H1 2018 Results

Press Release

Haaksbergen, the Netherlands

14 Aug 2018

Increase in turnover and result in all segments

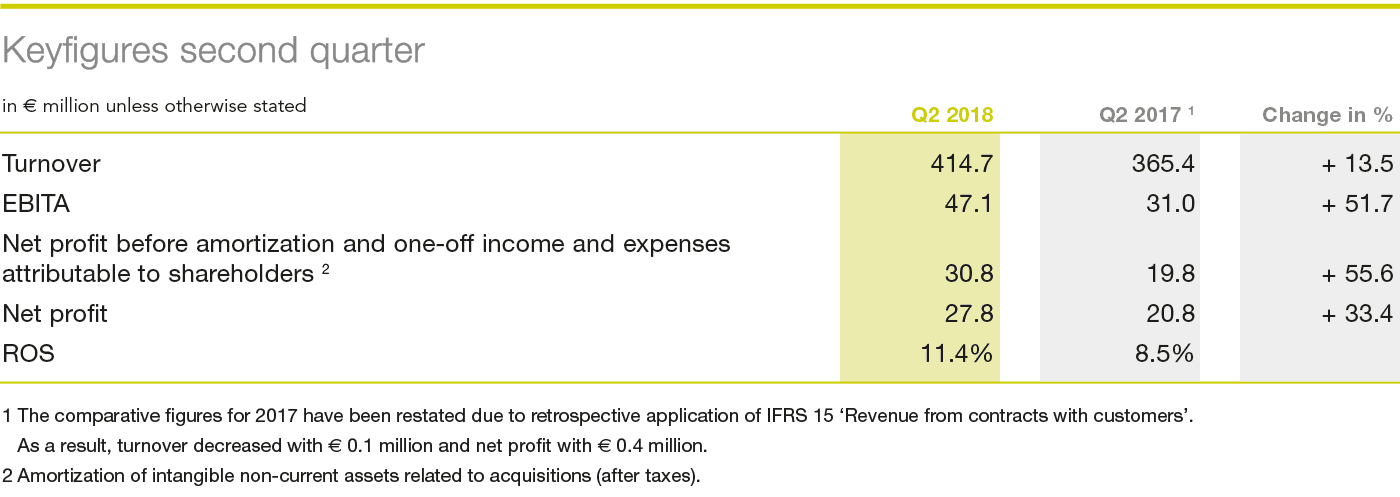

Highlights second quarter 2018

- Turnover growth of 13.5% to € 414.7 million – organic growth +13.0%.

- Organic turnover growth in Building Solutions (11.8%) and Industrial Solutions (18.2%) – strong contribution from vertical growth markets.

- EBITA rises by 51.7% to € 47.1 million.

