H1 2016 Results

Press Release

Haaksbergen, the Netherlands

16 Aug 2016

Decline in results due to lower contribution Industrial Solutions

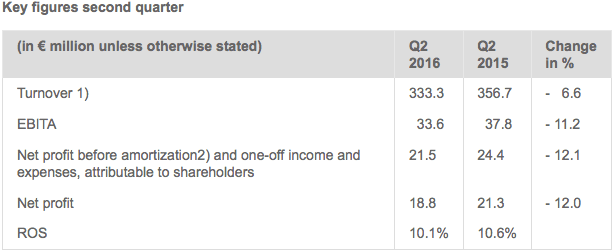

Highlights second quarter 2016

- Turnover drops 6.6% to € 333.3 million – organic decline in turnover 3.2%.

- Organic increase in turnover in Telecom Solutions (11.8%) and Building Solutions (2.6%).

- Organic decline in turnover in Industrial Solutions (12.0%), in accordance with previously reported lower order intake due to Chinese reluctance to invest.

- EBITA down 11.2%, largely due to lower turnover in Industrial Solutions.

- Higher EBITA in Telecom Solutions and Building Solutions.

- Postponed orders manufacturing systems sub-segment results in order intake of

€ 50 million in Q2 –expected recovery in order intake in the coming quarters.

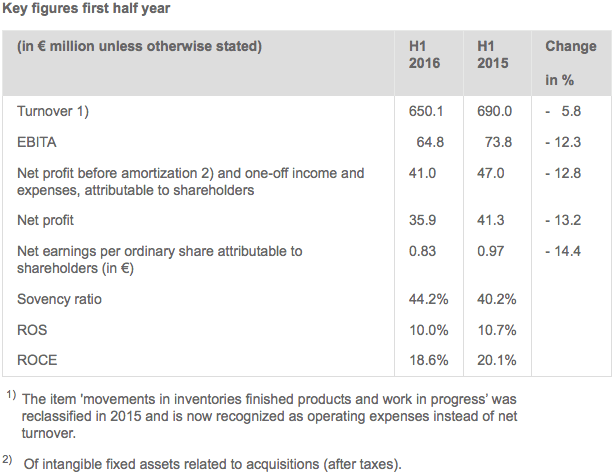

Highlights first half 2016

- Turnover down 5.8% at € 650.1 million, organic decline 3.0%.

- Organic turnover decline of 7.3% in Industrial Solutions and 0.5% in Building Solutions.

- Organic turnover increase of 5.6% in Telecom Solutions.

- EBITA down 12.3%, largely due to lower turnover in Industrial Solutions.

- Net profit before amortization and one-off income and expenses attributable to shareholders down 12.8%.

Outlook

- Outlook for the full year 2016: a net profit before amortization and one-off income and expenses attributable to shareholders of between € 88 and

€ 93 million (2015: € 99.9 million).

Alexander van der Lof, CEO of technology company TKH:

“The decline in the results in the second quarter was in line with the previous reported reduced order intake from China in the manufacturing systems sub-segment. The situation in China did not improve in the second quarter due to the postponement of a number of expected orders, also from the big five tire manufacturers. The outlook for the order intake in the second half of the year is better, due to a number of newly announced large-scale projects in which TKH is well positioned. In the second quarter, we were able to agree on a framework agreement with a major tire manufacturer. We have further adjusted our production capacity upwards with a view to the expected higher activity levels in the coming quarters. We also made a number of breakthroughs in the Building and Telecom Solutions segments and closed some major contracts that will result in an increase of turnover. The investments in R&D within Building Solutions were increased to accelerate the completion of a number of large R&D projects on the basis of positive feedback from pilot projects. Great interest is shown by customers in the form of concrete orders for the new technologies, including CEDD, machine vision, subsea-connectivity and light truck tire building systems. Investments in preparation for the targeted growth within the vertical growth markets create a lot of confidence for the future but are having a slightly negative impact on short-term ROS.”

Financial developments second quarter

Turnover declined by € 23.4 million (6.6%) to € 333.3 million in the second quarter of 2016 (2015: € 356.7 million). The divestment of Parking & Protection resulted in a 0.4% decline in turnover. The on average weaker foreign currencies against the euro had a negative impact of 1.0% on turnover. Lower raw materials prices had a negative impact of 2.0% on turnover. On balance, the organic turnover decline was 3.2%.

