H1 2017 Results

Press Release

Haaksbergen, the Netherlands

15 Aug 2017

Further turnover growth driven by strengthened position in vertical growth markets

Highlights second quarter 2017

- Turnover up 9.7% at € 365.5 million – organic growth 7.4%.

- Organic turnover growth in Telecom Solutions (10.9%), Building Solutions (7.9%) and Industrial Solutions (5.8%) on the back of strong contribution vertical growth markets.

- Higher start-up costs in vertical markets Marine & Offshore, Tunnel & Infra and Parking (Building Solutions) lead to 6.0% decrease in EBITA.

- Increase EBITA in Telecom Solutions and Industrial Solutions.

- Order intake manufacturing systems € 114 million – market recovery China and further growth of market share among top five tire manufacturers.

- Cost of settlement with minority shareholders in Augusta Technologie AG in squeeze-out procedure lower than expected.

Highlights first half 2017

- Turnover up 11.5% at € 725.2 million – organic growth 9.1%.

- Organic turnover increase in Telecom Solutions (12.3%), Building Solutions (10.1%) and Industrial Solutions (7.3%).

- EBITA up by 9.5%.

- Net profit before amortization and one-off income and expenses attributable to shareholders up 10.0%

Outlook

- Outlook for full-year 2017: net profit before amortization and one-off income and expenses attributable to shareholders of between € 92 and € 97 million (2016: € 94.4 million).

Alexander van der Lof, CEO of technology company TKH:

“In the second quarter, turnover growth continued in all segments, largely driven by the growth in our vertical growth markets, in which we are well positioned to expand our new technologies. In line with the first quarter, a high order intake was booked in Tire Building Industry. The recovery from China continues and our market share in the top five tire manufacturers has expanded, which gives confidence for further growth. The increase in sales was not fully translated into the consolidated TKH-result due to additional costs in the second quarter. For the further development and positioning of our technologies in key growth markets, significant start-up costs had to be made. We expect these costs will also continue in the third quarter, although to a lesser extent. However, this will strengthen our starting position for profit growth for 2018. In addition, in April and July of this year, we strengthened our market positions through targeted acquisitions in Canada and Australia within our subsegment vision & security systems. The underlying developments are solid and we see a lot of interest in our distinctive technologies, such as our vision technology and the airfield ground lighting portfolio based on CEDD technology.”

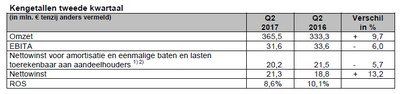

Financial developments second quarter

Turnover in the second quarter of 2017 was € 32.2 million (9.7%) higher at € 365.5 million (Q2 2016: € 333.3 million). Higher raw materials prices accounted for an increase of 1.6% in turnover. Acquisitions accounted for 0.6% of the increase. The on average stronger foreign currencies against the euro had a positive impact of 0.1% on turnover. On balance, turnover increased organically by 7.4%.

All segments recorded an increase in turnover in the second quarter. Telecom, Building and Industrial Solutions realized organic growth of 10.9%, 7.9% and 5.8% respectively.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) declined by 6.0% to € 31.6 million in the second quarter of 2017 (Q2 2016: € 33.6 million). The EBITA at both Telecom and Industrial Solutions was higher when compared to the second quarter of 2016, while EBITA at Building Solutions declined. The decline in Building Solutions was due to the start-up costs for up scaling of new technologies and for strengthening our market positioning in the vertical growth markets Marine & Offshore, Tunnel & Infra and Parking. These costs peaked in the second quarter, while the associated turnover was still limited. TKH also incurred one-off costs related to technology upgrades .

TKH recorded a ROS of 8.6% in the second quarter of 2017 (Q2 2016: 10.1%). Excluding the above mentioned items, the ROS would have been in line with the first quarter of 2017 (10.9%).

The lower operating result led to a decline in net profit before amortization and one-off income and expenses attributable to shareholders of 5.7% to € 20.2 million (Q2 2016: € 21.5 million). However, net profit was up 13.2%, partly on the back of one-off net income of on balance € 3.5 million.

