Q1 2017 Market update

Press Release

Haaksbergen, the Netherlands

2 May 2017

Trading update Q1 2017

Highlights:

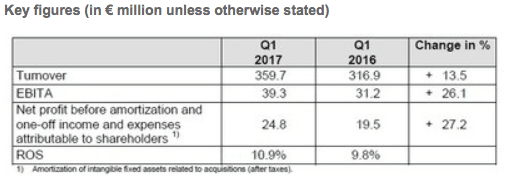

- Organic increase in turnover 10.9% – effect of raw materials prices, currency exchange rates and acquisitions 2.6% – overall turnover increase 13.5%.

- Organic turnover growth Telecom Solutions 13.9%, Building Solutions 12.6% and Industrial Solutions 8.7% – mainly driven by the vertical growth markets.

- EBITA up 26.1% to € 39.3 million – increase in all segments, where the contribution of Industrial Solutions was the strongest.

- Increase in order intake manufacturing systems to € 114 million – improved situation in China and growth in market share among the top 5 tire manufacturers.

Alexander van der Lof, CEO of technology company TKH: “The healthy organic turnover growth of 10.9% in the first quarter of 2017 was mainly due to the growth in our vertical growth markets. In Building Solutions, the vertical growth markets Machine Vision and Marine & Offshore in particular contributed to the increase in turnover and profit we realized. TKH benefited from the increase in investments in the consumer electronics market in the field of advanced vision technology thanks to investments in our R&D and international market positioning. The vertical growth market fiber optic networks also showed healthy growth. In addition, the continued growth in order intake in the tire building industry, which was due to a recovery from China and growth in our market share among the top 5 tire manufacturers, gives confidence in the future”

Developments Q1

Turnover in the first quarter of 2017 came in at € 359.7 million and was € 42.8 million higher than in Q1 2016 (+13.5%). Organic turnover growth came in at 10.9%. Higher raw materials prices pushed turnover up by 2.1%, while the on average higher foreign currencies against the euro had a positive effect of 0.2% on turnover. Acquisitions resulted in a 0.3% increase in turnover. All segments contributed to the growth in turnover.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 26.1% to € 39.3 million in the first quarter of 2017 (Q1 2016: € 31.2 million). All segments contributed to this increase, with Industrial Solutions recording the biggest improvement in EBITA. The ROS for TKH increased to 10.9% (Q1 2016: 9.8%).

Net profit before amortization and one-off income attributable to shareholders increased to € 24.8 million in the first quarter of 2017, a rise of 27.2% compared to the first quarter of 2016 (Q1 2016: € 19.5 million). Net profit came in 29.5% higher at € 22.2 million in the first quarter of 2017.

Net bank debt calculated in accordance with the bank covenants increased to € 188.8 million, up € 23.8 million compared to 31 December 2016. This increase was largely due to an increase in working capital due to seasonal impact and increased revenue. The net debt/EBITDA ratio stood at 1.0. TKH is operating well within the financial ratio agreed with its banks.

Telecom Solutions

Telecom Solutions comprises two sub-segments: indoor telecom & copper network systems and fiber network systems.

Turnover in the Telecom Solutions segment came in at € 44.4 million (Q1 2016: € 39.0 million). The organic growth in turnover was 13.9%, while currency exchange rates had a negative impact of 0.2% on turnover. Growth came primarily from the fiber network systems sub-segment, where growth was recorded in Germany, Poland and China.

EBITA improved as a result of higher turnover and higher added value.

Building Solutions

Building Solutions comprises two sub-segments: vision & security systems and connectivity systems.

Turnover in the Building Solutions segment was € 150.7 million (Q1 2016: € 129.2 million). Organic growth came in at 12.6%. Acquisitions contributed 0.8% to growth. Currency exchange rates had a positive impact of 0.4% on turnover, while higher raw materials prices had an impact of 2.8% on turnover. Growth was realized in both sub-segments connectivity systems and vision & security systems. The vertical growth markets Machine Vision, Tunnel & Infra, Care and Marine & Offshore made a major contribution to the growth in turnover. EBITA improved despite an increase in R&D expenditures and the start-up costs for airfield ground lighting systems (CEDD-technology) and the subsea cable system activities.

Industrial Solutions

Industrial Solutions comprises two sub-segments: connectivity systems and manufacturing systems.

Turnover in the Industrial Solutions segment came in at € 164.6 million (Q1 2016: € 148.6 million). Organic growth in turnover was 8.7%. Higher average raw material prices resulted in turnover growth of 2.1% and overall turnover growth came in at 10.8%. Growth in the sub-segment connectivity systems was largely due to an increase in demand for robot cable systems. The increase in the sub-segment manufacturing systems was due to the higher order intake we realized in the tire building industry in recent quarters. The order intake in the first quarter of 2017 came in at € 114 million. This was driven by both a recovery in order intake from China after a period of reluctance for investments, and growth in TKH’s market share among the top 5 tire manufacturers.

EBITA increased on the back of the higher turnover.

Outlook

TKH reiterates its forecast made at the presentation of the annual results in March 2017. As usual, TKH intends to give a more specific indication of the profit forecast for the full-year 2017 when it presents its interim results in August 2017.