The turnover decline in the second quarter was due entirely to Industrial Solutions and is a consequence of a lower order intake in the manufacturing systems sub-segment in recent quarters. The other segments, Telecom and Building Solutions, realized organic growth of 11.8% and 2.6% respectively.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) declined by 11.2% in the second quarter of 2016 to € 33.6 million (€ Q2 2015: € 37.8 million). Both Building Solutions’ and Telecom Solutions’ EBITA came in higher than in the second quarter of 2015, while Industrial Solutions recorded a clear decline in EBITA.

Net profit before amortization and one-off income and expenses attributable to shareholders fell by 12.1% to € 21.5 million (Q2 2015: € 24.4 million), as a result of the lower operating result.

The ROS for TKH came in at 10.1% in the second quarter of 2016 (Q2 2015: 10.6%).

Financial developments first half year

Turnover declined by 5.8% to € 650.1 million in the first half of 2016 (H1 2015: € 690.0 million). The divestment of Parking & Protection resulted in a drop in turnover in the first half year of 0.4%. Both weaker foreign currencies against the euro and a drop in raw materials prices had a negative impact on turnover of 0.7% and 1.8% respectively. The organic turnover decline was 3.0%.

The contribution from Industrial Solutions to overall turnover dropped to 44.9% in the first half year, from 46.7% in the year-earlier period. The contribution from Building Solutions was up slightly at 42.1%, from 41.7% of total turnover. The contribution from Telecom Solutions rose to 13.0%, from 11.7%.

The gross margin increased to 46.4% in the first half of 2016, from 46.0% in the first half of 2015. The higher margin was realized in Building and Industrial Solutions on the back of an improved product mix.

Operating costs were down 2.6% compared to the first half of 2015. However, operating costs as a percentage of turnover rose to 36.5% in the first half of 2016, from 35.3% in the first half of 2015. This relative increase was largely due to lower turnover levels in the manufacturing systems sub-segment, while investments in the required expansion of the organization in a number of specific vertical growth markets in the area of R&D, commerce and production capacity were higher.

Depreciations came in at € 10.1 million, down from € 10.9 million in the first half of 2015.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) fell by 12.3% to € 64.8 million in the first half of 2016, from € 73.8 million in the first half of 2015. EBITA in Telecom Solutions was up 16.0% compared to the first half of 2015. In Building Solutions, EBITA was down 3.7%, while Industrial Solutions recorded a drop in EBITA of 23.2%.

ROS fell to 10.0% in the first half of 2016, from 10.7% in the first half of 2015.

Amortization costs increased by € 0.5 million to € 15.9 million (H1 2015: € 15.4 million), due to higher investments in R&D made in recent years.

The financial result improved with € 2.0 million to a net amount of € 2.4 million in the first half of 2016. Interest expenses were € 0.8 million lower and a reduction in the negative currency exchange effects resulted in an improvement of € 0.9 million. The result from participations was up € 0.3 million.

The tax rate was 21.7% in the first half of 2016, compared with € 22.6% in the same period of 2015. The use of the Dutch innovation box facility once again had a positive impact on the overall tax rate.

Net profit before amortization and one-off income and expenses attributable to shareholders was down 12.8% at € 41.0 million in the first half of 2016 (H1 2015: € 47.0 million). Net profit fell to € 35.9 million in the first half of 2016 (H1 2015: € 41.3 million).

Net bank debt, calculated in accordance with the covenants agreed with the banks,increased by € 46.0 million from year-end 2015, to € 207.0 million. This increase was due to dividend payments, investments and the higher working capital due to seasonal effects. The net debt/EBITDA ratio came in at 1.3 and the interest coverage ratio stood at 23.7. This means that TKH is operating well within the bandwidth of the financial ratios agreed with its banks. The solvency ratio stood at 44.2% (H1 2015: 40.2%). Working capital increased to 14.4% at 30 June 2016, from 11.4% at year-end 2015, due to seasonal effects, but was considerably lower when compared to mid-2015 (18.2%).

At 30 June 2016, TKH had a total workforce (FTEs) of 5,433 (mid-2015: 5,337) and employed an additional 405 temporary staff at 30 June 2016 (mid-2015: 478).