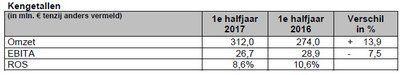

Financial developments first half

Turnover increased by 11.5% to € 725.2 million in the first half of 2017 (H1 2016: € 650.1 million). Organic turnover growth amounted to 9.1%. Higher raw materials prices accounted for an increase of 1.8% in turnover, while on average stronger foreign currencies against the euro had a positive impact of 0.1% on turnover. Acquisitions accounted for turnover growth of 0.5%. All segments contributed to the growth in turnover.

The contribution of Industrial Solutions to overall turnover declined to 44.0% in the first half of 2017, from 44.9% in the year-earlier period. The contribution of Building Solutions to overall turnover increased to 43.0%, from 42.1% a year earlier. Telecom Solutions’ contribution remained stable at 13.0%. The gross margin declined to 45.6% in the first half of 2017, from 46.4% in the first half of 2016. The decline in margin was due to higher raw materials prices and one-off costs related to the upgrade of technology for parking guidance systems.

Operating costs were 9.6% higher compared to the first half of 2016. This increase was largely due to higher production levels, start-up costs for the subsea production capacity, as well as the expansion of the R&D and commercial organization. Acquisitions resulted in a 1.5% increase in costs. As a percentage of turnover, production costs declined to 35.8% in the first half of 2017, from 36.5% in the first half of 2016.

Depreciation amounted to € 11.9 million and were higher than in the first half of 2016 (€ 10.1 million), due to the high investment levels in recent years.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) was 9.5% higher at € 70.9 million in the first half of 2017, from € 64.8 million in the first half of 2016. The EBITA at Telecom Solutions was up 21.1%. At Building Solutions, the EBITA was down 7.5% and at Industrial Solutions the EBITA was 24.6% higher.

ROS came in lower at 9.8% (H1 2016: 10.0%).

Amortization increased by € 2.3 million to € 18.2 million (H1 2016: € 15.9 million), due to higher R&D spending in recent years.

The financial result declined by € 0.4 million to € 2.8 million in the first half of 2017. Interest expenses were up € 0.3 million due to an on average higher outstanding bank debt. Currency effects had a negative impact of € 0.3 million. The result from other participations was € 0.2 million higher.

At the end of July, TKH agreed a settlement with the former minority shareholders of Augusta Technologie AG in the squeeze-out procedure. This settlement was lower than anticipated and therefore resulted in one-off untaxed income of € 2.1 million due to a partial release of the financial liability. The financial settlement will be completed in August. In addition to this, a release has been made of earn-out liabilities. On balance, there was an one-off income of € 3.5 million.

The tax rate declined to 18.6% in the first half of 2017, from 21.7% in the first half of 2016. The releases of the squeeze-out and earn-out liabilities is tax exempt and therefore reduced the overall tax rate. Normalized tax burden was 20.3% (H1 2016: 22.0%). Fiscal R&D incentives such as the Dutch innovation box facility had a lowering impact on the overall tax rate. With effect from 2017, TKH has agreed on a new innovation box arrangement with the Dutch Tax Authorities that is in line with the revised innovation box regime. This arrangement is effective through 2022 and offers fiscal benefits comparable to the previous arrangement.

Net profit before amortization and one-off income and expenses attributable to shareholders rose by 10.0% to € 45.1 million in the first half of 2017 (H1 2016: € 41.0 million). Net profit was up 21.0% at € 43.4 million in the first half of 2017 (H1 2016: € 35.9 million).

Net bank debt, calculated in line with the bank covenants, increased by € 56.9 million to € 223.0 million compared to year-end 2016. This increase was related to the dividend pay-out, investments and higher working capital. Working capital was higher due to seasonal influences. Working capital as a percentage of turnover had increased to 14.5% at end-June 2017, from 13.4% at year-end 2016. The net debt/EBITDA ratio came in at 1.2, which means that TKH is operating well within the financial ratio agreed with the company’s banks. Solvency amounted to 43.7% in the first half of 2017 (H1 2016: 44.2%).

