H1 2022 Results

Press Release

Haaksbergen, the Netherlands

16 Aug 2022

Strong performance from Q1 continued in Q2 leading to record results over H1 2022 Positive outlook supported by strong order book.

Today, TKH Group N.V. (TKH), a leading technology company focused on advanced innovative technology systems in high-growth markets, publishes its interim results 2022.

Highlights second Quarter 2022

- All technology segments contributed to strong turnover growth (+17.8%).

- EBITA before one-off income grew to € 57.1 million (+8.7%), despite shortages of components and new lock downs in China.

- EBITA increased to € 66.4 million (+26.5%), including one-off income of € 9.3 million from divestments.

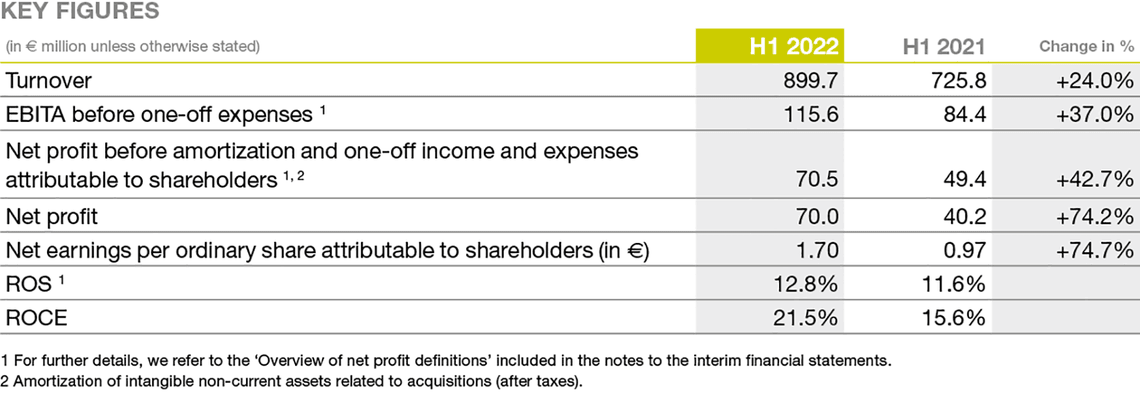

Financial highlights first half 2022

- Strong turnover growth to € 899.7 million (+24.0%), with organic growth at 15.7%.

- EBITA before one-off income and expenses increased 37.0% to record level of € 115.6 million.

- ROS improved to 12.8% (H1 2021: 11.6%), despite negative impact from shortages in components and price increases of components and raw materials.

- Net profit before amortization and one-off income and expenses attributable to shareholders increased significantly by 42.7% to € 70.5 million.

- Order book shows a solid increase to € 803 million as at June 30, 2022 (+7.5%), compared to year-end 2021.

Strategic highlights first half 2022

- Strength of innovative technology portfolio (with share of innovations at 18.7%) drove strong demand resulting in solid turnover growth in all technology segments.

- External environment:

- Geopolitical situation, supply chain imbalances and lockdowns in China had limited negative impact on turnover.

- Further increase priority and ambition of energy transition agenda in Europe – TKH well positioned to contribute.

- Strategically important capex programs launched to increase production capacity, especially related to energy transition.

- Factory in Ukraine restarted production in April; now running again at full capacity.

- Divestment program progress: properties held for sale divested in H1.

Outlook

- Strong demand and orderbook give TKH a positive outlook for the second half of 2022.

- Current geopolitical uncertainties, combined with challenges in the supply chain, are expected to persist.

- Net profit before amortization and one-off income and expenses attributable to shareholders is expected to increase to between € 136 million and € 144 million, compared to € 114.1 million in 2021.

