H1 2015 Results

Press Release

Haaksbergen, the Netherlands

18 Aug 2015

Highlights second quarter 2015

- Turnover 3.2% higher at €353.7 million - organic decline of 3.1%.

- EBITA increased 12.7%, largely from Building Solutions.

- Sequential growth result Q2 compared to Q1 in all segments.

- Continued improvement in ROS, rises to 10.7%.

- Net profit before amortisation and one-off income and expenses attributable to shareholders rises by 13.4%.

Highlights first half 2015

- Turnover 5.1% higher at € 690.3 million, organic decline of 0.5%.

- Building Solutions books 6.2% organic increase in turnover based on success vertical growth markets.Organic decline in turnover Industrial Solutions of 5.4%, due to lower turnover in manufacturing systems segment in Asia – in accordance with previously communicated delayed deliveries.

- Improvement gross margin to 45.9% from 41.8%, due to a better product mix and insourcing.

- EBITA up 22.5% due to strong improvement in efficiency and a good product mix.

Outlook

- Forecast for the full year 2015: net profit before amortisation and one-off income and expenses attributable to shareholders of between € 93 million and € 98 million (2014: € 86.3 million).

Alexander van der Lof, CEO of technology company TKH:

"In the first half of 2015, we were once again able to improve our results, which is a clear evidence of our strong market positions due to focus on innovations. In the period under review, innovations accounted for more than 20% of turnover. Profit at Industrial Solutions increased despite delay in deliveries in China, due to the problems of Chinese tyre manufacturers faced with US import duties on their tyres. However, Building Solutions performed especially well, with a 60% increase in result, on the back of the success of our focus on the defined vertical growth markets. Our differentiating potential in recent years has had a positive impact on margins, which also showed a nice improvement in the period under review. Our advanced technology offers good prospects that could result in a substantial growth in market shares among a number of customers with large turnover potential in the years ahead. This puts us well on track to realise our long-term growth targets to grow over the next 3-5 years with € 300 million to € 500 million in the defined seven vertical growth markets."

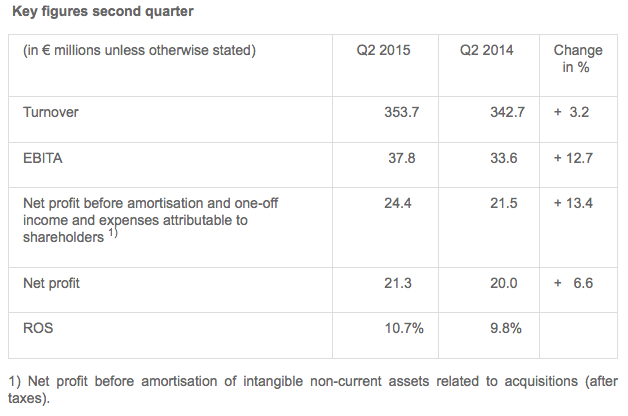

Financial developments second quarter

In the second quarter of 2015, turnover came in € 11.0 million (3.2%) higher at € 353.7 million (Q2 2014: € 342.7 million). Acquisitions accounted for 3.1% of turnover. Stronger foreign currencies compared to the euro had a positive impact on turnover of 2.3%, while on average higher raw materials prices added 0.9% to turnover. On balance, turnover declined by 3.1% organically.

The increase in turnover was realised by Building Solutions, with a rise of 15.9%. Turnover at Telecom Solutions and Industrial Solutions declined by 2.9% and 4.6% respectively.

The operating result before amortisation of intangible assets and one-off income and expenses (EBITA) increased by 12.7% to € 37.8 million in the second quarter of 2015 (Q2 2014: € 33.6 million). EBITA at Building Solutions increased considerably. At Telecom Solutions, EBITA also showed a marked increase, while EBITA at Industrial Solutions declined slightly.

Due to the higher operating result and reduced financial expenses, net profit before amortisation and one-off income and expenses attributable to shareholders was up 13.4% at € 24.4 million (Q2 2014: € 21.5 million).

The ROS for the TKH group increased to 10.7% in the second quarter of 2015 (Q2 2014: 9.8%).