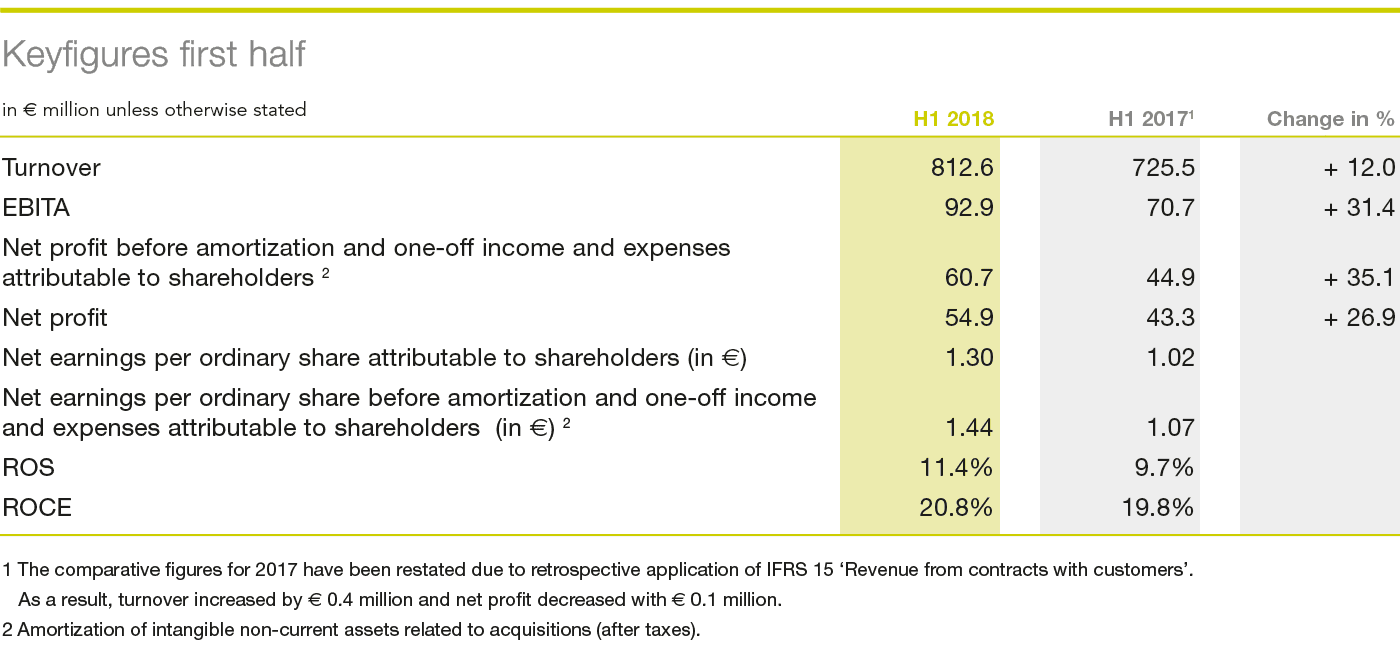

Highlights first half 2018

- Turnover growth of 12.0% to € 812.6 million – organic growth +11.9%.

- Organic turnover growth in Telecom Solutions (6.3%), Building Solutions (10.6%) and Industrial Solutions (14.8%).

- EBITA growth of 31.4% – increase in all segments.

- Net profit before amortization and one-off income and expenses attributable to shareholders up 35.1%.

Outlook

- Outlook for full-year 2018: Net profit before amortization and one-off income and expenses attributable to shareholders of between € 116 million and € 122 million (2017: € 95.6 million).

Alexander van der Lof, CEO of technology company TKH: “The strong growth in both turnover and result in the first half year is the direct result of the strategy we launched, aimed at translating unique technologies into smart solutions for our customers. The growth we expected is now materializing as planned and we are clearly gaining benefits from the focus on our four core technologies and seven vertical growth markets. Strict investment discipline has helped us to substantially improve our market position in recent years and our start-up costs have gradually normalized. In anticipation of further turnover growth, costs are still outpacing income in the subsea (Marine & Offshore) and CEDD airfield ground lighting (Tunnel & Infra) segments. ROS increased to 11.4% in the first half of the year, which means we are well on track to realize our medium-term ROS target of 12-13%.”

Financial developments second quarter

Turnover in the second quarter of 2018 was € 49.2 million higher (+13.5%) at € 414.7 million (Q2 2017: € 365.4 million). Acquisitions accounted for 0.4% of the increase. Higher raw materials prices accounted for an increase of 0.9% in turnover. On average weaker foreign currencies against the euro had a negative impact of 0.8% on turnover. On balance, turnover increased organically by 13.0%. The increase in turnover in the second quarter was realized primarily in Building Solutions and Industrial Solutions. These segments recorded organic growth of 11.8% and 18.2% respectively.

The operating result before amortization of intangible non-current assets and one-off income and expenses (EBITA) increased by 51.7% to € 47.1 million in the second quarter of 2018 (Q2 2017: € 31.0 million). The EBITA at Telecom Solutions, Building Solutions and Industrial Solutions was higher than in the second quarter of 2017. Due to to a higher turnover, TKH operated more cost-efficiently. The start-up costs for investments in new technology, expansion of production capacity and market positioning declined considerably when compared to the same period of last year.