Developments per solutions segment

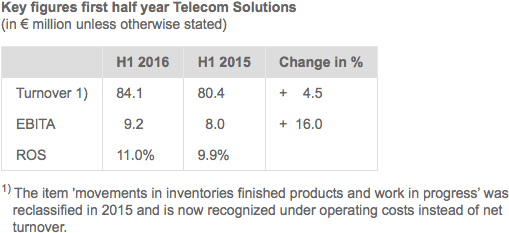

Telecom Solutions

Profile

Telecom Solutions develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. The focus of the business is on the delivery of completely worry-free systems for its clients, thanks to the system guarantees it provides. Around 60% of the portfolio consists of hub-to-hub optical fibre and copper cable systems. The remaining 40%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in network hubs.

Turnover in the Telecom Solutions segment was up 4.5% at € 84.1 million.

Currency exchange rates had a negative impact of 1.1% on turnover. Organic turnover growth was 5.6%. The organic turnover growth was realized in fibre network systems. The demand for optical fibre systems in the Netherlands and Poland declined, but this was more than offset by strong demand for optical fibre in China and growth in Germany and France.

EBITA was up 16.0% at € 9.2 million. ROS improved to 11.0%, from 9.9%, on the back of a higher capacity utilization rate in optical fibre production and higher added value in the indoor telecom systems sub-segment due to an improved product mix.

Indoor telecom & copper networks - home networking-systems, broadband connectivity, IPTV software solutions, copper cable, connectivity systems and components, active peripherals – turnover share 5.6%

Turnover was down 2.2% due to a continued decline in investment levels in copper networks. Indoor telecom is seeing growing demand, driven by higher consumer spending in the European market. The margin came in higher as a result of an improved product mix.

Fibre network systems - optical fibre, optical fibre cables, connectivity systems and components, active peripherals – turnover share 7.4%

Turnover was up by 10.5% despite a decline in demand in the Netherlands and Poland. In the Netherlands, the decline in demand is still not being offset by the installation of fibre optic networks in rural areas. In Poland, the decline in European subsidies had a negative impact on the willingness to invest. However, TKH recorded turnover growth in China, Germany and France. The higher capacity utilization level and the realized efficiency improvements had a positive impact on the result.

Building Solutions

Profile

Building Solutions develops, produces and delivers solutions in the field of efficient electro-technical technology, ranging from applications within buildings to technical systems which, linked to software, provide efficiency solutions for the care and security sectors. TKH’s know-how in this segment is focused on vision technology and connectivity systems combined with efficiency solutions to reduce the throughput time for the realization of installations within buildings and industrial automation. In addition, TKH’s focus in this segment is on intelligent video, intercom and access monitoring systems for a number of specific sectors, including elderly care, parking, marine, the oil & gas industry, tunnels and security for buildings and work sites.

Turnover in the Building Solutions segment fell by 4.7% to € 274.0 million, of which 0.9% is a result of the divestment of Parking & Protection. Currency exchange rates had a negative impact of 1.0% on turnover. In addition, lower raw materials prices had a negative impact of 2.3% on turnover. On balance, the organic drop in turnover came in at 0.5% in the first half year. A reluctance to invest had a negative impact on turnover in China and Poland. Organic turnover growth was 2.6% in the second quarter.

EBITA fell 3.7% to € 28.9 million, as a result of the drop in turnover. ROS improved slightly to 10.6% in the first half of 2016 (H1 2015: 10.4%).

Vision & Security systems - vision technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration, care systems – turnover share 25.5%

Organic turnover decreased 0.1%. The reluctance to invest in China and Poland had a negative impact on turnover. On the other hand, turnover was up in Europe, primarily in the security segment. Turnover in parking solutions increased due to a growing demand for efficient and intelligent parking systems, based on vision technology. The introduction of new, advanced vision-technology for the automation and inspection of production processes, in response to ever higher specifications, resulted in the first contracts.On the basis of feedback from customers, we see considerable potential for innovation within our vision technology, confirming our growth targets for the vertical growth market machine vision.

