Q1 2013 Market update

Press Release

Haaksbergen, the Netherlands

6 May 2013

Trading update 1st quarter 2013

Highlights

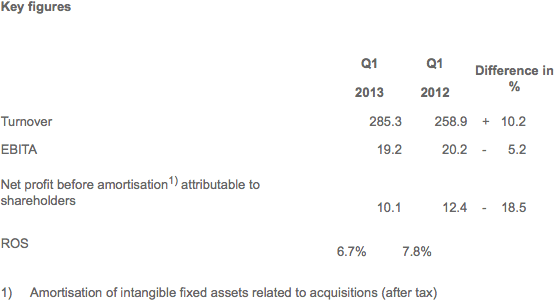

- Turnover up by 10.2% to € 285.3 million, organic drop 1.7%.

- Strong increase turnover Building Solutions (+ 28.0%), of which + 2.3% organic despite persistent difficult market conditions building and construction sector.

- Long winter affects turnover at Telecom Solutions negatively.

- Drop organic turnover in Industrial Solutions in line with low order intake in first half 2012 – strong increase order intake since mid-2012.

- EBITA down by 5.2% to € 19.2 million.

Alexander van der Lof, CEO of technology company TKH: “The strong improvement of the results in Building Solutions due to acquisitions, the efficiency measures taken in the second half of 2012 and the realised organic growth demonstrate TKH’s strength in difficult market conditions. The decline in revenue in Industrial Solutions was largely due to the previously announced low order intake in the first half of 2012 combined with the high cost of maintaining capacity for expected future growth. Given the sharp upturn in order intake since mid-2012 and the positive outlook for a continued rise in order intake, we are positive about a further improvement of our results in this segment from the second half year onwards. In Building Solutions, we expect market conditions to remain challenging for the rest of the year, due to the adverse conditions in the building and construction sector.”

Developments first quarter

Turnover rose by 10.2% to € 285.3 million in the first quarter of 2013 (Q1 2012: € 258.9 million). Acquisitions accounted for 12.5% of turnover. Reduced raw materials prices passed on to our customers had a negative effect of 0.6% on turnover. On balance, organic turnover was down by 1.7%.

Building Solutions booked the strongest turnover growth with a 28.0% increase, of which 2.3% was organic. Telecom Solutions saw turnover decline by 3.5% while turnover in Industrial Solutions was up 1.5%, with a 4.1% organic drop in turnover.

Operating result before amortisation of intangible assets (EBITA) was down 5.2% to € 19.2 million in the first quarter of 2013, from € 20.2 million in the first quarter of 2012. In Building Solutions, a strong increase, both organically and through acquisitions was realised. The Telecom and Industrial Solutions segments recorded a drop. The decline in Telecom was largely due to the long winter period in Europe. A lower capacity utilisation due to the lower order intake in the first half of 2012 accounted for the decline in Industrial Solutions.

Amortisation charges rose by € 2.2 million to € 6.1 million (Q1 2012: € 3.9 million) as a result of the acquisitions in 2012.

Financing costs increased by € 1.1 million compared with the first quarter of 2012, due to a higher outstanding interest-bearing debt.

The tax burden fell to 22.3% in the first quarter of 2013, from 23.2% in the first quarter of 2012.

Net profit before amortisation attributable to shareholders came in at € 10.1 million in the first quarter of 2013 (Q1 2012: € 12.4 million), a drop of 18.5%.

Net bank debt increased to € 214.0 million, a rise of € 25.8 million compared with 31 December 2012, mainly due to an increase in working capital. The net debt/EBITDA ratio stood at 1.9 and the interest coverage ratio at 8.9. TKH operates well within the financial ratios agreed with its banks.

Telecom Solutions

Turnover within the Telecom Solutions segment decreased 3.5% to € 37.6 million. This drop in turnover is largely attributable to copper network systems on the back of an accelerated decline in investments in this segment due to the continued market shift to optical fibre networks and the investments by telecom operators in 4G networks. In the segment optical fibre systems, the long winter period in Europe led to the postponement of deliveries. The order intake did increase further. EBITA declined as a result of lower capacity utilisation.

Building Solutions

In Building Solutions, turnover increased 28.0% to € 117.8 million in the first quarter of 2013. The companies Aasset Security and Augusta Technologie, acquired in 2012, accounted for 26.6% of growth. Despite difficult market conditions in the building and construction sector and the extended winter period TKH booked an organic turnover growth of 2.3% in the first quarter of 2013, also due to the innovations and investments in the organisation. EBITA increased due to the 2012 acquisitions, as well as the realised organic growth and the efficiency measures implemented in 2012.

Industrial Solutions

Turnover in the Industrial Solutions segment increased 1.5% to € 129.8 million in the first quarter of 2013. In organic terms, turnover was down 4.1%. Within connectivity systems turnover decreased due to some restraints within the automotive industry. Turnover in manufacturing systems dropped as a result of the lower order intake in the first half of 2012. The order intake increased in the first quarter of 2013 to € 55 million and a further increase is expected in the second quarter. This is a continuation of the positive trend in order intake that began in the second half of 2012. EBITA dropped due to the lower capacity utilisation, as well as investments in production capacity in anticipation of continued growth.

Outlook

TKH maintains the outlook for its business segments as presented at the publication of the annual results in March 2013. As usual, we will aim to give a more specific indication of the estimated profit for the full year 2013 at the presentation of the half-year results in August 2013.