H1 2020 Results

Press Release

Haaksbergen, the Netherlands

11 Aug 2020

Clear impact COVID-19 on turnover and result in Q2 2020 - Improved margin and lower cost level limit EBITA decline

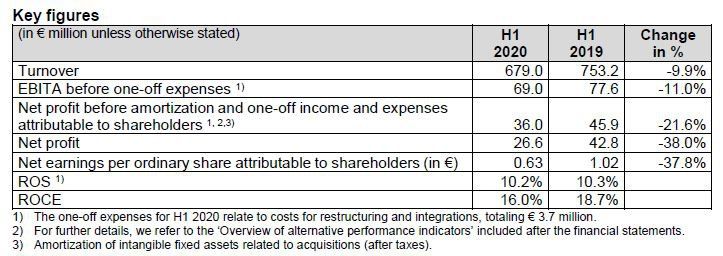

Financial highlights first half 2020

- Turnover down 9.9% at € 679 million, organic decline 7.5%.

- Strongest decline at Industrial Solutions and Telecom Solutions.

- Minor organic decline at Building Solutions. - EBITA before one-off income and expenses 11.0% lower at € 69 million.

- ROS virtually unchanged at 10.2% (H1 2019: 10.3%) supported by Building Solutions.

- One-off expenses totaling € 3.7 million due to restructuring, integrations and impairments of € 1.5 million.

- Net profit before amortization and one-off income and expenses attributable to shareholders declined by 21.6% to € 36.0 million.

Strategic highlights first half 2020

- Solid progress strategic development, driven by ‘Simplify & Accelerate’ program despite COVID-19:

- Integration and focus on margin improvement well on track.

- Completion divestment of ZTC (production of copper data communication cables in China) and Cruxin (system integration activities in the Netherlands).

- Since the start of the program, € 260 million in turnover divested. - Successful introduction and progress on innovations in the field of 3D vision-technology for 5G consumer electronics, UNIXX tire building technology and Indivion (medicine dosage and dispensing system) provide a strong foundation for growth and continued value creation.

- Substantial contracts won in subsea and Airfield Ground Lighting (CEDD/AGL) activities.

- Expansion production capacity for energy cable systems for energy networks due to strong

demand – operational from Q3 2021.

Outlook

The current economic uncertainties have impact on TKH’s operations and we expect this to continue in the second half of 2020. Forecast full year 2020: net profit from continued operations before amortization and one-off income and expenses attributable to shareholders of between € 63 million and € 69 million.

Alexander van der Lof, CEO of technology company TKH: “The past few months have been turbulent due to the COVID-19 outbreak. The health of our employees and the continuity of our activities were our main priority during this period. Although the impact has been considerable, we have come through the past few months reasonably well. Thanks to the solid progress we booked with our ‘Simplify and Accelerate’ program, we succeeded in increasing our gross margin and maintaining our ROS at virtually the same level as last year, despite a decline in turnover. In a number of markets, such as Tire Building and Parking, TKH has been affected by the consequences of the COVID-19 outbreak. We expect to feel the effects to continue in the coming period. TKH anticipated in time by reducing operational costs. On the other hand, the investments in innovation are paying off and will enable TKH to record growth in a number of key markets. Examples include the large orders we have won for subsea connectivity systems in offshore wind projects, Airfield Ground Lighting (CEDD/AGL) for Istanbul Sabiha Gökçen Airport and 3D vision technology for 5G consumer electronics. We also made a breakthrough with our medicine dosage and dispensing system, and thanks to specific interest we were able to initiate a large-scale roll-out of our high-quality Indivion system. In the coming months, we will continue to see (macro-economic) uncertainties, which will affect TKH the most in Industrial Solutions. Thanks to our innovations and our focus on growth markets, we still have good prospects for value creation in the medium term. It goes without saying that TKH will closely monitor developments and take measures where necessary."

COVID-19 situation

The COVID-19 outbreak has had a negative impact on TKH’s turnover and results since the start of the outbreak. The lockdowns in France, Italy and the US in April and May, for instance, had a major impact on our operations. From June onwards, following the easing of restrictions in these countries, we did see a resumption of deliveries, but not yet back to previous levels. The activity levels in China have recovered since March, COVID-19 had only a limited impact.

