H1 2012 Results

Press Release

Haaksbergen, the Netherlands

22 Aug 2012

TKH books lower profit on reduced turnover and retention of capacity for growth.

Highlights first half 2012

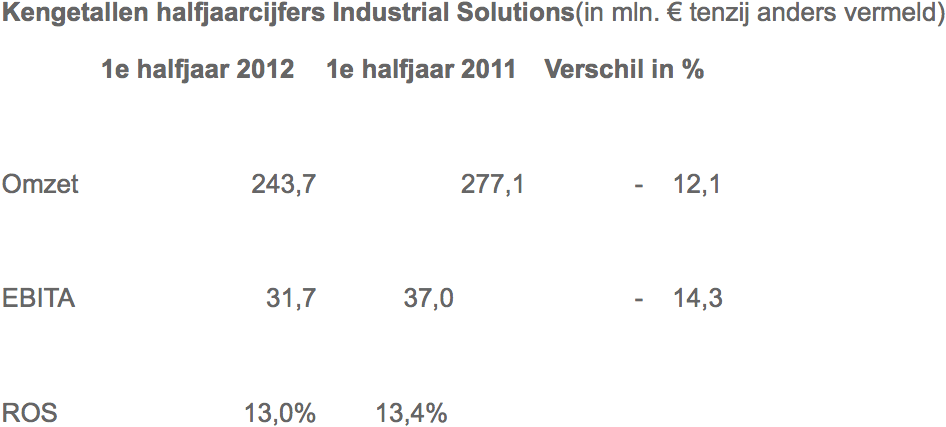

- Turnover down 4.2% - Industrial Solutions sees turnover drop by 12.1%, in line with reduced order intake in 2011.

- EBITA down 27.8%, mainly due to extra costs of retaining capacity for growth, as well as acquisition costs.

- Healthy improvement in gross margin to 40.2% from 37.8%.

- Successful completion of turnover target security systems through acquisitions Aasset and Augusta.

Highlights Q2 2012

- Postponed investments in market solar and infrastructure projects had negative impact on turnover Building Solutions.

- Order intake Industrial Solutions in Q2 not yet at desired level.