Strategic developments first half 2022

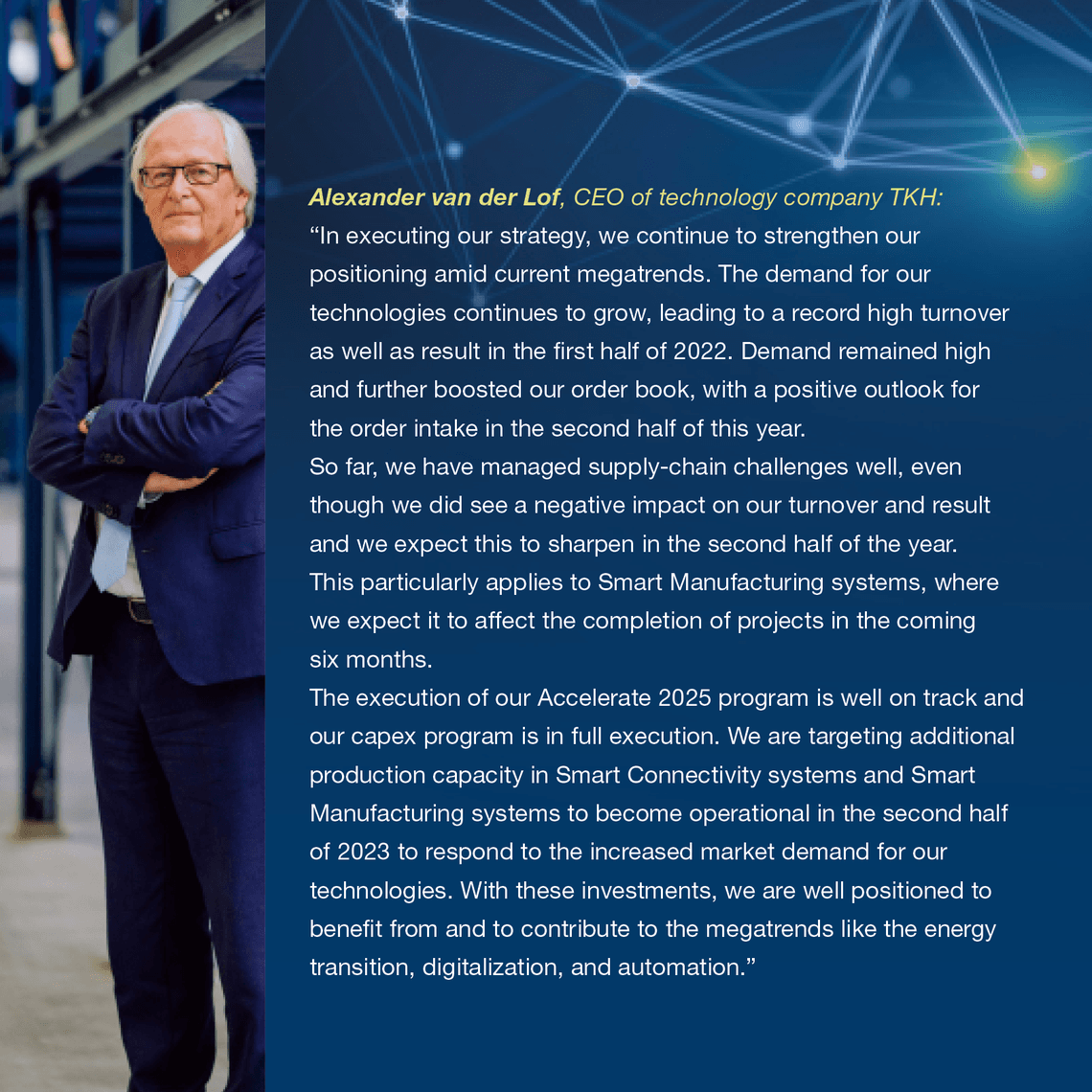

We continue to be well positioned to benefit from the longer term growth opportunities related to mega trends, supporting our future organic growth. The share from innovations in our turnover was again high at 18.7%. The markets in which TKH operates are still impacted by geopolitical uncertainties, renewed lock-downs in China and supply chain challenges, leading to shortages of components and price increases of components and raw materials. Our strong market positioning allows us to pass on a large part of the price increases to customers. Although the ROS in the first half year was negatively impacted by these shortages and price increases, our continued focus on its improvement led to a ROS of 12.8%.

During the first half of 2022, TKH has made significant progress with the execution of the Accelerate 2025 program and is well on track to reach its targets. We made progress with our divestment program, and further strengthened our leading position in Machine Vision with the acquisition of Nerian Vision GmbH, a small German niche player in 3D Vision (July 2022).