Financial developments first half

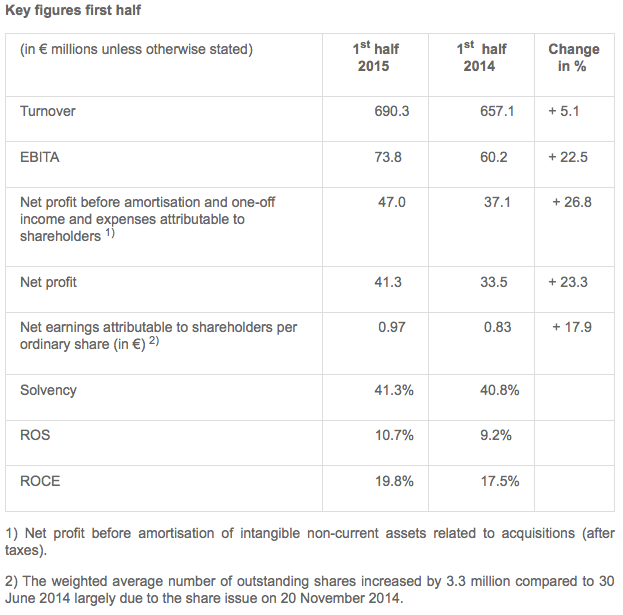

In the first half of the year, turnover came in 5.1% higher at € 690.3 million (H1 2014: € 657.1 million). Acquisitions accounted for 3.1% of total turnover. Stronger foreign currency exchange rates compared to the euro, had a positive impact of 2.0% on turnover, while a drop in raw materials prices had a limited positive impact of 0.5% on turnover. Turnover declined by 0.5% organically.

Industrial Solutions’ share in total turnover declined to 46.5% in the first half, from 50.9% in 2014. The contribution from Building Solutions in overall turnover rose to 41.7% from 36.8%, due to strong growth in vision & security systems. Telecom Solutions accounted for 11.8% of total turnover, down from 12.3% in 2014.

Innovations once again made a strong contribution of 21.5% to turnover.

The gross margin increased to 45.9% in the first half of 2015, from 41.8% in the first half of 2014, due to an improved product mix, the acquisition of Commend and less outsourcing to third parties.

Operating costs as a percentage of turnover rose to 35.2% in the first half of 2015, from 32.7% in the first half of 2014. Excluding acquisitions, operating costs would be 34.4% of turnover. The increase was largely due to a higher level of in-house production and thus reduced outsourcing to third parties, as well as an increase in R&D costs. The impact of the developments at Imtech is adequately provided for.

Depreciations amounted to € 10.9 million, which is at a higher level than in the first half of 2014 (€ 10.1 million), due to higher investment levels in recent years.

The operating result before amortisation of intangible assets and one-off income and expenses (EBITA) came in 22.5% higher at € 73.8 million in the first half of 2015, compared with € 60.2 million in the first half of 2014. EBITA at Building Solutions increased by 64.3% compared to the first half of 2014, as a result of the acquisition of Commend, turnover growth in vision & security and connectivity systems and the associated improvement in efficiency and capacity utilisation rates at the production locations. At Telecom Solutions, EBITA increased by 18.7%. Industrial Solutions recorded an improvement of 4.0% in EBITA.

The ROS rose to 10.7% in the first half of the year (H1 2014: 9.2%).

Amortisation charges came in € 2.5 million higher at € 15.5 million (H1 2014: € 12.9 million), due to the acquisition of Commend and higher R&D investments in recent years. The amortisation charges include the preliminary Purchase Price Allocations for the acquisition of Commend.

Financial expenses fell by € 0.1 million to € 4.4 million in the first half of 2015. Interest expenses declined by € 0.8 million, which was offset by negative currency exchange rate effects as a result of the weaker euro. The result from participations improved by € 0.3 million.

The tax rate increased to 22.6% in the first half of 2015, from 21.5% in the first half of 2014, because of a larger share of profits abroad. The application of the Dutch innovation box facility once again had a positive impact on the total tax rate.

Net profit before amortisation and one-off income and expenses attributable to shareholders rose by 26.8% to € 47.0 million in the first half of 2015 (H1 2014: € 37.1 million). Net profit for the first half of 2015 was up 23.3% at € 41.3 million (H1 2014: € 33.5 million).

TKH’s net bank debt in accordance with the bank covenants, increased by € 121.2 million from the year-end 2014 figure to € 286.0 million. The increase was related to the squeeze-out of Augusta minority shareholders, the acquisition of Commend, dividend payments, investments and higher working capital due to cyclical influences. The net debt/EBITDA ratio came in at 1.6 and the interest coverage ratio at 21.7, which means TKH is operating well within the financial ratios agreed with the banks. Solvency stood at 41.3% (H1 2014: 40.8%). The working capital increased to 18.3% of turnover, compared with 15.8% at 30 June 2014.

As per 30 June 2015, TKH had 5,337 permanent employees (FTEs), up from 4,918 a year earlier. In addition, TKH had 478 temporary employees at 30 June 2015 (mid-2014: 483).