We introduced a large number of measures to monitor and prevent the impact of the COVID-19 virus, including:

- In the various countries where we are active, we took all the required measures in accordance with the guidelines of the (local) authorities to safeguard a healthy working environment for our employees, as well as the continuity of our company.

- Where necessary and when deemed appropriate, we made use of any government support and working time reductions. The impact of COVID-19-related government subsidies on the result in the first half of the year was limited to € 1.3 million.

- Increased attention to working capital management, limitations of investment levels where possible and cost saving measures.

The measures we introduced to provide a safe and healthy working environment resulted in lower productivity and utilization levels at our manufacturing companies. In addition, there was an impact of reduced demand, as customers had less capacity available to realize projects. In a number of market segments, investments were reduced and/or postponed. This was particularly evident with respect to investments in airports and parking garages and in the industrial sector.

Financial developments first half

Turnover fell by 9.9% to € 679.0 million in the first half of the year (H1 2019: € 753.2 million). On an organic basis, turnover fell by 7.5%. Raw materials prices and currency effects had a negative impact of 0.4% on turnover. Acquisitions added 2.9% to turnover, while divestments had a negative impact of 4.8%. Turnover declined organically in all segments, although this was limited in Building Solutions.

The gross margin increased to 49.4% (H1 2019: 47.4%). TKH realized this increase in Building Solutions. Divestments and acquisitions also had an impact on the gross margin.

Operating expenses declined by 4.7% compared with the first half of 2019. The implemented integrations, cost savings and reduced cost of sales due to lockdowns, accounted for a significant share of the cost reductions. However, as a percentage of turnover, operating expenses increased to 39.3% in the first half of 2020, from 37.1% in the first half of 2019. The relative increase is related to the divestments in 2020 and lower productivity and utilization at our manufacturing companies as a result of COVID-19. Depreciations came in at € 22.9 million, € 0.6 million above the level in the first half of 2019, due to the higher investment levels in recent years.

Operating result before amortization of intangible assets and one-off income and expenses (EBITA) declined by 11.0% to € 69.0 million in the first half of 2020, from € 77.6 million in the first half of 2019. Building Solutions’ EBITA was 25.2% higher. Telecom Solutions and Industrial Solutions saw EBITA decline by 23.1% and 35.7% respectively.

ROS remained virtually unchanged at 10.2% in the first half of 2020 (H1 2019: 10.3%) due to an improvement of the gross margin and a lower cost level.

Amortization costs rose by € 3.8 million due to the acquisitions in the second half of 2019, as well as the high level of investments in R&D in recent years. TKH recognized an impairment of € 1.5 million in the first half of the year due to COVID-19.

TKH’s financial result improved by € 3.2 million, mainly as a result of a book profit on divestments.

The tax rate increased to 25.3% in the first half of 2020, from 23.2% in the first half of 2019, primarily due to divestments and lower profits at companies that charge lower tax rates.

Net profit from continued operations before amortization and one-off income and expenses attributable to shareholders declined by 21.6% to € 36.0 million (H1 2019: € 45.9 million). Net profit fell by 38.0% to € 26.6 million (H1 2019: € 42.8 million).

Net bank debt, calculated in accordance with the bank covenant, increased to € 357.6 million, up € 57.0 million from year-end 2019. This increase was primarily due to the dividend paid out, higher working capital and investments, but was partly offset by the proceeds from divestments. Working capital as a percentage of turnover increased to 16.6% (mid-2019: 16.5%). The postponement of the delivery of various projects, particularly in the Industrial Solutions segment, due to lockdowns at customers increased working capital by approximately € 40 million. At the same time, the deferral of tax payments obtained as at 30 June had an impact of € 22 million.

The Net debt/EBITDA ratio stood at 1.9 at end-June 2020, which means that TKH was operating well within the financial ratio agreed with its banks. Solvency amounted to 40.5% (H1 2019: 36.9%).

The number of permanent employees (FTEs) stood at 5,692 at 30 June 2020 (end 2019: 5,980 FTEs). In addition, TKH had 265 temporary employees at 30 June 2020 (end 2019: 310).

