Full year 2022 Results

Press Release

Haaksbergen, the Netherlands

7 Mar 2023

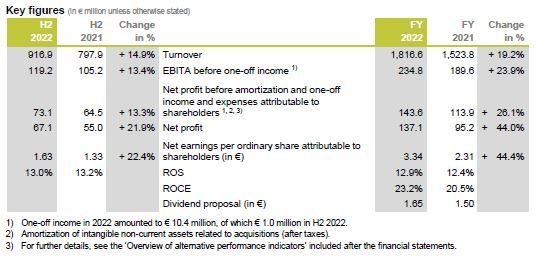

18% organic turnover growth and 24% growth in EBITA - Record year driven by automation, digitalization, and electrification

Financial highlights 2022

- Record order intake of € 2,042 million (2021: € 1,842 million), resulting in all-time high order book of € 971.9 million (December 31, 2021: € 746.6 million).

- Turnover increased by 19.2% to € 1,816.6 million (2021: € 1,523.8 million). Adjusted for currency effects, turnover increased 18.0% organically, with price effects accounting for 7.6%.

- EBITA before one-off income and expenses € 234.8 million up 23.9% (2021: € 189.6 million), with Smart Vision systems being the largest contributor to EBITA.

- Net profit before amortization and one-off income and expenses increased by 26.1% to € 143.6 million (2021: € 113.9 million); at upper end of communicated outlook (€ 136 - € 144 million).

- Increase in ROS to 12.9% (2021: 12.4%).

- Full-year dividend proposal: € 1.65 (per depositary receipt for) ordinary share (2021: € 1.50), a pay-out of 49.4% of net profit.

Financial highlights second half 2022

- Order intake increased by 20.0% to € 1,086.0 million (H2 2021: € 905.0 million).

- Turnover increased by 14.9% to € 916.9 million (H2 2021: € 797.9 million).

- EBITA before one-off income increased by 13.4% to € 119.2 million (H2 2021: € 105.2 million).

- ROS 13.0% (H2 2021: 13.2%), with ROS reaching 13.7% in the fourth quarter.

Strategic highlights 2022

- High innovative power, with innovations contributing 20.6% of turnover.

- Accelerate 2025 strategy program with focus on automation, digitalization, and electrification contributed to strong growth performance.

- Strategic Investment Program of approximately € 200 million initiated, of which € 150 million is related to support growth for new electrification initiatives.

- ESG progress supported by high-priority investments to reduce the CO2 footprint.

- Execution of divestment program on track, closing divestment of CCG completed.

- Share buyback of € 25 million initiated based on our strong financial foundation.

Alexander van der Lof, CEO of technology company TKH: “We were able to deliver excellent results in 2022, with turnover growing by 18.0% organically and EBITA growing by 23.9%. All segments contributed to these strong results. We are excited to see how the execution of our Accelerate 2025 strategy program is progressing.

Our strong high-end technologies and our focus on three important megatrends – automation, digitalization, and electrification – have created a strong foundation for growth. The order intake during 2022 reached record levels across all segments and the fourth quarter in particular. Worth noting is the all-time high intake of € 695 million achieved in Smart Manufacturing systems, mainly driven by Tire Building systems.

TKH’s transformation over the past decade is paying off. The Simplify and Accelerate program launched in 2019 has enabled us to divest cyclical businesses and focus investment on businesses with high-growth prospects.

In 2022, we introduced a substantial Strategic Investment Program of which the main part is geared towards electrification. This will further support our organic growth and provide our customers with the necessary capacity, enabling them to realize their goals. During the year, we continued to prioritize investments to meet our ESG targets and made particularly good progress in reducing our carbon footprint. Supply-chain constraints required close cooperation with our suppliers and creativity of our procurement teams to find solutions to material and component shortages. The right entrepreneurial spirit within our organization to cope with these challenges was again a key success factor in the results we achieved in 2022.

A special word for our team in Ukraine, who managed to work under exceptionally difficult circumstances. We have great respect for how they are coping with the challenges in their daily lives.

We look to the future with confidence, as we have a record order book, a strong foundation with our Accelerate 2025 strategy program, and an entrepreneurial workforce of more than 6,600 people around the world, who, together with our customers, are looking for ways to drive growth by bringing further innovations to the markets in which we operate. Based on our confidence in the future and our strong financial foundation we have decided to initiate a share buyback program of € 25 million.”