We are pleased to announce that our Ukrainian connectivity-assembly factory, which had been closed since the start of the war in Ukraine, has reopened in April. We have resumed full production with our 130 employees. We have great respect for our employees who have to deal with difficult circumstances on a daily basis.

We have launched strategically important capex programs to further increase our global production capacity to respond to the increased market demand in the fields of Energy, Digitalization, Industrial Automation and Tire Building systems. The capital investments specifically target:

- Subsea connectivity systems (new factory at a Dutch sea harbor)

- Medium- and high-voltage cables (expansion in the Netherlands)

- Fibre optic cables (new factory in Poland)

- Specialized connectivity systems (new factory in Poland)

- Tire building systems (expansion in Poland)

In Q2 2022, we finalized the scope of the investments and started executing the expansions. These capex programs will involve related investments in property, plant, and equipment of around € 160 million, spread over 2022 and 2023. The various programs will be commissioned in the second half of 2023.

Financial developments first half 2022

The turnover in the first half of 2022 increased by € 173.9 million (+24.0%) to a record level of € 899.7 million. Price effects had an upward impact of 7.0% on turnover, while exchange rates had an upward impact of 1.3%. On balance, TKH recorded a 15.7% organic increase in turnover. Geopolitical situation, supply chain imbalances and lockdowns in China had a limited negative impact on turnover of approximately € 10 million, mainly in the second quarter.

The gross margin decreased to 47.0% (H1 2021: 48.2%) due to a shift in the product mix with a smaller share for Smart Vision systems, combined with increased raw material and component prices. Although price increases had a negative effect, we were able to minimize this, as we pass on most price increases.

Operating expenses increased by 15.8%, of which 1.5% was related to foreign exchange rates. Selling expenses were almost back to pre-COVID-19 levels, partly due to the increase of travel and outgoing freight costs. As a percentage of added value, operational costs decreased from 75.9% in H1 2021 to 72.7% in H1 2022 due to economies of scale. Depreciation came in at € 23.5 million, € 1.4 million above the level in the first half of 2021, mainly due to investments in our production capacity during recent years.

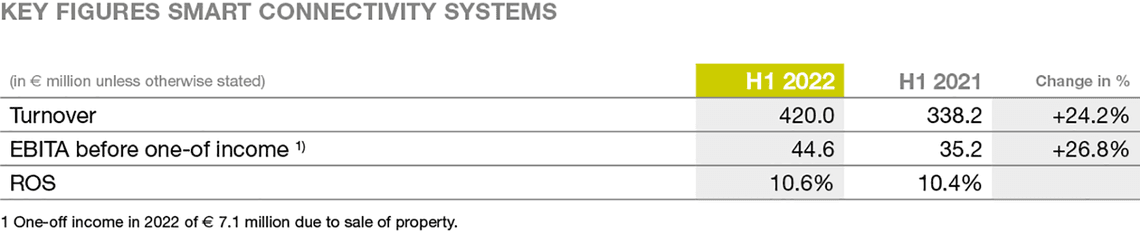

The operating result before amortization of purchase price allocations (intangible assets) and one-off income and expenses (EBITA) increased by 37.0% to € 115.6 million in H1 2022, from € 84.4 million in H1 2021. All technology segments positively contributed to the increase in EBITA: Smart Vision systems (+10.7%), Smart Manufacturing systems (+92.7%), and Smart Connectivity systems (+26.8%).

ROS increased to 12.8% in the first half of 2022 (H1 2021: 11.6%) due to the turnover growth and a lower relative cost level. The strongest ROS increase was noted in Smart Manufacturing systems.

One-off income of € 9.3 million was realized from the divestment of two properties that were held for sale.

Amortization increased by 6.1% due to higher amortization of capitalized R&D, as a result of increasing investment levels during prior years, whereas the amortization on PPAs from acquisitions is declining.

The financial result was stable at € 3.5 million expense. The improved result from associates was offset by foreign exchange losses in H1 2022.

The normalized effective tax rate decreased to 26.3% in the first half of 2022, from 28.4% in the first half of 2021, primarily due to relatively higher profits at companies benefitting from R&D tax facilities.

Net profit before amortization and one-off income and expenses attributable to shareholders increased significantly by 42.7% to € 70.5 million (H1 2021: € 49.4 million). Total net profit amounted to € 70.0 million, showing an increase of 74.2% compared to the same period a year earlier (H1 2021: € 40.2 million).