Developments per solutions segment

Telecom Solutions

Profile

Telecom Solutions develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. The focus of the business is on delivering completely worry-free systems for its clients, thanks to the system guarantees provided. Around 40% of the portfolio consists of hub-to-hub optical fibre and copper cable systems. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in the network hubs.

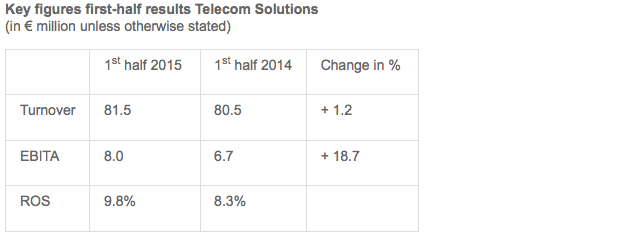

Turnover in the Telecom Solutions segment was up 1.2% at € 81.5 million. Turnover declined by 0.8% organically, while currency exchange rates had a positive impact of 2.0% on turnover. The organic decline was due to fibre network systems, which lagged behind the strong second quarter of 2014. The demand for fibre optic cable declined in the Netherlands and the increase in fibre optic projects in Poland and Germany could not fully compensate that decline. Turnover within indoor telecom & copper networks increased by 5.2%.

EBITA rose by 18.7% to € 8.0 million. The ROS improved to 9.8% from 8.3% due to efficiency advantages in production, cost savings and the continued international roll-out.

Indoor telecom & Copper networks - home networking systems, broadband connectivity, IPTV-software solutions, copper cable, connectivity systems and components, active peripherals – turnover share 5.4%

Turnover increased by 5.2% as a result of an increase in demand due to higher consumer spending in the European market. Demand also increased due to a rise in investments aimed at upgrading the copper network to higher transmission speeds in a number of countries.

Fibre network systems - optical fibre, optical fibre cables, connectivity systems and components, active peripherals – turnover share 6.4%

Turnover declined by 1.9%. The decline in demand was particularly marked in the Netherlands, due to a shift in priorities among customers towards investments in upgrading copper networks at the cost of optical fibre networks. The decline in demand in the Netherlands was largely offset by growth in demand in other countries, with Poland and Germany in particular. The proposed expansion of production capacity for optical fibre was successfully taken into operation and resulted in an improvement in efficiency and margin.

Building Solutions

Profile

Building Solutions develops, produces and delivers solutions in the field of efficient electro-technical technology, ranging from applications within buildings to technical systems which, linked to software, provide efficiency solutions for the healthcare and security sectors. TKH’s know-how in this segment is focused on vision technology and connectivity systems combined with efficiency solutions to reduce the throughput-time for the realisation of installations within buildings and industrial automation. In addition, TKH’s focus in this segment is on intelligent video, intercom and access monitoring systems for a number of specific sectors, including elderly care, parking, marine, oil & gas, tunnels and security for buildings and work sites.

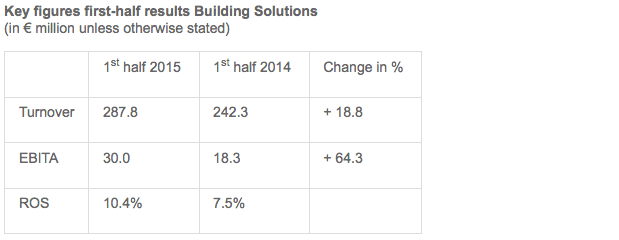

Turnover in the Building Solutions segment increased by 18.8% to € 287.8 million. Acquisitions accounted for growth of 8.5%, while currency exchange rates had a positive impact of 3.4% on turnover. Higher raw materials prices had an impact of 0.7% on turnover. On balance, organic growth came in at 6.2%. Although the market conditions in the Benelux region did not improve, TKH realised organic growth in both connectivity systems and vision & security systems, of 3.4% and 8.5% respectively.

EBITA showed a strong increase of 64.3% to € 30.0 million, partly due to the acquisition of Commend and turnover growth in both segments. The ROS increased to 10.4% in the first half of 2015, compared with 7.5% in the first half of 2014.

Vision & Security systems – Vision technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration, healthcare systems – turnover share 24.6%

Turnover rose by 27.0% largely due to the vision technology companies and the acquisition of Commend (+15.4%). Currency effects resulted in a turnover growth of 3.1%. The organic turnover and order intake improved in China and North America in particular. The vertical growth markets made a positive contribution to turnover growth and compensated for the persistent difficult market conditions in the Benelux. The vertical growth markets vision, parking and marine, oil & gas performed particularly well. Thanks to the high gross margin in this segment, the result increased more than proportionately due to the turnover growth.