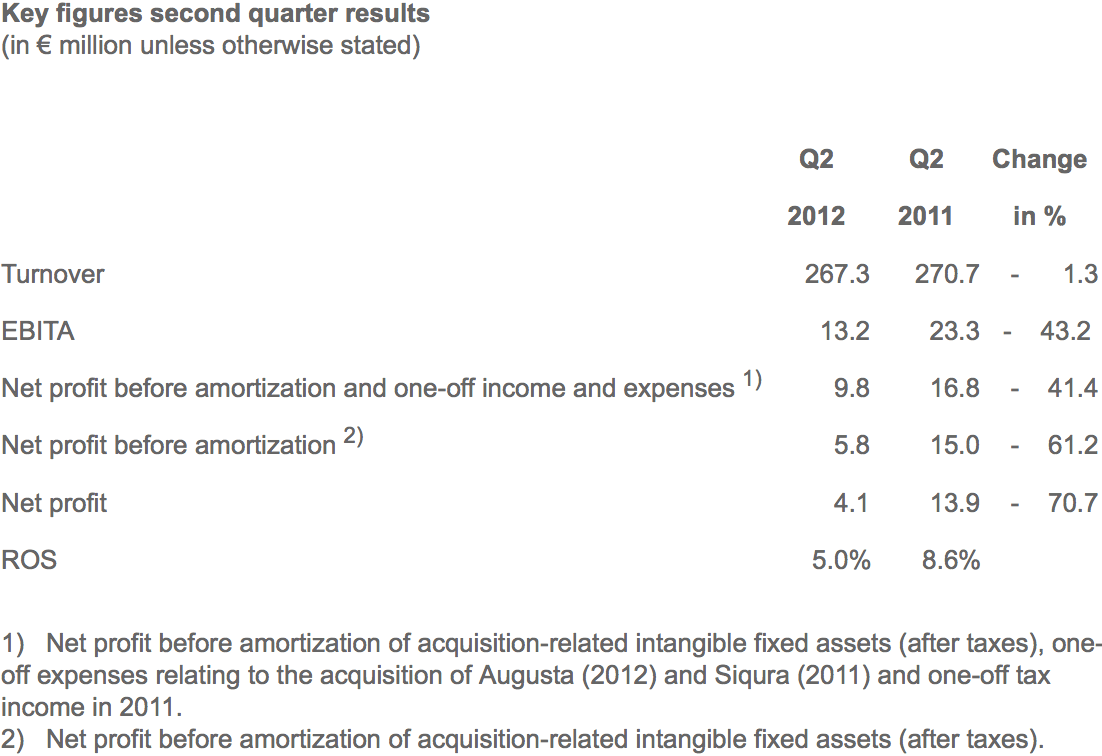

- EBITA decreased mainly due to acquisition costs of € 4 million and € 5 million in expenses to retain the capacity.

- Stronger drop in net profit due to one-off tax effects, higher financial expenses and higher amortization charges.

- Successful completion takeover bid Augusta Technologie.

- Program started to bring costs more in line with turnover.

Outlook

- For the full year 2012, TKH expects to realize net profit of between € 45 and € 50 million before amortization and one-off income and expenses.

Alexander van der Lof, CEO of technology company TKH: "The decrease of the profit in the second quarter, linked with the lower turnover, is mainly the result of relatively high expenses anticipating on growth. TKH once again strengthened its foundation in the first half of the year. This was also thanks to the significant contribution from the acquisitions we made. One clear example is the expansion of the vision activities, which will allow TKH to claim a leading global position in vision activities. The investments in innovations, R&D and the commercial organization, as well as the retention of capacity supports TKH's growth strategy. In a rapidly changing market, our increased R&D efforts will give TKH a strong competitive edge. We are convinced that this gives TKH more potential in the coming years, particularly in view of the downturn in economic conditions.”

