H1 2013 Results

Press Release

Haaksbergen, the Netherlands

21 Aug 2013

Healthy profit improvement in 2nd quarter

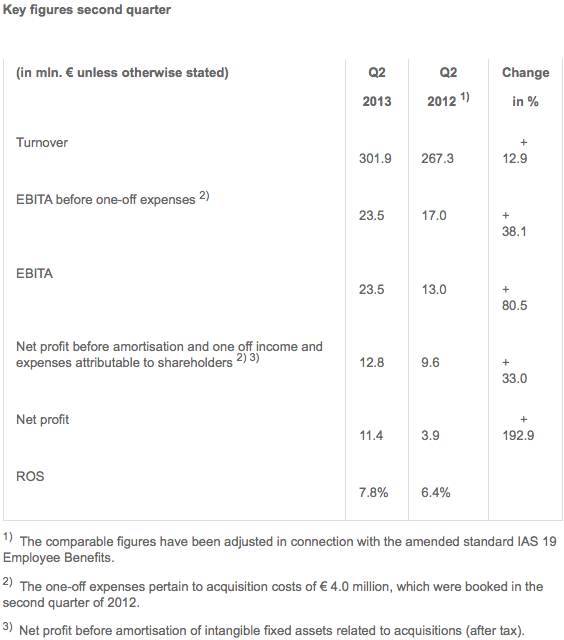

Highlights second quarter 2013

- Turnover up by 12.9% at € 301.9 million, organic growth 4.3%.

- Turnover growth at Industrial Solutions (17.2%) and Building Solutions (13.5%).

- Building Solutions books strong improvement in operating result with solid organic growth.

- Industrial Solutions operating result slightly lower due to initial costs for continued growth and innovations – record order intake tyre manufacturing systems.

- EBIT up by 80.5% – partly due to solid contribution Augusta and the impact of one-off expenses in 2012.

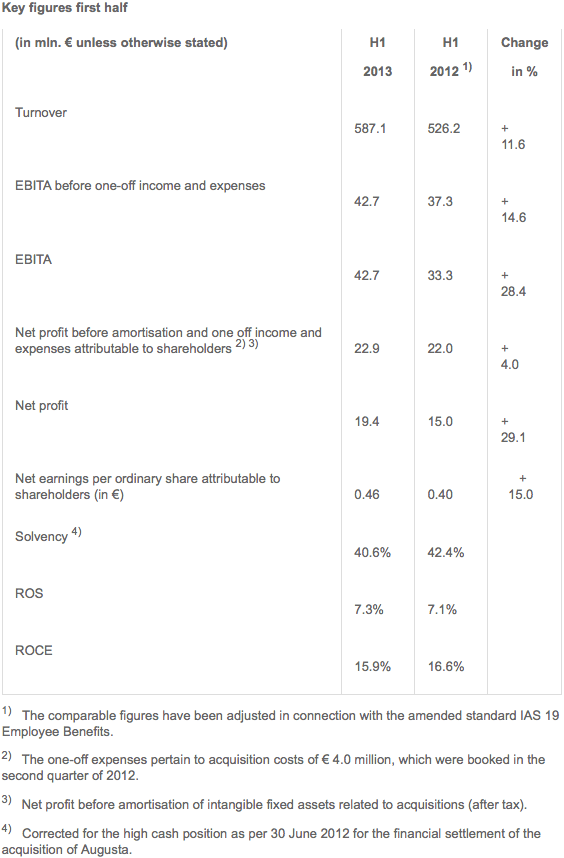

Highlights first half 2013

- Turnover rises by 11.6% to € 587.1 million, organic growth 1.3%.

- Gross margin improves to 40.9% from 40.2%

- EBITA up by 28.4% due to acquisitions, impact of efficiency programmes and one-off expenses in 2012

Outlook

- Forecast for full year 2013: net profit before amortisation and one-off income and expenses attributable to shareholders of between € 52 million and € 57 million (2012: € 47.5 million).