Strategic developments

We have made considerable strategic progress, and are generally ahead of our original plan as communicated during the Capital Markets Day on November 17, 2021. The outlook for the megatrends we are focusing on has improved significantly. In particular, the priority for investments for automation and electrification has improved considerably.

In 2022, we launched our Strategic Investment Program to further increase our global production capacity to respond to the increased market demand in the fields of automation, digitization, and electrification. The execution of these expansions started in the second half of the year and is progressing on schedule. In total, we expect these investments to generate an additional € 250 - € 300 million annual turnover in the coming years, the majority of which will be realized by Smart Connectivity systems. The investments specifically target:

- Onshore and offshore power cables. The market outlook has further strengthened, as investment plans for infrastructure have picked up significantly due to the increased focus on renewable energy and the reduction of dependency on oil and gas. In 2022, we decided to invest € 150 million to meet the additional demand for onshore and offshore connectivity. The expansion of our existing facilities in Lochem for the production of medium and high voltage cables is expected to become operational in Q3 2023. The investment in a new plant for inter-array cables in Eemshaven is progressing well and is expected to start serial production in Q2 2024.

- Fibre optic cables: We began constructing a new plant in Poland, which will increase our EU cabling capacity to eliminate the € 10 million import duties incurred in 2022. The plant will be operational as of Q3 2023.

- A new plant in Poland specializing in connectivity systems. This plant will increase capacity by 25% and reduce current lead times. The plant will be operational in Q3 2023.

- The construction of additional capacity for Tire Building systems in Poland, which will be operational early Q2 2023.

- Out of the total amount of € 200 million allocated for strategic investments, € 41 million has been spent in 2022.

Besides the accelerated strategic investments to support the organic growth, we also execute a divestment program as part of our Accelerate 2025 program. In Q1 2023, we closed the divestment of our minority share in CCG with a one-off profit of € 36 million. We are making good progress in realizing our Accelerate 2025 divestment target of € 150 - € 200 million turnover.

The organic turnover growth of 18% was well above the average annual Accelerate 2025 organic growth of 7%. We achieved strong organic growth of 12.5% in our Smart Vision systems segment, with ROS increasing from 17.2% in 2021 to 19.1% in 2022 and accounting for 41% of the operating result. The megatrend of “eyes-off, hands-off” manufacturing is supporting this success, and the recent inflationary development in labor costs and the shortage of manufacturing employees have increased the sense of urgency for automation. Past investments in R&D have proven to be the right choice and have supported the high organic growth.

EBITA grew by a strong 23.9%. The progress in ROS to 12.9% does not fully reflect the progress made towards our Accelerate 2025 target of >17%, as ROS was impacted by price effects on turnover and temporary effects. The temporary effects consist of € 10 million in import duties on fibre optic cables and of shortages of critical components within Smart Manufacturing systems, which led to operational inefficiencies due to delayed deliveries shifting € 30 million of turnover. We expect these temporary effects to be eliminated by the initiated construction of a fibre optic cable plant in Poland and the easing of component shortages at Tire Building systems in the course of 2023. The improvement of the ROCE to 23.2% is within our Accelerate 2025 targeted bandwidth of 22% - 25%.

In early October we opened a Solution Center for TKH Vision Technologies in Germany, which enables us to offer the full scope of TKH’s vision systems and solutions. By selling smart systems and solutions we are better positioned to serve the customer demands and at the same time broaden the scope of supply, driving higher margins and turnover growth.

TKH continues to demonstrate a strong commitment to its ESG ambitions and made further progress in 2022 towards our key sustainability targets as set out in the Accelerate 2025 strategy program. Our net carbon footprint for scopes 1 and 2 decreased by 42.7% in 2022 compared with the reference year 2019 (2021: 29.8%). This does not include any acquired carbon offsets and was mainly driven by energy efficiency measures, a higher share of renewable energy and green certificates. The turnover related to the Sustainable Development Goals (SDG) stood at 68%.