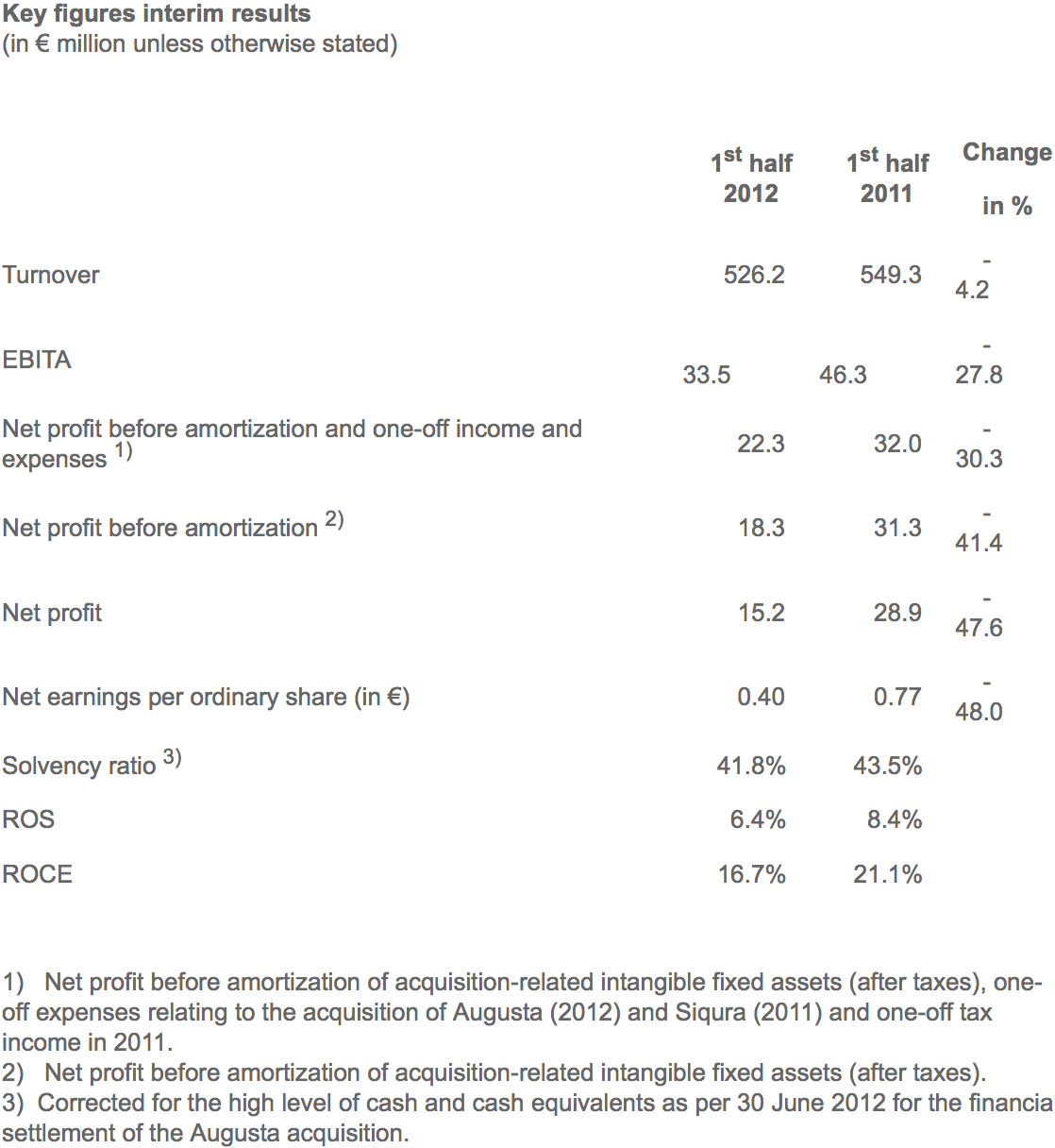

Financial developments

In the first half of 2012, turnover dropped by 4.2% to € 526.2 million, from € 549.3 million in the first half of 2011. Of this total, 0.8% was due to a drop in raw materials prices passed on to our customers. Acquisitions increased turnover by 3.8%. Organic turnover fell by 7.2% on balance. In the second quarter, organic turnover dropped by 6.6%.

Turnover fell by 12.1% at Industrial Solutions, while turnover at Building Solutions was up 4.0% and turnover at Telecom Solutions increased by 3.4%. In the first half of 2012, the contribution from Industrial Solutions to overall turnover dropped to 46.3% from 50.5% in the same period in 2011, while the contribution from Telecom Solutions increased to 15.5%, from 14.4%, and from Building Solutions to 38.2% from 35.2%.

The gross margin increased to 40.2% in the first half of 2012 from 37.8% in the first half of 2011, thanks to the improved activity mix. All the solutions segments improved gross margins in the period under review.

The operating costs as a percentage of turnover increased to 33.8% in 2012, from 29.4% in the same period of 2011. This was due to acquisitions and in particular to the excess capacity in the Building Solutions division, which means cost levels are not in line with the current turnover level. In the second quarter a program has been started to bring the costs more in line with turnover. The acquisition costs, relating to the acquisition of the majority stake in Augusta Technologie, were € 4.0 million (2011: € 2.0 million relating to Siqura).

Total depreciations, at € 8.0 million, was up from the € 7.4 million reported in 2011 because of the higher level of investments in 2011 and 2012.

The operating result before amortization of intangible assets (EBITA) fell to € 33.5 million in the first half of 2012, a drop of 27.8% from the € 46.3 million reported in the first half of 2011. This drop was partly due to lower capacity utilization as a result of lower turnover. In addition, more than half the decline was due to the retention of capacity for growth, as well as acquisition costs.

EBITA at Industrial Solutions dropped by 14.3% compared with the first half of 2011. Telecom Solutions recorded an organic increase in EBITA of 15.9%. At Building Solutions, EBITA was down 59.5%.

The ROS dropped to 6.4%, from 8.4% in 2011.

Amortization charges increased by € 2.2 million to € 8.2 million, compared with € 6.0 million in the first half of 2011, due to investments in R&D, software and the acquisitions of companies such as Siqura, Mextal, KLS Netherlands and Aasset.

Financial expenses rose by € 1.5 million to € 4.9 million in the first half of 2012. The increase was due to the higher outstanding interest-bearing debt.