Alexander van der Lof, CEO of technology company TKH: "The continued internationalisation and the focus on the vertical growth markets identified by TKH helped us to generate organic turnover growth in the second quarter, despite the economic headwinds. Building Solutions did see marked margin pressure in the Benelux due to overcapacity in those markets following a drop-off in demand. However, operating result improved strongly compared with the year-earlier period thanks to acquisitions and efficiency programmes executed in the second half of last year. ROS growth did lag our growth targets due to the difficult market conditions, especially in the connectivity segment. At Industrial Solutions, the high order intake for tyre manufacturing systems was positive. TKH increased its market share among the top-five tyre manufacturers and increased the order intake outside the top five. This increases the prospect of future turnover and operating result growth. TKH incurred relatively high costs in the first half of the year in preparation for the growth we plan to realise in the second half of the year. Cost levels will normalise in the second half of the year. TKH expects overall second-half results to be higher than in the first half."

Financial results in the second quarter

Turnover rose by 12.9% to € 301.9 million in the second quarter (Q2 2012: € 267.3 million).

Acquisitions added 9.8% to the quarter’s turnover. Organic growth came in at 4.3%.

A drop in raw materials prices had a negative impact on turnover of 1.2%.

Turnover at Industrial Solutions came in 17.2% higher.

Turnover growth in the tyre manufacturing systems segment was especially high,

due to the order intake, which has continued to increase since the second half of 2012.

The second quarter saw record order intake levels of € 80 million.In view of this, TKH

has taken additional measures to respond to this growth. At Building Solutions, turnover was 13.5% higher. The acquisition of Augusta Technologie made a strong contribution to this growth. Despite the challenging market conditions, organic turnover growth - corrected for a reduction in inventories and a drop in raw materials prices – came in at 3.1%.

Turnover at Telecom Solutions fell by 0.3% due to the continuing drop in investments in copper networks.Telecom Solutions’ optical fibre systems business booked turnover growth of 7.4%.

EBITA rose by 38.1% to € 23.5 million in the second quarter. Building Solutions

made a strong contribution to this growth, both organically and through acquisitions.

The efficiency programmes launched in the second half of 2012 led to lower

cost levels as a proportion of the turnover,which in turn led to an organic rise in ROS. Margin pressure in the connectivity systems segment and low activity levels

at security systems for infrastructure projects did have a negative impact on ROS.

Despite this, Building Solutions booked a strong improvement in ROS, which rose to

7.4%, from 1.5% in the second quarter of 2012. Industrial Solutions saw a slight drop

in its operating result on the back of lower gross margins, due to the fact that many

projects are currently in the early stages of production, as well as temporarily higher innovation costs for new customers and new technology. Telecom Solutions recorded a higher EBITA, as a result of improved efficiency levels and the impact of lower raw materials costs.

Financial results in the first half

Turnover came in 11.6% higher at € 587.1 million in the first half (H1 2012: € 526.2 million). Acquisitions accounted for 11.1% of the total turnover, while organic turnover growth came in at 1.3%. Lower raw materials prices had a negative impact of 0.9% on turnover in the first half.

In the first half of 2013, Building Solutions accounted for 41.1% of total turnover, up from 38.2% in the same period of 2012. This increase was largely due to the acquisitions made in 2012. As a result Industrial Solutions saw its share of total turnover drop to 45.2% from 46.3% in 2012 and the share accounted for by Telecom Solutions fell to 13.6% from 15.5% in the year earlier period.

The gross margin rose to 40.9% in the first half of 2013, from 40.2% in the year-earlier period, due to a better product mix, partly due to acquisitions, and the reduction of inventories at production locations.

Operating costs (excluding one-off costs) as a percentage of turnover fell to 32.1% in the first half of 2013, from 33.1% in 2012, excluding the impact of acquisitions. This was due to the impact of the efficiency programmes executed in the second half of 2012.

Depreciation charges came in at € 9.7 million and where higher than in the first half of 2012 (€ 8.0 million), largely due to depreciations at the companies acquired in 2012.

The operating result before amortisation of intangible fixed assets (EBITA) was up by 28.4% at € 42.7 million in the first half of 2013, compared with € 33.3 million in the first half of 2012.