In February 2023, TKH signed a new € 625 million multicurrency committed credit facility, consisting of a € 500 million revolving credit facility (“RCF”) and a € 125 million term loan, linked to TKH's sustainability targets. The new RCF, which matures in February 2028 with two one-year extension options, replaces the € 500 million committed RCF in place since January 2017. Together with the term loan, the RCF will be used to finance strategic investments and working capital needs as TKH continues to grow.

Dividend

The 2023 General Meeting of Shareholders will be asked to approve the payment of a cash dividend of € 1.65 per (depositary receipt for a) share (2021: € 1.50), amounting to a payout ratio of 47.1% of the net profit before amortization and one-off income and expenses attributable to shareholders and 49.4% of the net profit attributable to shareholders. The dividend will be payable on May 2, 2023.

Announcement of share buyback program

Based on the strong financial foundation, TKH has decided to start a share buyback program as of March 7, 2023 amounting to € 25 million. At present, TKH owns 2.8% of TKH shares, and the company will notify the Authority Financial Markets (AFM) as soon as this percentage surpasses the notification obligation of 3%. The intention is to execute the program within a period of four months, within the conditions set by the 2023 General Meeting of Shareholders, with a maximum purchasing volume of 10% of the trading volume. TKH will report on the progress of the program on a weekly basis.

Financial developments second half of 2022

Turnover increased by € 119.0 million (+14.9%), bringing the total for the second half of 2022 to € 916.9 million (H2 2021: € 797.9 million). Adjusted for currency effects, turnover grew organically by 13.7%, with price effects accounting for 8.1%. Smart Vision systems and Smart Connectivity systems were the largest contributors, both growing by 21.0%.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 13.4% to € 119.2 million in the second half of 2022 (H2 2021: € 105.2 million). The strongest growth came from Smart Vision systems (+49.0%), followed by Smart Connectivity systems (+12.3%), driven by high demand for automation and electrification. Smart Manufacturing systems experienced a decline (-21.6%) due to the component shortages at Tire Building systems. Overall, the ROS was 13.0% (H2 2021: 13.2%), and ROS in Q4 amounted to 13.7%.

Financial developments full year 2022

Turnover reached € 1,816.6 million in 2022, a 19.2% increase (2021: € 1,523.8 million). Adjusted for currency effects, turnover grew organically by 18.0%, with price effects accounting for 7.6% of turnover. All segments contributed to the organic growth in turnover, although the turnover growth at Tire Building systems was impacted by the delayed deliveries of near-finished products due to component shortages.

The geographical distribution of turnover remained broadly in line with 2022. The turnover share in the Netherlands grew to 25% of total turnover (2021: 22%), while the share in Europe, excluding the Netherlands, decreased to 44% (2021: 45%). In Asia, the share of turnover decreased to 15% (2021: 19%), partly due to the lockdowns and reshoring, while in North America turnover increased to 13% (2021: 11%). The turnover share of the other geographical areas remained unchanged at 3%.

The gross margin decreased to 47.2% in 2022 (2021: 48.3%) due to a shift in the product mix, with a larger share coming from Smart Connectivity systems combined with increased raw material and component prices and the inflationary price impact on margins.

The order intake remained strong in 2022, resulting in a record order intake of € 2,042 million (2021: € 1,842 million), and resulting in an order book at year-end of € 971.9 million (2021: € 746.6 million), an increase of 30.2% compared to last year. Whereas all segments benefitted from the increase in order intake, the order intake at Smart Manufacturing systems was exceptionally strong at € 694.5 million (2021: € 561.5 million). This increase was mainly driven by Tire Building systems, which further boosted its market share during the year and benefitted from the effects of reshoring and the capex programs of the tire manufacturers.

Operating expenses (excluding amortization and impairments) increased by 13.9% compared to last year. The relatively largest increase was in selling expenses, due to the return of travelling and higher freight costs. Operating expenses were impacted by component shortages at Tire Building systems, leading to operational inefficiencies. Furthermore, personnel expenses increased due to the expansion of the workforce and payroll increases. Currency changes had an upward impact of 1.7%, mainly due to the USD-EUR movement in the Smart Vision systems segment.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 23.9% to € 234.8 million in 2022, from € 189.6 million in 2021. All segments contributed to the increase in EBITA. In 2022, Smart Vision systems was the largest contributor to EBITA (€ 95.5 million, or 40.7% of EBITA).