Connectivity systems – specialty cable (systems) for shipping, rail, infrastructure, wind energy, as well as installation and energy cable for niche markets, structured cable systems – turnover share 17.1%

Turnover increased 8.6%, with 5.2% of this due to higher raw materials prices and currency effects. The vertical growth markets also had a positive impact and we were able to record growth despite lower market volumes in the building and construction sector. Thanks to a strong focus on efficiency improvements, TKH was able to realise this turnover growth at lower cost levels. The product mix also improved as a result of the focus on the vertical growth markets, where it is possible to realise above-average margins. The marine, oil & gas segment performed particularly well.

Industrial Solutions

Profile

Industrial Solutions develops, produces and delivers solutions ranging from specialty cable and plug and play cable systems to integrated systems for the production of car and truck tyres. The company’s know-how in the automation of production processes and improvements in the reliability of production systems gives TKH the differentiating potential to respond to the increasing desire to outsource the construction of production systems or modules in a number of specialised industrial sectors, such as tyre manufacturing, robotics, and the medical and machine construction industries.

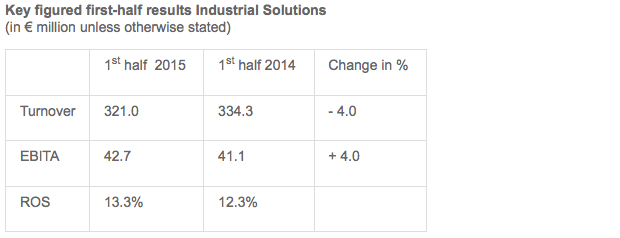

Turnover in the Industrial Solutions segment decreased 4.0% to € 321.0 million. Currency effects had a positive impact of 1.0% on turnover. Due to average higher raw materials prices, turnover increased 0.4%. Organically, turnover was down by 5.4%. Production in the sub-segment manufacturing systems was at a lower level, mainly due to reluctance among Asian tyre manufacturers. This was offset to some degree by a number of large-scale projects involving measuring and control systems for the automotive and aerospace industries.

Despite the decline in turnover, EBITA came in 4.0% higher at € 42.7 million, due to effective cost controls, improved efficiency and a higher level of in-house production. As a result, the ROS increased to 13.3% in the first half of 2015, from 12.3% in the first half of 2014.

Connectivity systems - specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 17.5%

Turnover in the segment decreased 0.3% despite the positive impact of 1.3% from higher raw materials prices charged on to customers and currency effects. The focus on turnover with a higher margin led to a decline in turnover, but an increase in profit. TKH recorded turnover growth in the medical and robotics industries.

Manufacturing systems - advanced manufacturing systems for the production of car and truck tyres, can washers, test equipment, product handling systems for the medical industry, machine operating systems – turnover share 29.0%

Turnover declined 6.1%. The reluctance to invest among Chinese tyre manufacturers due to the US import duties on their tyres, which started in the fourth quarter of 2014, resulted in reduced order intake and deliveries. This resulted in a drop in order intake to € 60 million in the second quarter, compared to an order intake of € 85 million in the first quarter. Outside China, order intake and turnover increased in line with expectations. We also made further steps in our positioning among the top 5 tyre manufacturers. However, this had only a limited impact on order intake and turnover in the first half of the year. TKH expects to see less reluctance to invest among Chinese customers in the second half of 2015 due to efforts to relocate production capacity to other countries. Due to high order intake since early July and good prospects of an increase in demand outside China, we expect order intake in the second half of the year to exceed the order intake recorded in the first half.

Outlook

The outlook for the second half of the year is generally positive for the market segments in which TKH is active in.

In Telecom Solutions, TKH expects investments in optical fibre networks to remain at low levels in the Netherlands in the second half of the year. However, the rest of Europe and Asia offer sufficient growth perspective, which means TKH will still be able to realise growth in this segment in the second half of the year.

At Building Solutions, TKH expects the vertical growth markets to have the potential to realise further growth. However, the market conditions in the building and construction sector in the Benelux remain challenging, although it does seem as if the market has bottomed out. On balance, TKH expects the results in the second half of the year to be better than those recorded in the first half of the year.

The lower order intake in manufacturing systems in the first half of the year is having a negative impact on capacity utilisation in the second half of the year, which means that the result at Industrial Solutions will be in line with the first half, despite improvements in other segments within Industrial Solutions. The order intake, which has improved once again since July, and the expected positive development in order intake in the second half of the year, gives TKH a solid basis as from 2016.

On balance and barring unforeseen circumstances, for the full year 2015 TKH expects to achieve a net profit before amortisation and one-off income and expenses attributable to shareholders of between € 93 million and € 98 million (2014: € 86.3 million).

The complete press release and the powerpoint presentation can be downloaded in PDF.