline of 12.5%.

- EBITA before one-off income and expenses down 29.9% at € 66.5 million.

- ROS increased slightly to 10.9% (H1 2020: 10.2%), driven by Building Solutions.

- Good order intake in the fourth quarter, partly due to high order intake in Tire Building.

- One-off income and expenses totalling € 3.3 million (expense) - impairments of € 2.4 million.

- Net profit before amortization and one-off income and expenses attributable to shareholders down 42.2% at € 34.4 million.

- Cash flow from operating activities increased strongly to € 150.1 million (H2 2019: € 126.6 million and H1 2020: € 37.7 million) - driven by strong working capital improvement Q4.

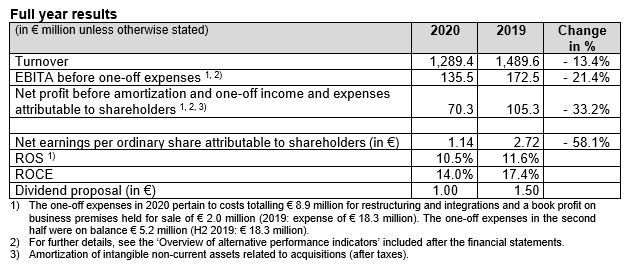

Financial highlights 2020

- Turnover down 13.4% at € 1,289.4 million, organic decline 9.9%.

- EBITA before one-off income and expenses declines by 21.4% to € 135.5 million – strongest decline in Industrial Solutions, increase in Building Solutions.

- ROS remained at good level of 10.5%, despite lower turnover.

- Net profit before amortization and one-off items attributable to shareholders down 33.2% at € 70.3 million – above the previously communicated bandwidth (€ 65 - € 69 million).

- Solid financial position at year-end – net debt / EBITDA ratio 1.6.

- Dividend proposal: € 1.00 per (depositary receipt for) ordinary share (2019: € 1.50).

Strategic highlights 2020

- Good progress in strategic development, despite COVID-19, driven by 'Simplify & Accelerate' program.

- Successful introduction of and progress on innovations provide a strong basis for growth and further value creation.

- Innovations again at high level, with 21.1% revenue share – R&D programs continued despite cost saving programs.

- Turnover share of vertical growth markets increased to 63.0%.

- Progress on the share buy-back program – At 8 March 2021 € 18 million of the announced € 25 million of treasury shares purchased.

Alexander van der Lof, CEO of technology company TKH: "The consequences of the COVID-19 pandemic had a clear impact on the results in the 2020 financial year, and we expect to continue to feel this impact in the first half of 2021. The health of our employees and the continuity of our business remain our priority.

The impact of COVID-19 on our business eased somewhat from the third quarter of 2020 onwards, although capital expenditure still lagged, resulting in a low order intake in Industrial Solutions over the first nine months. This recovered in Q4 with a high order intake, especially within Tire Building. There were also activities that showed healthy growth in 2020. This applied to both our Machine Vision business, where we saw the effects of innovations introduced for consumer electronics and medical applications, including a COVID-19 vaccine analysis tool, plus our connectivity solutions that respond to the high demand for the upgrading of energy networks.

The strength of TKH’s strategy is shown in the development of our ROS, which despite the sharp decline in turnover over the course of the year, remained at a good level of 10.5%. This was primarily due to the refinement of our strategy via the Simplify & Accelerate program. The implementation of this program is well on track. The share buy-back program we announced in November further underlined TKH's confidence in its strong financial foundation. But above all, the confidence in our strategy and potential to realize growth through our many innovations, which show a good progress, both in terms of technology and market penetration. At 21%, turnover from innovations was again at a high level in 2020. Our product launches and the orders we have acquired provide a strong basis for growth, and we are positive on our value creation potential in the medium term".

Impact COVID-19

Since the outbreak of the pandemic, COVID-19 has had a negative impact on both TKH's turnover and result. For one, the stricter measures in various countries in the course of the year had a substantial impact. The (temporary) easing of restrictions, especially in the summer and autumn, did restore opportunities for deliveries, but these did not recover to previous levels.

TKH has taken a large number of measures to minimize the impact of COVID-19 on its business operations. It is difficult to quantify the impact of COVID-19 on the 2020 results with any degree of accuracy. For the financial impact of COVID-19, the following elements had an impact on our results:

- The health of our employees and the continuity of our business were our main priority. By taking measures at an early stage, we were able to limit the impact on our business operations. The measures taken, aimed at providing a safe and healthy working environment, resulted in a significant drop in productivity and coverage at our production companies. In addition, demand was lower due to the fact that our customers had problems in the realization of projects. Investments were reduced or postponed in some segments. This was particularly applicable for investments for airports, car parks, shipbuilding and the industrial sector.