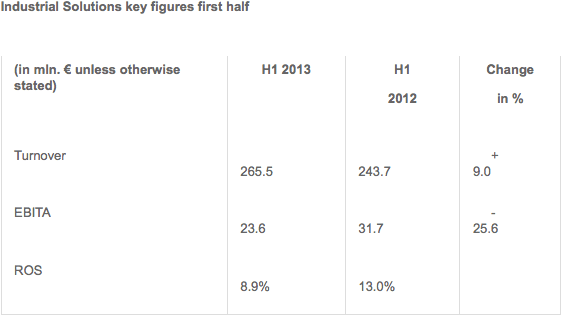

At Industrial Solutions, EBITA fell by 25.6% compared with the first half of 2012, mainly due to high costs levels and underutilisation in the first quarter in the run-up to the expected increase in order intake. Telecom Solutions saw EBITA rise by 10.4%, while at Building Solutions acquisitions and a strong organic improvement led to an increase in EBITA of 373% to € 16.7 million in the first half of 2013, from € 3.5 million in the same period of 2012.

ROS increased to 7.3% in the first half of 2013 (H1 2012: 7.1%).

Amortisation was € 3.8 million higher at € 12.0 million (H1 2012: € 8.2 million) mainly as a result of the acquisition of Augusta.

Financial expenses increased by € 2.1 million to € 7.2 million in the first half of 2013. This rise was the result of higher outstanding interest-bearing debts and a negative exchange rate effect of € 0.6 million compared with the first half of 2012. The higher financial expenses were partly offset by exceptional income of € 0.4 million due to the release of an earn-out provision, as well as a higher result from participations totalling € 1.2 million.

The tax burden fell to 23.0% in the first half of 2013, from 25.8% in the first half of 2012. The tax burden in the first half of 2012 was affected by one-off non-deductible acquisition costs.

Net profit before amortisation and one-off income and expenses attributable to shareholders came in at € 22.9 million in the first half of 2013 (H1 2012: € 22.0 million).

Net profit for the first half of 2013 came in 29.1% higher at € 19.4 million, compared with

€ 15.0 million in the year-earlier period.

Net bank debts increased by € 31.2 million from year-end 2012 to € 219.4 million.

This increase was the result of higher working capital – due to seasonal influences – and higher levels of investment. Solvency stood at 40.6%, from 42.4% in the first half of 2012. The net debt/EBITDA ratio came in at 1.9 and the interest coverage ratio at 9.0, which puts TKH well within the financial ratios agreed with its banks. Working capital rose to 15.5% of turnover, compared with 13.5% as per 30 June 2012.

The number of employees with an employment contract (FTEs) stood at 4,683 at 30 June 2013 (year-end 2012: 4,736).

Developments per solutions segment

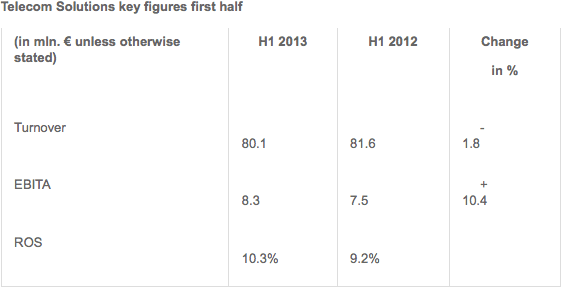

Telecom Solutions

Profile

Telecom Solutions develops, produces and delivers systems for applications from basic outdoor infrastructure for telecom and CATV networks to indoor home networking.

The focus is on providing customers with care-free systems due to the system guarantees we provide. Around 40% of the portfolio consists of optical fibre and copper cable for node-to-node connections. The remaining 60%, consisting of components and systems in the field of connectivity and peripheral equipment, is used mainly in the network’s nodes.

Turnover in the Telecom Solutions segment fell by 1.8% to € 80.1 million. The drop in turnover was due to a dip in investments in copper networks. This drop was partly offset by a 3.3% growth in optical fibre networks in the first half of 2013, thanks to growth in market share in both Europe and Asia.

EBITA came in € 0.8 million higher. ROS rose to 10.3% from 9.2% due to improved efficiency and the impact of lower raw materials prices.

Indoor telecom systems - home networking-systems, broadband connectivity, IPTV-software solutions – turnover share 4.2%

Turnover rose slightly by 1.5%. This growth was realised despite the reluctance among consumers in the Benelux region to make IT-related investments. The priority given to upgrading broadband connections offset consumers’ reluctance to invest.