Connectivity systems - specialty cable (systems) for marine, rail, infrastructure, wind energy, as well as installation and energy cable for niche markets – turnover share 16.6%

Turnover fell organically by 1.1%. This was the result of a drop in market volume due to fewer large-scale projects in the construction and infra sector, as well as a drop in the marine, oil & gas markets. On the other hand, turnover was up in energy and data cable systems. Due to TKH’s strong focus on margins and efficiency improvements, both added value and the result came in higher. The new plant for subsea cable systems was commissioned in the first half of 2016. In the second quarter, TKH started pilot productions. Series production is expected to start in the first quarter of 2017.

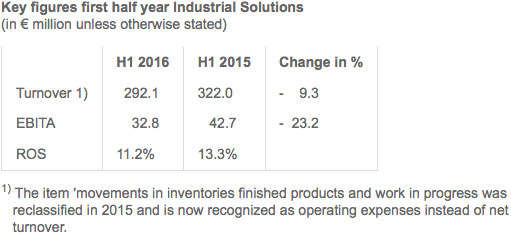

Industrial Solutions

Profile

Industrial Solutions develops, produces and delivers solutions ranging from specialty cable, plug and play cable systems to integrated systems for the production of car and truck tires. The company’s know-how in the automation of production processes and improvements in the reliability of production systems gives TKH the differentiating potential to respond to the increasing desire to outsource the construction of production systems or modules in a number of specialized industrial sectors, such as tire manufacturing, robotics, medical and machine building industries.

Turnover in the Industrial Solutions segment fell by 9.3% to € 292.1 million. Currency exchange rates had a negative impact of 0.2% on turnover. Turnover was down 1.8% due to lower average raw materials prices. Turnover fell by 7.3% organically. The drop in turnover was due entirely to the sub-segment manufacturing systems and was related to the previously reported lower order intake in 2015, which was in turn due to reluctance to invest in China. Turnover in the connectivity systems sub-segment developed positively and grew organically by 7.2%.

EBITDA was down 23.2% at € 32.8 million as a result of lower turnover and production capacity utilization, as well as investments in capacity expansion and higher R&D expenses. This in turn reduced ROS to 11.2% in the first half of 2016, from 13.3% in the first half of 2015.

Connectivity systems - specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 19.3%

Organic turnover growth came in at 7.2%. This turnover growth was realized in the medical and robot industries. Investments in R&D, making it possible for TKH to respond optimally to the trend of miniaturization and extending the life time of cable systems for advanced production systems, are clearly bearing fruit in these areas.

The strong increase in the demand for robot systems is also having a positive impact on this front.

Manufacturing systems - advanced manufacturing systems for the production of car and truck tires, can washers, test equipment, product handling systems for the medical industry, machine operating systems – turnover share 25.6%

Turnover declined organically by 16.2%. This decline was the result of the reduced order intake in 2015 and the effect of a relatively large share in engineering activities prior to production as a consequence of new developed technology and continued breakthroughs among the top five tire manufacturers. TKH continued to increase production capacity in the second quarter in order to meet the expected increase in production levels in the second half of 2016. The reluctance to invest in China still has a negative impact on the order intake. In the second quarter, we saw the postponement of a number of projects, which resulted in a relatively low level of order intake of € 50 million. Despite the low order intake, the order book is well-filled, which will result in a higher production value in the coming quarters. In the second quarter, the tire manufacturing industry announced a number of major projects, for which TKH is well positioned and which may result in order intake.

Outlook

The outlook for the second half of the year in the market segments in which TKH operates, shows generally a more positive picture.

In Telecom Solutions, we expect turnover in line with the first half year. The demand for optical fibre in China will be lower in the second half of 2016, but we expect that this will be largely compensated by higher demand in Europe. We expect a different geographical distribution of turnover to lead to a lower result than in the first half of the year.

In Building Solutions, turnover will develop positively in the second half of the year. The order book and order intake in both connectivity and vision & security are at healthy levels and the outlook for potential orders is overall positive. On balance, we expect the result in the second half of the year to be higher than in the first six months.

In Industrial Solutions, turnover will be higher as a result of the well-filled order book in both connectivity and manufacturing systems. We expect the order intake for manufacturing systems in the second half of the year to exceed that of the first half year. We expect the result to be higher in the second half of the year than in the first half year.

On balance, and barring unforeseen circumstances, TKH expects net profit before amortization and one-off income and expenses attributable to shareholders of between € 88 million and € 93 million for the full year 2016 (2015: € 99.9 million).

The complete press release can be downloaded in PDF