- TKH made limited use of the available COVID-19 government support, mostly consisting of schemes to retain jobs or a form of short-time working. This led to a temporary reduction of personnel costs of € 6.8 million. TKH did not make any use of government aid in the Netherlands.

- TKH introduced various cost-saving measures, but we did not incur any significant reorganization costs directly related to COVID-19.

- TKH evaluated additional scenarios in its impairment assessment, which resulted in the recognition of an impairment loss of € 2.0 million, mainly due to COVID-19.

- Delayed deliveries of various projects, particularly in the Industrial Solutions segment, due to lockdown situations at customers, have increased working capital by an estimated € 10 million at year-end 2020. On the other hand, deferrals of tax payments had a downward impact of € 22 million. This deferred tax will be paid in the first half of 2021. TKH’s increased focus on working capital management also led to a substantial reduction in working capital in the fourth quarter of 2020.

- Important investment programs, such as ongoing R&D programs, have been continued. TKH has limited other investment levels where possible.

Progress in the realization of targets and strategy

COVID-19 led to a sharp decline in turnover and a related decline in profit. This had a negative impact on the return on sales (ROS), despite the fact that this remained at a good level. ROS stood at 10.5%. The perspective of our medium-term ROS target of at least 15% remains unchanged. This will be supported by the solid progress in innovations and the ongoing execution of our Simplify & Accelerate program.

The year 2020 saw the following significant strategic developments:

- Machine Vision – First large order for 2D-embedded vision technology for COVID-19 vaccine analysis.

- Machine Vision – Expansion of market share with 3D vision technology and confocal inspection technology within consumer electronics.

- Tire Building – Breakthrough for the UNIXX, the ground-breaking new technology for car tire production, with first serial production at a launching customer.

- Infrastructure – Strong growth in the market for energy cables as a result of the investment impulse driven by the energy transition for which additional investments in production capacity have been initiated, that will be operational from Q3 2021.

- Infrastructure – Acquisition of substantial order for Airfield Ground Lighting (CEDD/AGL technology).

- Marine & Offshore – Order intake of subsea cable systems that will enable growth to more than € 40 million turnover in 2021.

- Care – Breakthrough in North America for the Indivion, an innovative medicine dosing and distribution system.

- Divestment of ZTC in China – Production of commodity data cables with low margins.

- Divestment of Cruxin in the Netherlands – System integration activities with insufficient alignment with TKH strategy.

- Integration of TKH’s Dutch cable production activities at one location and closure of Ittervoort production facility.

- Termination of unprofitable industrial cable production activities.

- Introduction of cost ratio program, part of the Simplify & Accelerate program, with a more short-term focus on financial returns.

Thanks to the fact that we are winning orders for our innovations, TKH is confident that it will realize our medium-term turnover targets in our vertical growth markets. We are also seeing a rise in the willingness to invest among our customers.

We expect that the implemented integration projects and return improvement programs will have a positive impact of € 7 million a year from 2021 onwards. The one-off expenses related to this amounted to € 8.9 million in 2020.

The Simplify & Accelerate program includes a targeted divestment program for activities with limited value creation in the TKH environment. TKH has now realized € 260 million of the targeted € 300 million to € 350 million turnover in divestments. The divestment of the remaining activities has been put on hold in 2020, as the return on these activities, as well as the calculation multiples, would not result in the targeted proceeds due to COVID-19. We resumed our divestment activities in the fourth quarter of the year.

TKH underlined its confidence in its strategy and its strong financial position in November by launching a € 25-million share buy-back program spread over four months. The fact that TKH had realized a net debt/EBITDA ratio of 1.6 at year-end 2020, confirmed that the company had sufficient headroom to finance this share buy-back program, but also to pay out a dividend, taking into account the uncertain circumstances due to the impact of COVID-19.

Financial developments second half of 2020

Turnover declined by 17.1% to € 610.4 million in the second half of 2020 (H2 2019: € 736.4 million). TKH recorded a 12.5% organic decline in turnover. Higher raw materials prices had a positive impact of 0.5% on turnover, while exchange rates had a negative impact of 0.5%. Acquisitions made in 2019 increased turnover by 1.0%, while divestments resulted in a 5.6% decline in turnover. All segments recorded an organic decline in turnover, although this was minor at Building Solutions.