Net debt, calculated in accordance with the bank covenants, increased compared to year-end 2021 by € 196.3 million to € 401.8 million. The increase is mainly related to the dividends paid, combined with higher working capital. On June 30, 2022, working capital as a percentage of turnover stood at 20.4%, substantially higher than on June 30, 2021 (11.5%). This was mainly due to a higher activity level, the (temporary) buildup of inventories to secure supply chains, the higher price level of most inventory items, and higher contract assets due to higher production volumes. Working capital was also impacted by the delays in the completion of projects related to the shortage of essential components. In comparison, working capital was lowered last year due to temporary deferrals of VAT and wage tax payments.

The net-debt/EBITDA ratio stood at 1.6 as at June 30, 2022, well within the financial ratio agreed with the banks. Solvency amounted to 38.5% (H1 2021: 40.3%).

The number of permanent employees (FTEs) grew to 6,028 as at June 30, 2022 (end of 2021: 5,784 FTEs). In addition, TKH had 462 temporary employees as at June 30, 2022 (end of 2021: 376).

Developments per technology segment

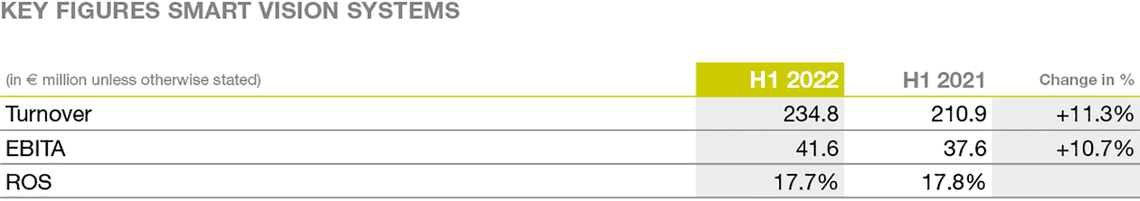

Smart Vision systems

TKH creates state-of-the-art Vision systems, and Vision technology represents about 88% of the turnover of the Smart Vision systems segment. This technology encompasses 2D and 3D Machine Vision and Security Vision systems. Combining these technologies with in-house software development allows us to create unique, smart, integrated plug-and-play systems, and one-stop-shop solutions.

In H1 2022, turnover in Smart Vision systems increased by 11.3% to € 234.8 million. Price effects and currency exchange rates had an upward impact of 3.2% and 3.7%. The organic turnover growth was 4.4%. Limitations in the supply of electronic components and lockdowns in China resulted in delayed revenues. The order book saw a strong growth of 16.0% compared to December 31, 2021 to € 161.6 million.

The added value slightly decreased from 58.4% to 58.1%. Higher purchase prices on secured components had a negative impact on the added value as a percentage of turnover, though this was compensated by the volume growth. As a result, EBITA rose to € 41.6 million (+10.7%) and a realized ROS of 17.7%.

Vision Technology – Machine Vision technology, the strongest contributor to this segment in H1 2022, showed growth in most regions and end markets. Growth was especially high in 2D Vision, where Alvium (embedded 2D vision platform) contributed substantially, mainly in factory automation. The turnover in 3D Vision was affected by the lockdowns in China. In most cases, we managed to either secure most of the required components or we redesigned our products to include more widely available components. Nevertheless, shortages delayed deliveries and, as a result, some turnover will shift from the first half to the second half of 2022.

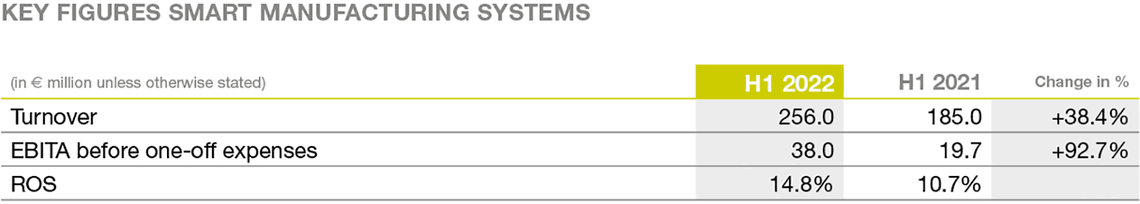

Smart Manufacturing systems

TKH leverages its unique expertise and deep understanding of automating production processes in specific industries to create superior manufacturing systems. TKH engineers complete manufacturing systems and machines that contribute to highly efficient processes. Tire Building systems represent about 71% of the turnover in the Smart Manufacturing systems segment.