TKH recorded a ROS of 11.4% in the second quarter of 2018 (Q2 2017: 8.5%).

Net profit before amortization and one-off income and expenses attributable to shareholders was 55.6% higher at € 30.8 million (Q2 2017: € 19.8 million). Net profit increased by 33.4%.

Financial developments first half year

Turnover increased by 12.0% to € 812.6 million in the first half of 2018 (H1 2017: € 725.5 million). Organic turnover growth amounted to 11.9%. Higher raw materials prices accounted for an increase of 0.6% in turnover, while on average weaker foreign currencies against the euro had a negative exchange impact of 1.1% on turnover. Acquisitions accounted for turnover growth of 0.6%. All segments contributed to the growth in turnover.

The gross margin remained unchanged at 45.6% (H1 2017: 45.6%).

Operating expenses were 6.8% higher than in the first half of 2017. This increase was largely due to higher production levels. The operating expenses of the acquisitions accounted for a 0.8% increase in costs. As a percentage of turnover operating expenses declined to 34.2% in the first half of 2018, from 35.8% in the same period of 2017. Depreciation amounted to € 13.5 million in the first half of 2018, up from € 11.9 million in the first half of 2017. This is due to a high investment level over the past few years.

The operating result before amortization of intangible non-current assets and one-off income and expenses (EBITA) was 31.4% higher at € 92.9 million in the first half of 2018, compared with € 70.7 million in the first half of 2017. Compared to the first half of 2017, EBITA was up 41.4% at Telecom Solutions, up 28.0% at Building Solutions and 27.4% higher at Industrial Solutions.ROS was higher in the first half of 2018 at 11.4% (H1 2017: 9.7%).

Amortization costs increased by € 0.4 million, due to higher R&D investments over the past few years.

The financial result improved by € 0.6 million due to the fact that a number of interest rate swaps expired at the end of 2017, as a result of which TKH was able to benefit from the lower interest rate levels in 2018. However, this was offset by negative currency effects of € 0.6 million. The result from other associates increased by € 0.6 million.

The effective tax rate increased to 23.7% in the first half of 2018, from 20.4% in the first half of 2017, partly due to higher profits in countries with a higher tax rate. In addition, the Dutch government has raised the tax rate for the innovation box facility to 7% from 5% effective 1 January 2018.

Net profit before amortization and one-off income and expenses attributable to shareholders rose by 35.1% to € 60.7 million (H1 2017: € 44.9 million). Net profit growth was 26.9% to € 54.9 million (H1 2017: € 43.3 million; net profit of the first half of 2017 was impacted by one-off untaxed income totaling € 3.6 million).

Net bank debt calculated in line with the bank covenants increased by € 99.9 million from the year-end 2017 figure to € 257.7 million. This increase was related to the dividend pay-out, acquisition of the non-controlling interest held by third parties in Commend International, investments and higher working capital. Working capital as a percentage of turnover increased to 16.4% (mid-2017: 14.6%). The Net debt/EBITDA ratio was 1.3, which means that TKH is operating well within the financial ratio agreed with its banks. Solvency stood at 43.1% (H1 2017: 43.7%).

The number of employees with a permanent contract (FTEs) stood at 6,129 at 30 June 2018 (mid 2017: 5,766 FTEs). In addition, TKH had a total of 543 temporary employees at 30 June 2018 (mid 2017: 491).