The gross margin increased to 49.5% (H2 2019: 49.0%).

The operating result before the amortization of intangible non-current assets and one-off income and expenses (EBITA) dropped 29.9% to € 66.5 million in the second half of 2020, from € 94.9 million in the second half of 2019. Industrial Solutions saw the strongest decline of 48.3%, as a result of lockdown situations at customers due to COVID-19. The EBITA at Telecom Solutions and Building Solutions also declined by 27.1% and 12.0% respectively.

The ROS improved to 10.9% in the second half of 2020, from 10.2% in the first half (H2 2019: 12.9%) due to lower cost levels.

Amortization expenses fell by € 0.2 million. The amortization of purchase price allocations declined, while the amortization of development expenses increased due to the high investment levels in recent years. TKH recognized an impairment of € 2.4 million in the second half, partly due to the impact of COVID-19.

The financial result fell by € 1.4 million, largely due to a lower result from associates, which were affected by the impact of COVID-19.

The tax rate increased to 25.8% in the second half of 2020, from 23.2% in the second half of 2019, largely due to divestments and lower profits at companies with a lower tax rate.

The net profit from continued activities before amortization and one-off income and expenses attributable to shareholders declined 42.2% to € 34.4 million (H2 2019: € 59.4 million).

Financial developments full year 2020

Turnover declined by € 200.3 million (-13.4%) to € 1,289.4 million in 2020 (2019: € 1,489.6 million), largely due to the impact of COVID-19. TKH recorded a 9.9% organic decline in turnover. Acquisitions made in 2029 contributed 1.9% to turnover. On balance, raw materials prices had a minimal impact on turnover, while currency exchange rates had a negative impact of 0.4%. Divestments led to a 5.2% decline in turnover.

Industrial Solutions recorded the biggest organic decrease in turnover, with a decline of 20.2%. Telecom and Building Solutions recorded declines of 8.4% and 2.9% respectively.

The gross margin increased to 49.4% in 2020 from 48.2% in 2019. This increase was partly driven by divestments and acquisitions within Building Solutions and the higher turnover share of Machine Vision.

Operating expenses before one-off expenses fell by 8.0% compared with 2019. The integration programs, cost savings and lower sales costs as a result of COVID-19 accounted for a significant part of the lower expenses. However, as a percentage of turnover operating expenses increased to 38.9% in 2020 from 36.6% in 2019. This relative increase was related to the divestments made in 2020, as well as lower productivity and coverage in TKH’s production companies as a result of COVID-19. Depreciations, excluding one-off results from divestments, amounted to € 45.5 million, € 0.1 million higher than in 2019.

The operating result before the amortization of intangible assets and one-off income and expenses (EBITA) declined by 21.4% to € 135.5 million in 2020 from € 172.5 million in 2019. EBITA in the Telecom and Industrial Solutions segments fell by 25.0% and 41.8% respectively. Building Solutions recorded a 2.4% rise in EBITA. The ROS fell to 10.5% (2019: 11.6%).

For the full year 2020, TKH recognized a one-off expense totalling € 6.9 million (2019: € 18.3 million) and an impairment of € 4.0 million (2019: € 5.0 million). These were primarily related to the execution of the Simplify & Accelerate program and the impact of COVID-19.

The amortization expense was € 3.7 million higher at € 53.7 million, due to the high R&D investments in recent years.

Financial expenses fell by € 0.8 million to € 8.4 million in 2020, due to lower interest rates. The effect was cancelled by the negative impact of exchange rates of € 2.0 million (2019: negative impact of € 0.9 million). The result from associates increased by € 1.9 million, largely due to a book profit on divestments. The operating result from associates was lower due to the impact of COVID-19 and one-off expenses.

The effective tax rate stood at 24.5% in 2020 (2019: 23.1%). The higher tax rate was related to divestments and lower profits at companies with lower tax rates.

The net profit from continued operations before amortization and one-off income and expenses attributable to shareholders fell by 33.2% to € 70.3 million in 2020 (2019: € 105.3 million).

The net result for 2020 amounted to € 47.5 million (2019: € 113.9 million). The divestment of the majority of TKH’s industrial connectivity activities, accounted for as ‘discontinued operations’, resulted in one-off income of € 45.2 million in 2019. Earnings per share from continued operations before amortization and one-off income and expenses amounted to € 1.69 (2019: € 2.51). Ordinary earnings per share were € 1.14 (2019: € 2.72).