Fibre network systems – fibre optic, fibre optic cables, connectivity systems and components, active equipment – turnover share 7.0%

Turnover was up 3.3%, as a result of a further increase in investment levels in optical fibre networks. Turnover was lower in the first quarter, due to the long frost period in the early months of the year, but turnover picked up and was higher in the second quarter. European investments in 4G networks led to a slow-down in investments in optical fibre networks in a number of countries.

Copper network systems - copper cable, connectivity systems and components, active equipment – turnover share 2.4%

Turnover in this segment fell by 18.3%, in line with the higher priority given to optical fibre networks and 4G networks, and the consequent shift in investments.

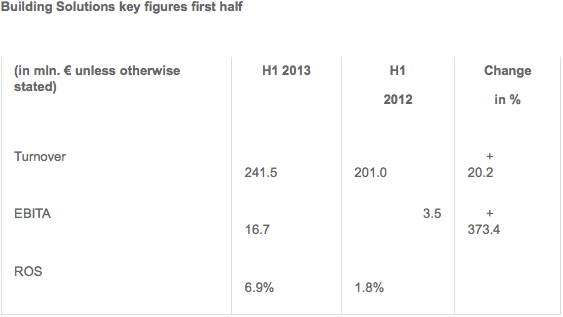

Building Solutions

Profile

Building Solutions develops, produces and delivers solutions in the field of efficient electro technical technology ranging from applications within buildings to technical systems which, linked to software, provide efficiency solutions for the care and security sectors.

The know-how focuses on vision technology and connectivity systems combined with efficiency solutions to reduce the throughput-time for the realization of installations within buildings and industrial automation. In addition, the segment focuses on intelligent video, intercom and access monitoring systems for a number of specific sectors, including elderly care, parking, shipbuilding, marine, oil and gas industry, tunnels and security for buildings and work sites.

Turnover at Building Solutions was up 20.2% at € 241.5 million. Acquisitions accounted for growth of 21.8%. The organic growth corrected for a reduction of inventories came in at 2.4% in the first half of the year. Lower raw materials prices had a negative impact of 1.1% on turnover. The in 2012 initiated international positioning and the focus on a number of vertical growth market that are a good match for TKH’s technological building blocks, resulted in organic growth, despite the challenging market conditions in the Benelux region.

EBITA rose to € 16.7 million, with contributions from both acquisitions and organic growth. Excluding acquisitions, operating result doubled in line with the efficiency programmes launched in 2012 and the growth realised. Pressure on margins in the connectivity segments had a negative impact on the efficiency and margin improvement programmes. The ROS nonetheless improved to 6.9% in 2013, from 1.8% in 2012.

Building technologies - energy-saving light and light switch systems, energy management systems, care systems, structured cabling systems – turnover share 7.6%

Turnover dropped by 4.6%, primarily as a result of a reluctance to invest in the building and construction sector. In the healthcare sector growth was realised because TKH technology provides an effective response to the growing need for efficiency solutions in this sector.

Vision & Security systems - Vision technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration – turnover share 19.2%

Turnover increased by 67.5%, with the acquisition of Augusta accounting for the majority of this turnover growth. Organic turnover growth came in at 2.2%, with growth hampered by the reluctance to invest in the building and construction sector in the Benelux region,

as well as in the traffic infrastructure sector.

Augusta’s result dropped compared to the first half of 2012, due to a weaker first quarter. The second quarter was in line with the result booked in the same period of last year.

In late 2012, TKH renewed its focus on the vertical growth markets it has identified in the vision and security segment, namely healthcare, parking, tunnels, ship building, oil and gas and machine vision markets. This will help the company to book further growth in this segment.

Connectivity systems - specialty cable (systems) for shipping, rail, infrastructure, solar and wind energy, as well as installation and energy cables for niche markets – turnover share 14.4%

Turnover increased 6.3%, corrected for inventory reductions and lower raw materials prices. The growth was realised mainly outside the Benelux region. Reduced market volume in the building and construction sector led to a sharp increase in competition and pressure on margins. Consequently, the growth in turnover combined with the efficiency programme we launched has not yet led to an improvement in ROS.

TKH has taken further steps to downsize its solar systems business due the low margins in this segment.