Smart Manufacturing systems showed substantial turnover growth. Price effects and currency exchange rates had an upward impact of 3.4% and 0.8%, while organic turnover growth was 34.2%. The order book remained at a high level of € 362.0 million. The added value increased slightly from 48.5% to 48.7%.

EBITA grew strongly and was up 92.7% to € 38.0 million. The ROS improved significantly to 14.8% compared to H1 2021, mainly due to the high order intake and production output.

Tire Building – There was a substantial increase in turnover in this segment compared to H1 2021. We increased our production output as a result of the record order intake from 2021, which helped to substantially improve results. The order intake for both passenger and truck tire systems remained at a high level in H1 2022. The REVOLUTE (combination of fully automated tire component preparation and bead assembly) received excellent market response, resulting in new booked orders. Industrialization of UNIXX technology is progressing well and on track for commercial launch by the end of this year.

Other – Turnover in care grew at a high rate, driven by the rollout and series production of our INDIVION technology in North America. We also achieved good growth in turnover and result in industrial automation.

Smart Connectivity systems

TKH manufactures advanced Connectivity systems and engineers complete Smart Connectivity systems with a unique, integrated system approach and sustainability proposition. Energy and Digitalization represent about 34% and 36% of the turnover in the Smart Connectivity systems segment.

urnover in Smart Connectivity systems increased across almost all market segments and grew by 24.2% to € 420.0 million in H1 2022. Price effects had an upward impact of 11.2% on turnover, whereas foreign exchange only had a slight impact of -0.1%. On balance, turnover increased organically by 13.1%. The order intake was high with the order book growing by 17.5% to € 279.2 million compared to December 31, 2021.

Added value as a percentage of turnover decreased from 40.4% to 38.5% in H1 2022, mainly due to higher raw material prices, and EU anti-dumping duties on the import of optical fibre cables.

EBITA significantly increased by 26.8% to € 44.6 million, driven by strong turnover growth and higher production utilization. This resulted in an increased ROS to 10.6%.

Energy – The strong demand for renewable energy sources and the expansion of the current network infrastructure are the main drivers for turnover growth. The extended production capacity for medium-voltage energy cables became operational during Q3 2021 and contributed to the increase in production volumes in H1 2022.

Digitalization – Turnover increased due to the high investment priority for fibre networks in Europe. In Q4 of 2021, the European Commission imposed anti-dumping duties on imports of optical fibre cables from China into the European Union. This had a negative impact on the added value in H1 2022, in spite of the starting increase in price levels of optical fibre. Substantial growth was also realized in data network cable systems and broadband products for data centers and offices, especially in France and Germany.

Other – There was substantial growth in specialized connectivity systems for the machine-building and robotics industry. The building and construction market also grew in H1 2022, even though there were limitations on production capacity.

Outlook

The demand for our technologies remains high, supported by a strong order book. The impact of supply-chain challenges will be more severe in the second half year.

In Smart Vision systems, we expect turnover and EBITA in H2 2022 to be higher than in H1 2022. Part of this growth will come from delayed revenues from the first six months due to component shortages and lockdowns, which are already reflected in the increased order book.

In Smart Manufacturing systems, turnover and EBITA is expected to be lower in H2 compared to H1 2022, because temporary delays in completion of projects are expected due to missing parts from a stressed supply chain. Market demand is high and the order intake in H2 2022 is expected to continue at a high level with a very good start in Q3.

In Smart Connectivity systems, turnover and EBITA in H2 2022 are expected to be comparable to H1 2022. Growth will be limited, because of the short-term capacity constraints.

On balance and barring unforeseen circumstances, TKH expects net profit before amortization and one-off income and expenses attributable to shareholders to increase to between € 136 million and € 144 million (2021: € 114.1 million) for the full year of 2022.

The complete press release can be downloaded in PDF