The cash flow from operating activities amounted to € 187.8 million in 2020 (2019: € 182.2 million). In 2020, the cash flow was boosted by a decline in working capital, while there was little change in 2019. At year-end 2020, working capital as a percentage of turnover had fallen to 12.1% (2019: 13.0%), and therefore remained within the bandwidth target of 12‑15%. The cash flow from investments in and divestments of property, plant and equipment amounted on balance to € 25.6 million in 2020, and were lower than in recent years (2019: € 30.6 million, partly due to the divestment of business premises held for sale). The investments in intangible non-current assets related to development costs, patents, licenses and software fell to € 39.2 million in 2020 (2019: € 40.4 million). TKH spent € 0.5 million on acquisitions (2019: € 65.5 million). Divestments boosted the cash position by € 21.2 million (2019: € 83.5 million).

Solvency fell slightly to 42.3% (2019: 43.6%). Net bank borrowings, calculated according to TKH’s bank covenants, fell by € 38.8 million from the level at year-end 2019 to € 261.8 million at year-end 2020. The Net debt/EBITDA ratio stood at 1.6, which means TKH is operating well within the financial ratio agreed with its banks.

At year-end 2020, TKH employed a total of 5,583 FTEs (2019: 5,980 FTEs). Divestments reduced the total workforce by 248 FTEs. In addition to this, TKH had 121 (FTE) temporary employees (2019: 310 FTEs).

Developments per solutions segment

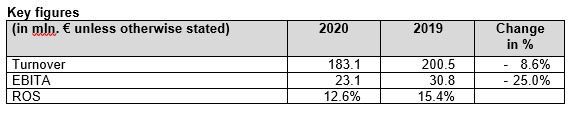

Telecom Solutions

Telecom Solutions represents the core technologies connectivity, vision & security and mission critical communication. TKH develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. Around 40% of the portfolio consists of hub-to-hub optical fibre and copper cable systems. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in network hubs – turnover share 14.2%.

Turnover in the Telecom Solutions segment declined by 8.6% to € 183.1 million. The organic decline in turnover was 8.4%, while currency exchange rates had a negative impact of 0.2% on turnover.

EBITA fell by € 7.7 million. This led to a 12.6% decline in the ROS.

Fibre Optic Networks – The COVID-19 restrictions had a strong negative impact on deliveries across Europe, especially in France. Due to the lockdowns and restrictions at customers, TKH was not yet able to translate increasing demand for bandwidth in combination with the roll-out of 5G networks into higher order intake. This resulted in lower production levels, which in turn led to lower coverage. In China, the lower market volumes put pressure on prices for fibre optics. TKH was largely able to absorb this price effect due to the higher turnover share of the connectivity systems portfolio.

Other markets – TKH was able to absorb part of the decline in other markets thanks to the growth in broadband products for home offices. However, a number of projects were postponed as a result of COVID-19. In mid-2020, TKH terminated the production of the telecom copper cable portfolio, after the turnover of this business had already declined to a low level in recent years.

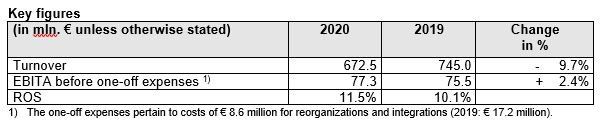

Building Solutions

Building Solutions connects the core technologies vision & security and connectivity in integrated solutions in and around buildings, infrastructure, as well as machine vision for inspection, quality, product and process controls. We provide solutions focused on efficiency, safety & security and sustainability for a number of specific sectors, including machine vision, healthcare, parking, marine & offshore and infrastructure – turnover share 52.2%.

Turnover in the Building Solutions segment fell by 9.7% to € 672.5 million. The organic decline in turnover was 2.9%. Acquisitions made in 2019 boosted growth by 3.9%, while divestments led to a 10.4% decline in turnover. Currency exchange rates had a negative impact of 0.3% on turnover. On balance, raw materials prices had no impact on turnover.

EBITA before one-off expenses rose 2.4% to € 77.3 million. The ROS improved to 11.5% in 2020 from 10.1% in 2019.

Machine Vision – In the first half of 2020, a strong organic growth was realized, despite the restrictions from lockdowns. In particular, the demand for our 3D vision technology for new applications in the consumer electronics industry made a significant contribution to the growth recorded, largely realized in the first half of the year. This growth levelled off in the second half of the year. The cost savings made through the integration of 2D vision activities contributed to higher EBITA and ROS.