The tax burden rose to € 25.8% in the first half of 2012, from 21.8% in the first half of 2011. The latter year included a one-off gain related to the application of the innovation box for previous periods. The tax burden in the first half of 2012 was affected by one-off non-deductible acquisition costs. In the second half of 2012 a limited lower effective tax rate is expected.

In the first half of 2012, net profit before amortization came in at € 18.3 million, down from € 31.3 million in the first half of 2011. Net profit for the first half of the year fell to € 15.2 million, a drop of 47.6% compared with the € 28.9 million recorded in the first half of 2011.

Net bank debt increased by € 32.4 million to € 160.7 million, as a result of acquisitions and investments. The solvency ratio stood at 41.8%, compared with 43.5%, adjusted for the high cash position on 30 June 2012 held for the financial settlement of the acquisition of the stake in Augusta in July of this year. The net debt/EBITDA ratio was 1.5 and the interest coverage ratio was 10.6, which means TKH operates well within the financial ratios agreed with its banks. The working capital had fallen to 13.5% of turnover on 30 June 2012, compared with 14.8% as per 30 June 2011.

The number of people in permanent employment (FTE) as per 30 June 2012 was 4,255, up from 4,062 at year-end 2011.

Developments per solutions segment

Telecom Solutions

Profile

Telecom Solutions develops, produces and delivers systems for applications from basic outdoor infrastructure for telecom and CATV networks to indoor home networking. The focus is on providing customers with care-free systems due to the system guarantees we provide. Around 40% of the portfolio consists of optical fibre and copper cable for node-to-node connections. The remaining 60%, consisting of components and systems in the field of connectivity and peripheral equipment, is used mainly in the network’s nodes.

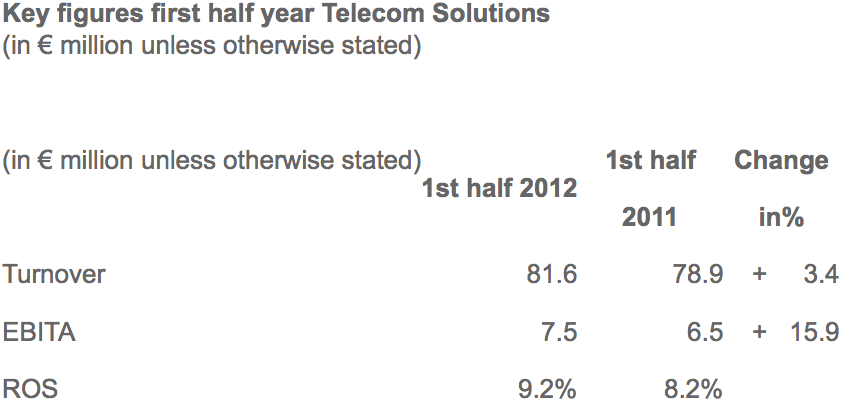

Turnover within the Telecom Solutions segment rose by 3.4% to € 81.6 million. Organic turnover growth came in at 3.6%. This increase was largely due to fibre network systems, where TKH booked growth of 16.7%. The market in both Europe and Asia recorded growth.

EBITA rose by € 1.0 million, while ROS was up at 9.2%, from 8.2%, due to the growth in fibre network systems.

Indoor telecom systems - home networking-systems, broadband connectivity, IPTV-software solutions – turnover share 4.6%

Turnover showed a slight increase of 0.3%. Turnover remained stable in the face of a marked reluctance among consumers to spend on ICT. The high priority given to upgrading broadband connections compensated for the reluctance to invest.

Fibre network systems – fibre optic, fibre optic cable, connectivity systems and components, active equipment – turnover share 7.6%

Turnover increased by 16.7%. This strong growth was due to the continued worldwide increase in investment levels in fibre optic networks. The launch of the additional production capacity which will allow TKH to double its output within the next 12 months went according to plan. The Chinese market is showing particularly strong growth, which meant we were able to utilize the additional capacity quite effectively. The financing of investments in fibre optic networks in Europe also progressed well. The number of projects in the pipeline increased, which confirms that there is additional growth in the investments in fibre optic networks. TKH also launched various innovations aimed at improving efficiency in the installation and operation of networks.