Developments per solutions segment

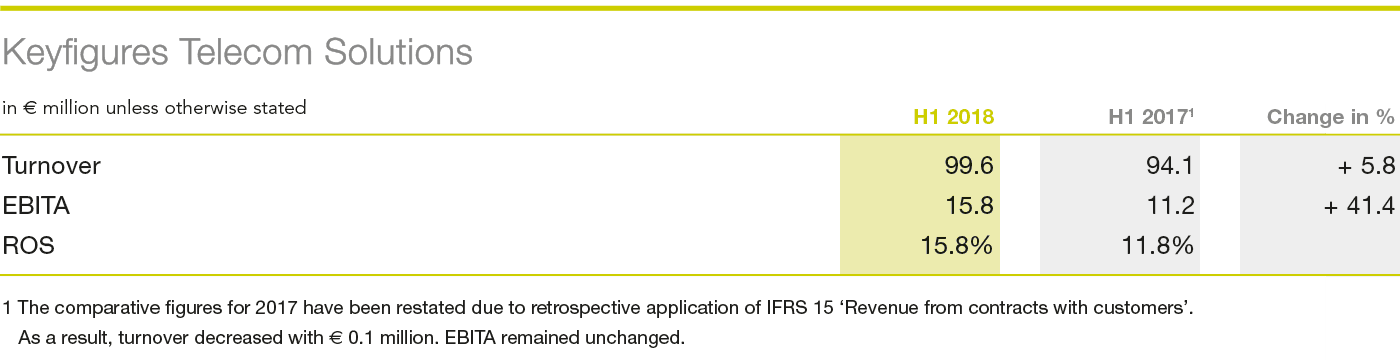

Telecom Solutions

Telecom Solutions develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. The focus of the business is on the delivery of completely worry-free systems for its clients, thanks to the system guarantees it provides. Around 40% of the portfolio consists of hub-to-hub optical fibre and copper cable systems. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals,is deployed primarily in network hubs.

Turnover in the Telecom Solutions segment increased by 5.8% to € 99.6 million. Currency exchange rates had a negative impact of 0.5% on turnover. Turnover increased organically by 6.3%.

EBITA was 41.4% higher at € 15.8 million. ROS improved to 15.8% in the first half of 2018 (H1 2017: 11.8%).

Fibre network systems - optical fibre, optical fibre cables, connectivity systems and components, active peripherals – turnover share 7.9%

The organic turnover growth was 6.3%. The growth was primarily realized in Germany, France and Poland. The high capacity utilization level, improved efficiency and demand for high -fibre count cable specifications also had a positive impact on the result. While growth in China has slowed down, the strong global demand for optical fibre remains undiminished. Our growth was hampered by the availability of preforms, a semi-finished product used to draw optical fibre. However, TKH will benefit from the capacity expansion for preforms at its joint venture partner. TKH will also expand its optical fibre production capacity. We expect the additional capacity to be fully available in mid-2019.

Indoor telecom & Copper networks - home networking-systems, broadband connectivity, IPTV software solutions, copper cable, connectivity systems and components, active peripherals – turnover share 4.4%

Turnover in this sub-segment saw organic growth of 6.2%. This growth was mainly realized in the broadband connectivity portfolio for the Benelux and Germany. The gross margin increased due to an improved product mix.