Infrastructure – Turnover remained stable on balance due to the increased need to invest in energy networks by network companies. This had a positive impact on the demand for energy cable systems, despite the restrictions technicians faced in the execution of their work. TKH has decided to expand production capacity for energy cable systems and expects to take this additional capacity into operation from the third quarter of 2021. The Airfield Ground Lighting (CEDD/AGL) activities were visibly impacted by the COVID-19 outbreak, as a result of investment limitations at airports due to a sharp decline in demand. Despite this, turnover did increase in the fourth quarter, partly due to a major contract for Istanbul Sabiha Gökçen Airport. The turnover in traffic monitoring systems declined due to the postponement of projects.

Marine & Offshore – The turnover from subsea connectivity systems was much higher than in 2019. In 2020, TKH acquired new contracts for Offshore Windfarm Kaskasi and Hollandse Kust Zuid, the largest part of which will be taken into production in 2021. Underutilization and start-up costs due to new cable types pressured results in this market. The growth in subsea connectivity systems more than compensated for the decline on the back of stagnation in the cruise ship building sector.

Parking – Turnover declined sharply compared with 2019, as projects at and tenders for airports and shopping malls ground to a halt due to the impact of COVID-19. This impact was particularly marked in North America, which is an important market for TKH. TKH anticipated lower investment levels at its customers by sharply reducing its operating costs. In addition to this, TKH initiated the further integration of its parking and security organization in the third quarter, with the aim of optimizing its synergy benefits.

Care – Despite the increased demand for our communication technology for care alarm systems and elderly care, turnover fell due to the fact that installation opportunities for care institutions were limited by the COVID-19 pandemic.

Other markets – The building & construction market was faced with restriction on the execution of projects and the COVID-19-related restrictions had a negative impact on production levels.

Industrial Solutions

Industrial Solutions represents the core technologies connectivity, vision & security and smart manufacturing. TKH’s know-how and expertise in the automation of production processes and improvements in the reliability of production systems gives the company the differentiating potential it needs to deliver innovative, integrated production systems for a number of specialized industrial sectors, such as tire manufacturing, robot, medical and machine-building industries – turnover share 33.6%.

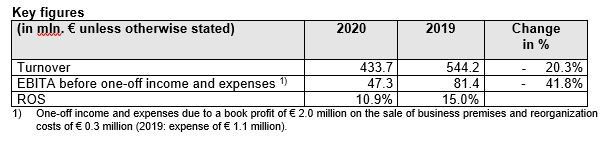

Turnover in the Industrial Solutions segment fell by 20.3% to € 433.7 million. The drop in turnover was largely the result of postponements of the completion of projects at customers due to lockdown situations. Currency exchange rates had a marginal impact of 0.1% on turnover. The organic decline in turnover was 20.2%.

EBITA fell by 41.8%, due to the sharp decline in turnover and the resultant lower coverage and a limited costs decrease. The ROS fell to 10.9% in line with this decline in turnover (2019: 15.0%).

Tire Building – Turnover declined as a result of the postponement in the completion of various projects due to lockdown situations at customers. The drop in demand at tire manufacturers led to the postponement of investments, which in turn resulted in lower order intake, mainly in the second and third quarter of 2020. We noted a recovery in order intake in the fourth quarter, with a relatively high proportion of the orders from China. The share of the top-five tire manufacturers in this order intake was still limited. The development of the UNIXX (a new tire-building platform) is progressing well, but the completion is being delayed as a result of access restrictions at the location of the launching customer due to COVID-19.

Care – Following the successful delivery of the Indivion, the high-grade medicine dosing and distribution system, in late 2019, TKH made a breakthrough with the Indivion technology in North America in 2020. TKH was recording turnover growth in the second half of the year.

Other markets – Turnover in the industrial sector came under pressure as a result of a lack of willingness to invest, especially among machine builders and in the robotics industry. This had a negative impact on TKH’s industrial connectivity activities, primarily due to the reduction of inventories.

Nominations for appointment to the Supervisory Board

At the General Meeting of 6 May 2021, Mrs. C.W. (Carin) Gorter and Messrs. J.M. (Mel) Kroon and P.P.F.C. Houben will step down from the Supervisory Board in line with the prevailing retirement schedule. Mrs. Gorter and Mr. Kroon are eligible for reappointment. The Supervisory Board will nominate Mrs. Gorter and Mr. Kroon for reappointment by the General Meeting. Mr. Houben is not eligible for reappointment, as the maximum term of 12 years has expired. This vacancy was filled last year through the appointment of Mrs. A.M.H. (Marieke) Schöningh. After the end of the General Meeting, the Supervisory Board will once again consist of five members.