Copper network systems – copper cable, connectivity systems and components, active equipment – turnover share 3.3%

Turnover in this segment fell 15.2%. Turnover in the segment was down, in line with the higher priority given to and accompanying shift in investments to fibre optic networks. This offset the revival that sparked a rise in turnover in the first half of 2011.

Building Solutions

Profile

Building Solutions develops, produces and delivers solutions in the field of efficient electro technical technology ranging from applications within buildings to technical systems which, linked to software, provide efficiency solutions for the care and security sectors. The know-how focuses on connectivity systems combined with efficiency solutions to reduce the throughput-time for the realization of installations within buildings. In addition, the segment focuses on intelligent video, intercom and access monitoring systems for a number of specific sectors, including elderly care, parking and security for buildings and work sites.

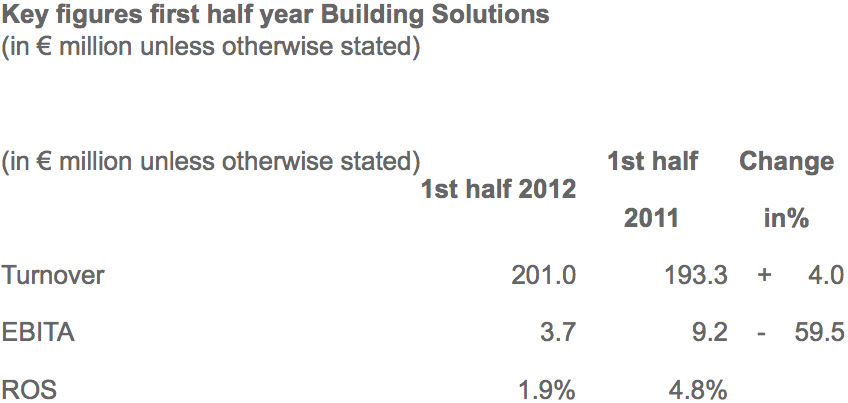

Turnover within the Building Solutions segment increased by 4.0% to € 201.0 million. Acquisitions accounted for 9.8% growth while lower raw materials prices led to a turnover drop of 1.1%. Organic turnover fell by 4.8% in the first half of the year. This drop in turnover was due to the postponement of investments in the field of solar and infrastructure projects for energy networks and traffic technology. The other segments realized growth, despite a drop in demand for utility construction projects in the Benelux.

EBITA at Building Solutions dropped to € 3.7 million. The reduction in organic turnover and difficult market conditions in the building and construction sector had a negative impact on the results. This was largely due to the available production and commercial capacity which we are retaining in anticipation of higher turnover in the coming quarters and which means cost levels are not in line with current turnover. This had an impact of around € 5 million on the operating result. ROS dropped to 1.9% in 2012, from 4.8% in 2011.

Building technologies – energy-saving light and light switch systems, energy management systems, care systems, structured cabling systems – turnover share 8.8%.

Turnover rose by 15.7%. The care sector booked particularly strong growth. The focused approach and the effective alignment of the TKH portfolio to specific needs in this segment improved the market position. Mextal, acquired in 2011, also contributed to the growth in the care market. The past year’s investments in product and market development paid off in this segment.

Security systems – systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration – turnover share 12.8%

Turnover increased by 17.2%. The acquisition of Aasset boosted our operating base, particularly in the French and German security markets. This acquisition made only a modest contribution to the results in the first half of 2012, as Aasset was consolidated only from 1 March 2012.

Within the security cluster, TKH made major headway in increasing the synergy between the security companies, through a further clustering of competencies and the focus of sales teams on specific markets. We invested heavily in innovations, in particular in the field of video management and video content analysis.

Postponed traffic infrastructure projects in Europe had a negative impact on growth.

Connectivity systems – specialty cable (systems) for shipping, rail, infrastructure, solar and wind energy, as well as installation and energy cable for niche markets – turnover share 16.6%

Turnover in this segment dropped by 8.9%. Of this decline, 2.1% was due to lower raw materials prices. The drop in market volume in the building and construction sector put pressure on margins. We were able to realize the targeted turnover growth in the building and construction sector. However, these gains has been offset by postponed investments in solar and infrastructure projects for energy networks and traffic technology.