The number of employees with a permanent contract (FTEs) stood at 5,766 at end-June 2017 (end-June 2016: 5,433 FTEs). In addition, TKH had a total of 491 temporary employees at end-June 2017 (end-June 2016: 405).

Developments per solutions segment

Telecom Solutions

Telecom Solutions develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. The focus of the business is on the delivery of completely worry-free systems for its clients, thanks to the system guarantees it provides. Around 40% of the portfolio consists of hub-to-hub optical fiber and copper cable systems. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in network hubs.

urnover in the Telecom Solutions segment increased by 12.0% to € 94.2 million. Currency effects had a negative impact of 0.3% on turnover. The organic increase in turnover amounted to 12.3%. This organic growth was realized in the fiber network systems sub-segment.

EBITA was 21.1% higher at € 11.2 million. ROS improved to 11.9% from 11.0% due to higher capacity utilization in optical fiber production and higher added value.

Indoor telecom & Copper networks - home networking-systems, broadband connectivity, IPTV software solutions, copper cable, connectivity systems and components, active peripherals – turnover share 4.6%

The turnover fell organically by 8.4% due to a further drop in investment levels in copper networks.

Fiber network systems - optical fiber, optical fiber cables, connectivity systems and components, active peripherals – turnover share 8.4%

The turnover saw organic growth of 28.2% due to the persistent high level of demand for optical fiber in China. On top of this, the turnover from fiber optic networks was higher in Germany, Poland and France. In France, TKH strengthened its sales organization and several orders were booked for a specifically for the French market designed portfolio. The growth in our market share due to these measures was largely seen in the second quarter of this year. TKH also recorded growth in the Nordics. The high utilization levels and the resultant efficiency benefits had a positive impact on results.

Building Solutions

Building Solutions connects the core technologies vision & security, communications and connectivity in comprehensive solutions for security and communications applications in and around buildings, in medical applications, as well as for inspection, quality, product and process control. Building Solutions also focuses on efficiency solutions to reduce the throughput-time for the realization of installations within buildings, and on intelligent video, mission critical communications, evacuations, access (control) and registration systems for a number of specific sectors, including care, parking, marine and offshore, tunnels and airports.

Turnover in Building Solutions segment was up 13.9% at € 312.0 million. Higher raw materials prices had an effect of 2.3% on turnover. Currency effects had an impact of 0.4%. Acquisitions accounted for 1.1% of the turnover. On balance, turnover rose organically by 10.1% in the first half of the year.

EBITA declined by 7.5% to € 26.7 million. The operating result was pressured by higher start-up costs related to the new subsea production capacity in Lochem and the development of the airfield ground lighting portfolio (CEDD). In addition to this, TKH incurred one-off costs for the upgrading of technology for parking guidance systems. ROS declined to 8.6% in the first half of 2017 (H1 2016: 10.6%).

Vision & Security systems – vision technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration, care systems – turnover share 24.7%

Turnover increased organically by 6.7%. A significant portion of this growth was realized in the vertical growth markets Machine Vision and Tunnel & Infra. In Machine Vision, TKH increased its market share among the manufacturers of consumer electronics. The newly developed innovative camera platform with ‘embedded vision’ for the automation and inspection of production processes generated positive feedback and has a lot of potential. In addition to this, TKH expanded the commercial and R&D organization within Machine Vision.

In the Tunnel & Infra market, TKH increased its market share in Norway with CCTV and communication solutions from its tunnel portfolio. Within Parking TKH saw a slowdown in order intake and delivery of parking guidance systems. The organization has been, in anticipation of expected growth, considerably expanded in this segment and this had a short-term negative impact on the results.