Developments per solutions segment

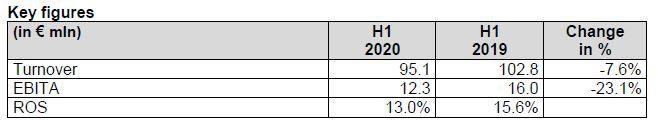

Telecom Solutions

Telecom Solutions encompasses the core technologies connectivity, vision & security and mission-critical communications. TKH develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. Around 40% of the portfolio consists of optical fibre and copper cable for hub-to-hub connectivity. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in network hubs – share in turnover 14.0%

Turnover in the Telecom Solutions segment declined by 7.6% to € 95.1 million. Currency exchange rates had a negative effect of 0.2%. On balance, turnover declined organically by 7.4%.

EBITA was down 23.1% at € 12.3 million. ROS declined to 13.0% in the first half of 2020 (H1 2019: 15.6%).

Fibre Optic Networks – In the first half of the year, the lockdown in Europe, particularly in France, had a significant negative impact on deliveries. Due to the obstacles created by the lockdown, TKH was unable to translate the increased demand for bandwidth in combination with the 5G-related demand into higher order intake. As a result, production was at a lower level, resulting in lower utilization. In China, we saw pressure on prices for optical fibre.

At TKH, this price effect was offset by a higher share of its complementary connectivity portfolio.

Other markets – Growth was realized in broadband products for home offices. However, a number of projects were postponed as a result of COVID-19. In 2020, the production of the telecom copper cable portfolio, an area where turnover has already declined significantly in recent years, will be terminated.

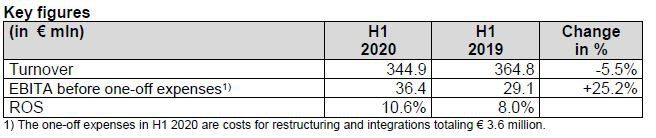

Building Solutions

Building Solutions combines the core technologies vision & security, mission-critical communications and connectivity in comprehensive solutions for security and communications applications in and around buildings, as well as for industrial inspection, quality, product and process controls. Building Solutions also focuses on efficiency solutions to reduce throughput times for the realization of installations within buildings, and on intelligent video, mission-critical communications, evacuations, access (controls) and registration systems for a number of specific sectors, including healthcare, parking, marine and offshore, tunnels and airports – turnover share 50.8%.

Turnover in the Building Solutions segment fell by 5.5% to € 344.9 million. Lower raw material prices had a negative impact of 0.7% on turnover. Acquisitions from 2019 contributed 5.9% to turnover. Divestments in 2020 reduced turnover by 9.9%. On balance, turnover declined organically by 0.8% in the first half of the year.

EBITA increased by 25.2% to € 36.4 million, mainly due to strong growth in Machine Vision. This resulted in an increase in ROS to 10.6% in the first half of the year (H1 2019: 8.0%).

Care - Despite increased demand for our communications technology for care alerts and elderly care, sales declined due to limited installation opportunities in care institutions as a result of COVID-19.

Marine & Offshore – Turnover increased on the back of orders for subsea connectivity systems won in 2019.

In addition, we won new contracts with Offshore Wind Farm Kaskasi and Hollandse Kust Zuid, which means that capacity utilization will increase for the coming quarters.

In addition, there are good prospects of new orders for offshore wind projects. The growth in subsea connectivity systems more than compensated for the drop in demand due to the stagnation in the construction of cruise ships.

Tunnel & Infra - Despite the obstacles, which installation technicians faced in carrying out their work, turnover remained stable due to an increased need for investments in energy networks among network companies. This had a positive impact on the demand for energy cable systems. We have decided to further expand our production capacity for these systems and expect to take this new capacity into operation from Q3 2021. The Airfield Ground Lighting (CEDD /AGL) technology felt the impact of COVID-19 and the related investment constraints at airports due to the drop in demand. Nevertheless, our AGL technology is still well positioned for new contracts, which was recently confirmed with a major order for Istanbul Sabiha Gökçen Airport.