Industrial Solutions

Profile

Industrial Solutions, develops, produces and delivers solutions ranging from specialty cable, plug and play cable systems to integrated systems for the production of car and truck tyres. Its knowledge in the field of automation of production processes and the improvement of the reliability of production systems gives TKH the distinctive ability to respond to the need in a number of specialized industrial sectors, such as tyre manufacturing, robotics, medical and machine construction industries, to increasingly outsource the construction of production systems or modules

Turnover in Industrial Solutions came in 9.0% higher at € 265.5 million. The acquisition of Augusta accounted for 6.0% of turnover growth. Organic turnover growth came in at 4.0% Raw materials prices had a negative impact of 1.0% on turnover. Turnover in connectivity systems, corrected for lower raw materials prices, was down 1.0%. Manufacturing systems saw organic turnover growth of 9.1%, which was in line with the increased order intake since the second half of 2012.

EBITA fell by 25.6% to € 23.6 million. The majority of this drop was recorded in the first quarter, as we maintained capacity for growth and invested in new customers and new technology. These investments translated into a record order intake for the second quarter. This has in turn improved our market positioning in terms of continued growth in market share in the coming years.

Connectivity systems - specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 20.5%

Turnover dropped by 1.0%, corrected for a negative impact on turnover of 2.0% related to charged-on lower raw materials prices. The first quarter saw some reluctance to invest in capital goods in Europe, which led to a drop in turnover. This situation changed in the second quarter, resulting in organic growth of 3.7%. The increase in investments from the medical industry had a particularly marked positive impact on the recovery in the second quarter. We also saw a continuation of the trend towards outsourcing more complete modules and systems.

Manufacturing systems - advanced manufacturing systems for the production of car and truck tyres, can washers, test equipment, product handling systems for the medical industry, machine operating systems - turnover share 24.7%

Turnover in this segment increased by 21.5%, with 12.4% of this accounted for by the acquisition of Augusta’s activities in this segment. Organic growth came in at 9.1%. The organic growth was realised in the second quarter, after a drop of 2.4% in the first quarter. Investments in maintaining capacity for future growth and new customers and new technology translated into strong growth in order intake, which reached the record level of € 80 million in the second quarter (Q2 2012: € 40 million). The market share among the top five tyre manufacturers in the industry continued to increase and also the order intake from outside the top five tyre manufacturers increased. The high cost levels combined with preparations for future growth and increasing our technological lead resulted in a drop in ROS in the first half of the year. The relatively high proportion of projects currently in the early stages of the production cycle also had a negative impact on ROS.

Events after 30 June 2013

As announced on 29 July 2013, TKH has acquired all the shares in Park Assist Ltd., which has further boosted TKH’s position in the field of vision technology for the parking market. With a staff of 36 employees, Park Assist realises annual turnover of more than € 15 million.

Outlook

The outlook is mixed for the second half of the year in the market segments in which TKH is active. The economic conditions in Europe remain poor.

In the Telecom Solutions segment, we expect a further increase in investments in optical fibre networks. Turnover in copper networks will continue to decline in line with the shift towards investments in optical fibre networks. For the second half of 2013, we expect results in line with the first half of the year.

In the Building Solutions segment, we expect the challenging market conditions to continue as a result of the lower investment levels in the building and construction sector. This is putting pressure on the margins in this segment and consequently is having a negative impact on profit. To counterbalance this, we have taken measures related to our increased focus on vertical growth markets. This will enable TKH to offer its various technological building blocks as integrated systems, increasing the potential for higher margins and continued growth. On balance, we expect the results for the second half of the year to be higher than in the first half of 2013.

For the Industrial Solutions segment, we expect turnover levels to rise in the second half of 2013, due to the higher order intake in recent quarters. The worldwide economic uncertainties and related reluctance to invest in capital goods makes it difficult to assess how order intake will develop in the coming quarters. At this moment, the outlook for order intake is positive. For the second half of 2013, we expect higher turnover and normalised cost levels to lead to a higher operating result than in the first half of the year.

On balance TKH expects, barring unforeseen circumstances, to realise net profit before amortisation and one-off income and expenses attributable to shareholders of between € 52 million and € 57 million for the full year 2013.

The complete press release and the powerpoint presentation can be downloaded in PDF