Connectivity systems – specialty cable (systems) for shipping, rail, infrastructure, wind energy, as well as installation and energy cable for niche markets, structured cabling systems - turnover share 18.3%

The organic turnover increase was 15.5%. This was partly the result of an increase in market volume in the construction and infra sector. Turnover in marine & offshore and data cable systems was also higher. In the vertical growth market Tunnel & Infra, TKH made solid progress with the new CEDD technology for airfield ground lighting, which integrates various TKH technologies and competencies. The strengthening of the operational organization and the expansion of R&D specifically targeting the airport market had a negative impact on results. Although the certification of the CEDD technology for large-scale projects will be completed at the end of this year, airports are already showing a great deal of interest in this disruptive technology. TKH also incurred higher start-up costs in Marine & Offshore for the new production facility for subsea cable systems in Lochem, while this is not yet generating turnover. This operation will contribute to turnover in the second half of 2017.

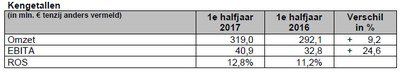

Industrial Solutions

Industrial Solutions develops, produces and delivers solutions ranging from specialty cable, plug and play cable systems to integrated systems for the production of car and truck tires. The company’s know-how in the automation of production processes and improvements in the reliability of production systems gives TKH the differentiating potential it needs to respond to the increasing desire to outsource the construction of production systems or modules in a number of specialized industrial sectors, such as tire manufacturing, robotics, medical and machine building industries.

Turnover in the Industrial Solutions segment increased by 9.2% to € 319.0 million. Turnover was 1.9% higher due to higher raw materials prices. Organic turnover growth was 7.3%. Turnover growth was largely accounted for by the sub-segment manufacturing systems and was related to the higher order intake in the past quarters.

EBITA was up by 24.6% at € 40.9 million, as a result of higher turnover and production capacity utilization. ROS consequently increased to 12.8% in the first half of 2017, from 11.2% in the first half of 2016.

Connectivity systems – specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 18.3%

Organic turnover growth was 1.2%. This turnover growth was realized in the medical and robot industries. Continued investments in R&D are enabling TKH to respond optimally to the trend towards the miniaturization and the extension of the lifespan of cable systems for advanced manufacturing systems. In addition, TKH has also benefited from a growing increase in the demand for robot systems.

Manufacturing systems – advanced manufacturing systems for the production of car and truck tires, can washers, test equipment, product handling systems for the medical industry and machine operating systems – turnover share 25.7% Organic turnover growth was 11.9%. This was due to the higher order intake in the past quarters, which led to higher levels of engineering activities and production. This in turn led to an improvement in both EBITA and ROS. In the second quarter, order intake amounted to € 114 million (H1 2017: € 228 million) in line with the first quarter. The order intake was driven by the continued recovery of order intake from China, as well as growth in TKH’s market share among the top five tire manufacturers. Thanks to the higher order intake over the past quarters, TKH has a well filled order book. Due to the fact that the order book is filled with relatively large number of new machines, among others the MILEXX and customer-specific developments for the top five tire manufacturers, the share accounted for by engineering has increased sharply. This has a significant impact on the throughput time of orders, which means the higher order intake will primarily only just have a positive impact on higher production value and turnover as from 2018. The increase in turnover and the related overhead coverage and profit contribution were therefore still limited in the second quarter.

Outlook

The outlook for the second half of the year in the market segments in which TKH is active shows generally a positive picture.

In Telecom Solutions, we expect demand for optical fiber in China and fiber optic networks in Europe to be in line with the first half of the year. Thereby we expect the result to also be in line with the result of the first half of the year.

In Building Solutions, turnover will increase in the second half of the year. The order book and order intake in both connectivity systems and vision & security systems is at a healthy level. Start-up costs will remain at a high level in the third quarter in line with the previous quarters. On balance, we expect the result in the second half of the year to show an improvement compared to the first half of the year.

In Industrial Solutions, turnover will increase compared to the first half of the year. Customer-specific developments and new technologies within manufacturing systems will require relatively high levels of engineering activities in the coming quarters, which means the positive impact of the increases in the order book and order intake will primarily only just be visible in the result as from 2018. Nevertheless, the result in the second half of the year will be higher than in the first half of the year.

On balance and barring unforeseen circumstances, for the full-year 2017 TKH expects net profit before amortization and one-off income and expenses attributable to shareholders of between € 92 million and € 97 million (2016: € 94.4 million).

The complete press release can be downloaded in PDF