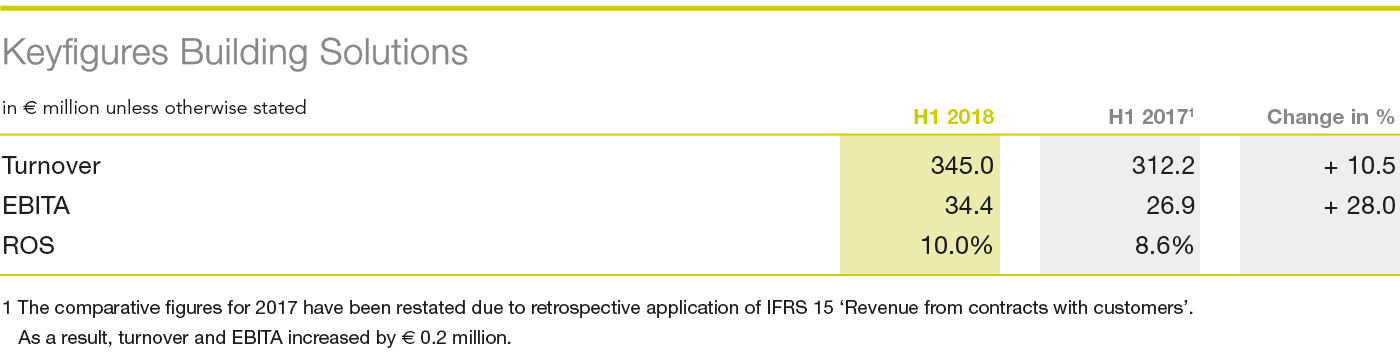

Building Solutions

Building Solutions connects the core technologies vision & security, mission critical communications and connectivity in comprehensive solutions for security and communications applications in and around buildings, in medical applications, as well as for inspection, quality, product and process control. Building Solutions also focuses on efficiency solutions to reduce throughput times for the realization of installations within buildings, and on intelligent video, mission critical communications, evacuations, access (control) and registration systems for a number of specific sectors, including healthcare, parking, marine and offshore, tunnels and airports.

The Building Solutions segment saw turnover increase by 10.5% to € 345.0 million. Higher raw materials prices had an impact of 0.8% on turnover. Currency exchange rates had a negative impact of 2.1%. Acquisitions contributed 1.2% to turnover. On balance, turnover increased organically by 10.6% in the first half of 2018.

EBITA increased by 28.0% to € 34.4 million. Start-up costs normalized in the first half, with the exception of the costs related to subsea cable production and the development of the airfield ground lighting portfolio (CEDD). ROS improved to 10.0% in the first half (H1 2017: 8.6%).

Vision & security systems - vision technology based on 2D and 3D camera technology, camera sensor technology and 3D laser technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration, healthcare systems – turnover share 22.7%

Turnover increased organically by 3.9%. The vertical growth market Parking accounted for an important share of this growth. This market saw strong order intake, especially in the field of parking guidance systems, which led to further growth in both turnover and the order book. Machine Vision recorded strong growth in 3D smart sensor technology. With a view to future growth prospects, TKH further expanded production capacity, which led to higher operating costs. Due to the program initiated last year to further increase our focus on core activities and on improving returns, TKH terminated a number of activities in the security segment.

Connectivity systems - specialty cable (systems) for marine, rail, infrastructure, wind energy, as well as installation and energy cable for niche markets, structured cabling systems and connectivity systems for contactless energy and data distribution – turnover share 19.7%

Turnover increased organically by 19.6%. This growth was realized in several market segments. For instance, market volumes continued to grow in the construction and infrastructure sector. The higher investment needs for energy networks in connection with alternative energy resources had a positive impact on the demand for energy cables from network companies. Turnover came in higher in the data cable system segment.Marine & Offshore also recorded growth, partly due to the start-up of the new production facility for subsea cable systems. The vertical growth market Tunnel & Infra recorded significant growth due to the increase of TKH’s market share in airfield ground lighting (AGL) systems. The new CEDD technology for AGL, which integrates various TKH technologies and competencies, was applied successfully in a number of projects.

Industrial Solutions

Industrial Solutions develops, produces and delivers solutions ranging from specialty cable, plug and play cable systems to integrated systems for the production of car and truck tires. TKH’s know-how in the automation of production processes and improvements in the reliability of production systems gives the company the differentiating potential it needs to respond to the increasing desire to outsource the construction of production systems or modules in a number of specialized industrial sectors, such as tire manufacturing, robotics, and the medical and machine building industries.