Industrial Solutions

Profile

Industrial Solutions, develops, produces and delivers solutions ranging from specialty cable, plug and play cable systems to integrated systems for the production of car and truck tyres. Its knowledge in the field of automation of production processes and the improvement of the reliability of production systems gives TKH the distinctive ability to respond to the need in a number of specialized industrial sectors, such as tyre manufacturing, robotics, medical and machine construction industries, to increasingly outsource the construction of production systems or modules.

Turnover within the Industrial Solutions segment fell 12.1% to € 243.7 million. Raw material prices had a negative impact of 0.9% on turnover. Turnover within connectivity systems dropped slightly, while turnover in manufacturing systems fell in line with the reduced order intake over the past year.

EBITA was down 14.3% at € 31.7 million, in line with the drop in turnover. ROS fell to 13.0% in the first half of 2012, from 13.4% in the same period of 2011.

Connectivity systems – specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 23.6%

Turnover fell 4.6%. The lower raw materials prices had a negative impact of 1.9% on turnover. Demand from the robot, medical and machine building industry remained high, especially in Germany. The trend towards outsourcing the production of more complete modules and systems continued.

Manufacturing systems – advanced manufacturing systems for the production of car and truck tyres, can washers, product handling systems and machine operating systems - turnover share 22.7%

Turnover in this segment dropped by 18.7%, largely as a result of the reduced order intake for tyre building systems in 2011 and the first half of 2012. Despite the long-term plans for expansion investments, we have noted a reluctance to invest since last year. This means that the brief revival in the first quarter did not continue. In the second quarter, order intake, at around € 40 million, was at the lower level seen in 2011. The postponement of investment plans was particularly marked on the Asian continent. Orders from this region accounted for more than 70% of order intake in 2010.

We further extended our technological lead with the introduction of upgrades and a new generation of tyre building systems, launched on the market under the brand name Exxium®. We also introduced the MAXX® tyre-building technology at several new clients, making further headway in penetrating the car tyre industry and gaining market share.

Developments after 30 June 2012

As per 2 July 2012, TKH has a majority stake of 59.73% in Augusta Technologie, following the completion of the € 23 per share takeover offer. This acquisition is also a significant step for TKH in the field of vision technology and the associated market leadership that TKH is targeting. As of 2 July 2012, Augusta will be financially consolidated in TKH’s results, with 60% of the activities included within Building Solutions and the remaining 40% within Industrial Solutions. TKH has considerably strengthened the distinguishing potential of its activities in recent years through the expansion of applications with vision systems as their core technology. TKH sees enormous growth potential in applications in which vision technology will be used, both now and in the future. The segments in which TKH vision technology is already being used are: security, parking technology, retail, traffic technology, tyre building systems and care and medical systems.

Outlook

The outlook for the second half of the year in the market segments in which TKH operates is varied.

In Telecom Solutions, we expect investments in fibre optic networks to continue to grow. European plans to increase the number of FttH connections are well under way and we are in a good position in the European market to grow in line with this expected market growth. Turnover in copper networks will continue to fall in line with the shift in investments to fibre optic networks.

In Building Solutions, we expect lower investments in the building and construction sector to result in a continuation of the current challenging market conditions. In 2011 and the first half of 2012, we made a concerted effort to realize growth in our market share for the coming years. On balance and partly on the basis of our distinguishing potential due to innovations, we expect to book growth, provided that the economic conditions in Europe do not deteriorate further. For the second half of the year, we are expecting a modest recovery in investments in solar and infrastructure projects.

In Industrial Solutions, turnover in the second half of 2012 will be lower than in the first half of the year, due to the reduced order intake in recent periods. Based on the current order portfolio and the investment projects we are aware of, we expect the order intake to be higher than in the first half, provided the global economic conditions do not deteriorate further.

As from 2 July 2012, Augusta Technologie, in which TKH has acquired a majority stake, is included in the consolidated figures of TKH group. The consolidation of Augusta Technologie is not included in the above outlook per segment.

On balance and barring unforeseen circumstances, for the full year 2012 TKH expects to realize a net profit available to shareholders of between € 45 and € 50 million, before amortization and one-off income and expenses.

The full press release can be downloaded as pdf on this page