Q1 2016 Market update

Press Release

Haaksbergen, the Netherlands

25 Apr 2016

Highlights

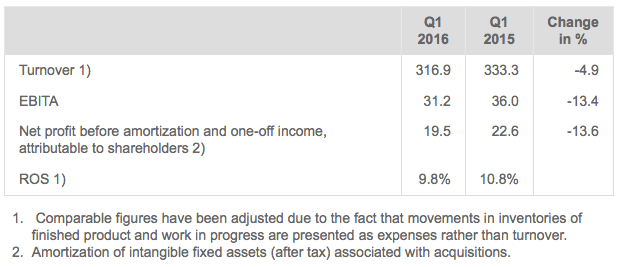

- Organic turnover decline of 2.7% – effect of raw materials prices, exchange rates and divestment -2.2% – total turnover decline Q1 2016 4.9%.

- Organic turnover Telecom Solutions down 0.6%, Building Solutions 3.8% and Industrial Solutions 2.2% – declines primarily due to reluctance to invest in China.

- EBITA down 13.4% at € 31.2 million – relatively high cost levels due to investments in planned growth.

- Order intake manufacturing systems € 80 million despite limited intake from China.

Alexander van der Lof, CEO of technology company TKH: "The first quarter of 2016 lagged behind the strong first quarter of 2015. Within the sub-segment manufacturing systems, the order intake increased compared to the fourth quarter 2015, despite the ongoing reluctance to invest in China. As we noted in the outlook in March 2016, TKH is preparing this year for growth in the coming years, which means costs will be relatively higher in the short-term. These efforts related to the expansion of capacity and an increase in R&D costs are currently exceeding income, but are expected to generate return in line with the previously raised ROS and ROCE targets we communicated.”

Developments in the first quarter

Turnover in the first quarter of 2016 came in at € 316.9 million, a decline of € 16.4 million compared to Q1 2015 (- 4.9%). Organic turnover declined 2.7%. This decline was largely the result of a reluctance to invest in China. The divestment of Parking & Protection also had a negative impact of 0.4% on turnover. Weaker foreign currencies vis-à-vis the euro and lower raw materials prices also had a negative impact on turnover of 0.3% and 1.5% respectively.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) decreased 13.4% to € 31.2 million in the first quarter of 2016, compared with € 36.0 million in the first quarter of 2015. Industrial Solutions accounted for the largest part of this decline.

Net profit before amortization and one-off income and expenses attributable to shareholders amounted to € 19.5 million in the first quarter of 2016, a decline of 13.6% compared to the same period last year.

Net bank debt, calculated in accordance with the bank covenants, increased to € 162.6 million, a rise of € 1.6 million compared to 31 December 2015. The net debt/EBITDA ratio stood at 1.0 and the interest coverage ratio was 23.5. TKH is operating well within the financial ratios agreed with its banks.

Telecom Solutions

Telecom Solutions comprises two sub-segments: indoor telecom & copper network systems and fibre network systems.

Turnover in the Telecom Solutions segment was € 39.0 million (Q1 2015: € 39.7 million). The organic turnover decline was 0.6%. Currency exchange rates also had a negative impact of 0.9% on turnover in this segment. The decline was due to lower turnover in the sub-segment indoor telecom & copper network systems, while the sub-segment fibre network systems saw an increase in turnover. The demand for optical fibre declined in the Netherlands but this was offset by an increase in activities in Germany and China. EBITA was down as a result of the lower turnover.

Building Solutions

Building Solutions comprises two sub-segments: vision & security systems and connectivity systems.

Turnover in the Building Solutions segment came in at € 129.2 million (Q1 2015: € 139.0 million). Organic turnover was down 3.8%. The divestment of Parking & Protection resulted in a 0.9% decrease in turnover. Currency exchange rates had a negative impact of 0.3% on turnover, while lower raw materials prices had a negative effect of 1.9%.

Turnover declined in both sub-segments. In the sub-segment connectivity systems, this decline was largely due to the phasing-out of activities with a lower margin, which improved the gross margin in this segment. The decline within the sub-segment vision & security systems was largely due to the reluctance to invest in China and the fact that the first quarter of 2015 was strong. EBITA was down as a result of the lower turnover and investments in the planned growth of the vertical growth markets.

Industrial Solutions

Industrial Solutions comprises two sub-segments: connectivity systems and manufacturing systems.

Turnover in the Industrial Solutions segment came in at € 148.6 million (Q1 2015: € 154.6 million). Organic turnover was down 2.2%. Currency exchange rates had a negative impact of 0.2% on turnover, while lower raw materials prices had a negative effect of 1.5%.

Turnover within the sub-segment connectivity systems was up as a result of our improved position in the medical and robotics industry. Turnover within the sub-segment manufacturing systems was down as a result of the previously mentioned lower order intake in 2015 due to the reluctance to invest in China. Order intake in the first quarter of 2016 came in at € 80 million and was therefore higher than the previous quarter. The intake from the top-five tire manufacturers accounted for a greater share of this order intake. EBITA was down as a result of the lower turnover and production capacity utilization and on the back of investments in the expansion of capacity and higher R&D expenses.

Outlook

TKH maintains its forecast made at the presentation of the 2015 annual results in March 2016. As usual, TKH will strive to provide a more specific indication of its forecast of the profit for the full year 2016 at the presentation of the interim results in August 2016.