Dividend proposal and progress in share buy-back program

It will be proposed to the General Meetings that it authorize the payment of a dividend of € 1.00 per (depositary receipt for a) share (2019: € 1.50). On the basis of the number of shares outstanding held by third parties at year-end 2020, the pay out-ratio amounts to 59.0% of the net profit before amortization and one-off income and expenses attributable to shareholders and 87.3% of the net profit attributable to shareholders respectively. It is proposed that the dividend be paid out in cash and charged to the reserves. The dividend will be payable on 14 May 2021.

Next to the dividend, TKH launched a € 25 million share buy-back program on 18 November 2020, with the intention of using the purchased shares to reduce the issued share capital in due time. Through 8 March 2021, € 18 million in treasury shares have been purchased under this program. Alongside the ongoing share buy-back program, TKH will purchase an additional 200,000 treasury shares to meet its obligations pursuant to share and options schemes. Due to the additional share buy-back program, as well as the lower average trading volume over the recent period, TKH expects to complete the program within six months from today, taking into account a maximum buy-back volume of 10% of the average trading volume.

TKH has closed a Discretionary Management Agreement with ABN AMRO to buy treasury shares during open and closed periods, independently of TKH. TKH reports on the progress of the program via its website on a weekly basis.

Outlook

Despite that the macro-economic uncertainties caused by COVID-19 will continue for the foreseeable future, we expect the global economy to gradually improve in 2021. However, we do expect the impact of COVID-19 to be felt in the first half of 2021, as it was in the first half of 2020. Barring any escalation of the afore-mentioned circumstances and any unforeseen circumstances, TKH expects the following developments per business segment in 2021.

Telecom Solutions

- In fibre optic networks, the investments in Europe are expected to increase further. Due to COVID-19-related restrictions in the first half of 2021, turnover will not return to pre-COVID levels, but on balance we expect to record higher turnover in 2021.

- The Chinese market is currently dealing with overcapacity, which could lead to pressure on margins. An improved product mix and additional focus on Fibre to the Home (FTTH) projects will absorb a large part of this.

- On balance, we expect to see an increase in both turnover and result in this segment.

Building Solutions

- In Machine Vision, we also expect to see a continued increase in turnover in 2021. This will be driven by new technologies, such as the Alvium 2D and confocal 3D vision technology.

- In Infrastructure, we expect a further increase in turnover, driven by the increased need to invest in energy networks among network companies. We expect our CEDD/AGL activities to record growth on the basis of the projects we have identified and contracted.

- In Marine & Offshore, we expect to book strong turnover growth in subsea connectivity systems, thanks to solid order intake in 2020. This will easily compensate for the drop in demand for cable systems for cruise ships.

- In Parking, we expect limited recovery in turnover, as the impact of COVID-19 are still noticable.

- We expect an increase in turnover in Care in 2021, driven by the normalization of COVID-19-related restrictions and due to higher demand for health care-related domotics solutions.

- In the other activities of Building Solutions, we expect to see a partial recovery from the COVID-19-related turnover decline in 2020.

- We also expect the effects of the Simplify & Accelerate program to have a positive impact on the result this year.

- On balance, we expect to record higher turnover and result in this segment in 2021.

Industrial Solutions

- Due to the very low order intake in Tire Building in the second and third quarter of 2020, we expect to see a sharp decline in both turnover and result in this segment in the first half of 2021. The high order intake in the fourth quarter of 2020 and the expected order intake in the first quarter of 2021 offers good prospects of an increase in both turnover and result in the second half of this year.

- In Industrial Care, we expect the international roll-out of Indivion to increase turnover this year.

- We expect our other activities in the Industrial Solutions segment to recover in 2021.

- On balance, we expect to see a decline in both turnover and result this year.

Due in particular to the impact of the low order intake in Tire Building in the second and third quarter of 2020, the profit of TKH in the first half of 2021 will be lower than in the same period in 2020. For the full year 2021, TKH expects to record a higher profit. As usual, TKH will give a concrete profit forecast for the full year 2021 at the presentation of its interim results in August 2021.

The complete press release can be downloaded in PDF.