ROS improved to 12.9% (2021: 12.4%) due to the turnover growth and lower relative cost levels. The upward price effects, higher raw material and components prices, the shift in product mix, the EU anti-dumping duties on fibre optic cables, and supply chain constraints at Tire Building systems all had a dampening effect on ROS.

Amortization increased by 6.7% due to the higher amortization of capitalized R&D, as a result of increasing investment levels in previous years, while the amortization on PPAs from acquisitions decreased.

The net financial expenses increased by € 0.9 million to € 8.9 million (2021: € 8.0 million) due to higher interest expenses and foreign exchange losses. However, this was partly offset by an improved result from associates and a lower impact from earn-out liabilities.

The normalized effective tax rate decreased to 24.8% in 2022 from 26.9% in 2021, primarily due to relatively higher profits at companies benefitting from R&D tax facilities and several settlements of prior year tax positions.

Net profit before amortization and one-off income and expenses attributable to shareholders increased by 26.1% to € 143.6 million (2021: € 113.9 million). Net profit rose by 44.0% to € 137.1 million (2021: € 95.2 million). Earnings per share before amortization and one-off income and expenses amounted to € 3.50 (2021: € 2.77). Ordinary earnings per share were € 3.34 (2021: € 2.31).

Net bank debt rose by € 101.7 million from the level at year-end 2021 to € 307.2 million at year-end 2022. The net debt/EBITDA ratio, calculated according to TKH’s bank covenant, stood at 1.1, well within the financial ratio agreed with our banks. Solvency decreased to 38.0% (2021: 42.5%).

The cash flow from operating activities amounted to € 116.2 million in 2022 (2021: € 199.0 million) and was impacted by the increase in working capital of € 116.3 million. This was mainly due to higher activity levels, the (temporary) buildup of inventories to secure supply chains and higher price levels of most inventory items. The cash flow from net investments in property, plant, and equipment amounted on balance to € 91.8 million in 2022 (2021: € 31.0 million), of which € 41 million is attributable to the Strategic Investment Program.

Investments in intangible assets related to development costs, patents, licenses, and software increased slightly to € 45.9 million in 2022 (2021: € 40.5 million). TKH spent € 0.9 million on acquisitions (2021: € 0.5 million). In 2022, two properties classified as held for sale were sold for € 14.0 million (2021: € 0.2 million divestment of associates).

At year-end 2022, TKH employed a total of 6,607 FTEs (2021: 6,160), of which 409 were temporary employees (2021: 367 FTEs).

Outlook

The favorable market conditions for our leading technologies, underlined by our strong order book and our capacity expansions, lead to a positive outlook for our businesses. We expect total capital expenditure in property, plant and equipment to be around € 200 million for 2023, of which approximately € 160 million relate to the Strategic Investment Program. Barring unforeseen circumstances, we anticipate organic growth in turnover and EBITA in 2023. TKH expects the following developments per business segment in 2023.

Smart Vision systems

- Turnover and EBITA are expected to grow in 2023 compared to 2022, thanks to a combination of a good order intake in 2022, expected growth of the main markets we are active in as well as a number of product launches and targeted programs in key markets.

Smart Manufacturing systems

- Turnover is expected to grow in 2023 compared to 2022, driven by the record high order book.

- We expect a continuing high order intake due to onshoring and initiated capex programs at the tire manufacturers. However, due to foreseen continuing supply-chain constraints, we expect full year EBITA to be in line with 2022, with a weak first half year that is compensated in the second half of 2023.

Smart Connectivity systems

- On balance, turnover and EBITA will grow organically, despite start-up costs for the new plants.

- We expect a strong order intake for offshore wind and onshore energy connectivity systems on the back of continuing growing demand related to the energy transition programs.

- The demand for our fibre optic and specialty cable is foreseen to be on a high level. The coming on stream of EU capacity in the second half year will support the improvement of margins.

As usual, TKH will provide a more specific outlook for the full year of 2023 at the presentation of its interim results in August 2023.

You can follow the presentation of the full-year results on March 7, 2023 at 10:00 CET via video webcast (www.tkhgroup.com).

For further information:

Jacqueline Lenterman

Investor Relations

j.lenterman@tkhgroup.com

Tel: +31(0)53 5732901

The complete press release can be downloaded in pdf.