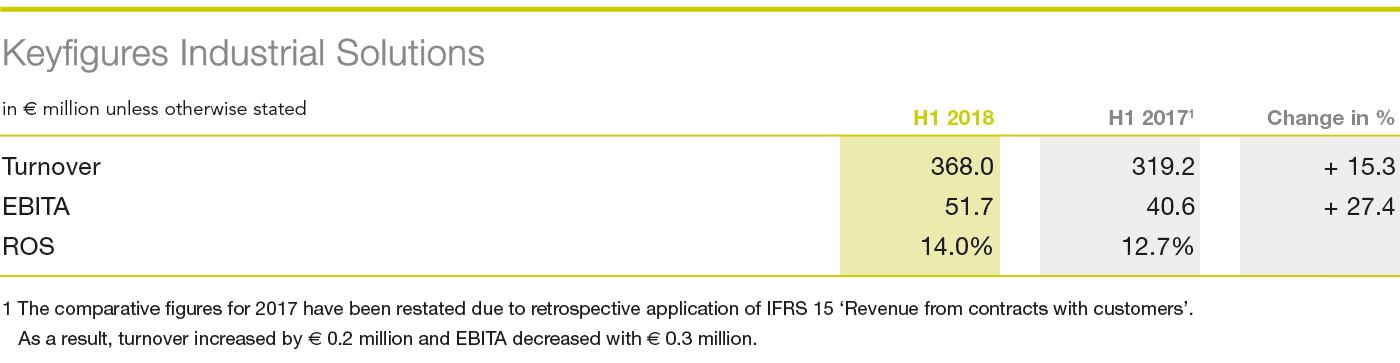

Turnover in the Industrial Solutions segment increased by 15.3% to € 368.0 million. Turnover increased by 0.6% on the back of on average higher raw materials prices. Currency exchange rates had a negative impact of 0.2% on turnover. Acquisitions contributed 0.1% to turnover. Turnover increased organically by 14.8%.

EBITA rose by 27.4% to € 51.7 million as a result of higher turnover and higher production capacity utilization. As a result, ROS increased to 14.0% in the first half of 2018, compared with 12.7% in the first half of 2017.

Connectivity systems - specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 18.7%

Organic turnover growth was 12.4% in this sub-segment, in particular due to the growing demand for capital goods with a need for robotization and automation. With our cables and cable systems we are well positioned for this robotization and automation application. In addition, we realized higher turnover in the medical industry. Our investment in the new production facility for high-grade industrial cable systems in China is on schedule and we will take this new facility into use in the third quarter of this year.

Manufacturing systems - advanced tire manufacturing production systems for the car and truck tire manufacturing industries, can washers, testing equipment, product handling systems for the medical industry and machine operating systems – turnover share 26.6%

This sub-segment recorded an organic turnover increase of 16.6%. This increase was due to the higher order intake over the past few quarters, which resulted in higher levels of engineering and production. Both EBITA and ROS improved, despite the relatively high number of new machines and applied technologies. Order intake amounted to € 80 million in the second quarter of 2018 (H1 2018: € 203 million). The share of the top-five tire manufacturers in order intake continued to increase. TKH has decided to further increase the capacity at its Polish production facility, related to the envisaged growth and the flexibility in our production locations.

Outlook

The outlook for the second half of the year per Solution segment is as follows.

Telecom Solutions

At Telecom Solutions, we expect to see a slight decline in demand for optical fibre in China, while the demand for optical fibre networks in Europe will continue to be strong. Thanks to the market positions we have gained, the growth potential for TKH will be largely concentrated in Europe. The capacity expansion we have initiated will only materialize in 2019. TKH expects the result for the second half of the year to be in line with the first half of the year.

Building Solutions

At Building Solutions, turnover will increase in the second half of the year. The order book and order intake in both connectivity systems and vision & security systems are at a good level. Despite the fact that the second half will also include start-up costs, on balance we expect the result for the second half of the year to be slightly higher than in the first half of the year.

Industrial Solutions

At Industrial Solutions, turnover will be slightly lower in the second half of the year, despite the well-filled order book in both connectivity systems and manufacturing systems. In the connectivity systems segment, we are seeing a shift in current orders in the German machine building sector, which will have a negative impact on turnover in the second half of the year. Based on the order intake in the first half year and the current order book, we expect the activities in the manufacturing systems segment to remain at a high level and TKH has initiated further investment in the expansion of capacity for the medium term. TKH expects the result at Industrial Solutions to be slightly lower in the second half of the year, in line with turnover development.On balance and barring unforeseen circumstances, TKH expects a net profit before amortization and one-off income and expenses attributable to shareholders for 2018 of between € 116 million and € 122 million (2017: € 95.6 million).

The complete press release can be downloaded in PDF