Parking - In North America, TKH’s main market for Parking solutions, TKH saw a significant negative impact on sales, as projects and tenders at airports and shopping centers were halted due to the effects of COVID-19. TKH anticipated a lower level of investment at customers by significantly reducing operational costs.

Machine Vision – in the first half of the year, a strong organic growth was booked, despite limitations created by lockdowns. In particular, there was an increase in demand for our 3D vision technology for new applications in the consumer electronics industry, which made a significant contribution to growth. The measures taken last year to achieve cost efficiencies through the integration of the 2D vision activities also contributed to higher EBITA and ROS this year.

Other markets - The building & construction market faced limitations in the execution of projects and the COVID-19 measures had an impact on production efficiency and output.

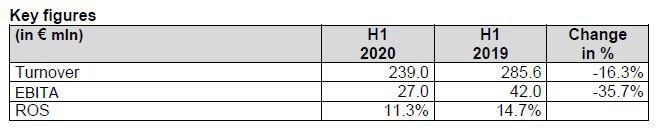

Industrial Solutions

Industrial Solutions encompasses the core technologies connectivity, vision & security and smart manufacturing. TKH develops, produces and delivers specialty cable and plug and play cable systems. TKH’s know-how in the automation of production processes and improvements in the reliability of production systems gives the company the differentiating potential it needs to deliver innovative, integrated production systems in a number of specialized industrial sectors, such as tire manufacturing, robot, medical and machine-building industries - turnover share 35.2%

Turnover in the Industrial Solutions segment fell by 16.3% to € 239.0 million. As a result of lower average raw material prices, turnover was down by 0.2%. Exchange rates had a negative effect of 0.1%.

Organically, turnover fell by 16.0%.

EBITA was down 35.7% at € 27.0 million, mainly due to the postponement of the delivery of various projects to customers due to lockdown situations.

ROS declined to 11.3% in the first half of 2020, from 14.7% in the first half of 2019.

Tire Building – Turnover was down due to the fact that the completion of various projects was postponed due to lockdowns at customers. The drop in demand from tire manufacturers led to the postponement of investments and thus to a lower order intake. The development of UNIXX (new tire-building platform) is progressing well, but the completion of delivery was delayed due to the temporary closure of the test site of the launching customer.

Care – After the successful delivery of Indivion at the end of 2019, the high-quality medicine dosage and dispensing system, a breakthrough in large-scale roll-out in Indivion technology from the US.

Other markets – Turnover in the industrial sector declined due to a reluctance to invest, particularly among machine manufacturers and in the robot industry. This had a negative impact on TKH’s industrial connectivity activities, mainly due to the reduction of inventories.

Outlook

Macro-economic uncertainties have increased since the outbreak of COVID-19. We expect this to have an impact in the second half of 2020, as it did in the first half of the year.

Barring unforeseen circumstances and an escalation in the aforementioned situations, we expect the following developments per business segment for the second half of 2020.

Telecom Solutions

We expect to see some recovery in the demand for fibre optic networks in Europe. TKH’s strong market positions in Europe put us in a position to benefit from this recovery. We expect turnover and result to be comparable to the first half of 2020.

Building Solutions

Turnover in Marine & Offshore and Tunnel & Infra will be higher than in the first half of the year, driven by a well-filled order book. We expect growth in Machine Vision to level off after a strong first half of the year. On balance, we expect turnover and result to be comparable to the first half of the year.

Industrial Solutions

Turnover in Tire Building will decline due to postponed deliveries of existing contracts and a reluctance to invest among tire manufacturers. The latter will also have an impact on the expected order intake in the second half of the year. We expect a modest recovery in other markets, as the effects of inventory reductions will be more limited.

On balance, we expect turnover and result to be lower than in the first half of the year.

The current economic uncertainties have an impact on TKH’s activities and we expect this to continue in the second half of 2020. However, partly due to its solid financial position, TKH is optimally positioned to also benefit from the opportunities associated with its numerous innovations.

On balance and barring unforeseen circumstances, for the full year 2020 TKH expects net profit from continued activities before amortization and one-off income and expenses attributable to shareholders of between € 63 million and € 69 million.

The complete press release can be downloaded in PDF