Q3 2012 Market update

Press Release

Haaksbergen, the Netherlands

6 Nov 2012

Trading update 3rd quarter 2012

Highlights third quarter

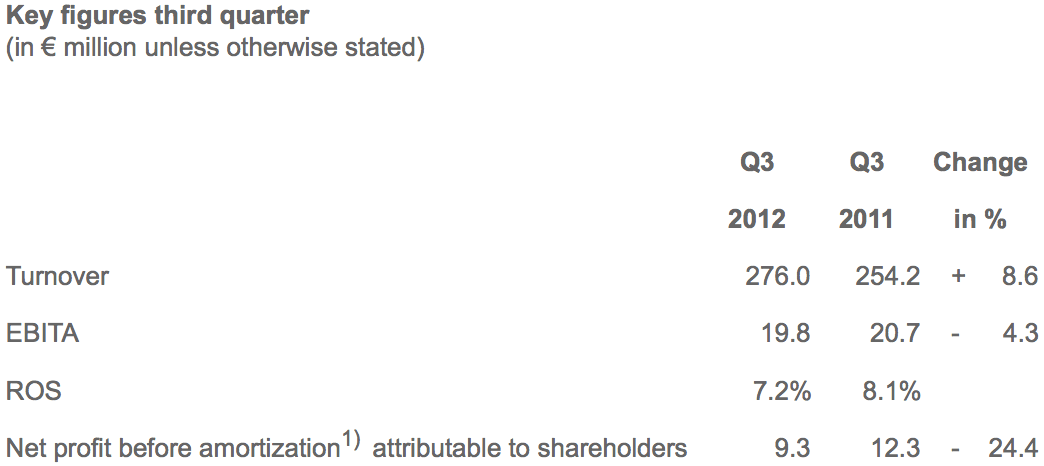

- Turnover up by 8.6%, organic decrease of 7.3%.

- Organic turnover decrease Industrial Solutions 17.6%, in line with lower order intake H1.

- Order intake Industrial Solutions Q3 increased.

- Augusta contributes strongly to turnover and result, consolidation as of Q3.

- Modest decrease in EBITA with 4.3%, mainly due to Industrial Solutions.

- Costs in Q3 down by € 4.2 million compared to Q2 2012 as a result of cost measures.

- Good progression in organic improvement ROS Building Solutions.

Outlook

- TKH reiterates its expectation to realize a net profit of between € 45 and € 50 million before amortization and one-off income and expenses, attributable to shareholders, for the full year 2012.

- Initiation of efficiency program for 2013 with annual cost savings of € 10 million leads to one-off expenses in Q4 2012 of around € 10 million.

Alexander van der Lof, CEO of technology company TKH: "Due to a further worsening of the market conditions in a number of segments in the industrial sector and the building and construction sector, we decided to implement efficiency improvements throughout the organization. The related cost savings enhance the group’s resilience against possible turnover drops and pressure on margins as a result of a declining demand. Although the deteriorating market conditions put pressure on the outlook, we were able to maintain it. The focus on innovations and a strong market positioning, enabled us to grow turnover and order intake in a large number of segments, despite the difficult market circumstances.”

Developments third quarter

Turnover in the third quarter of 2012 rose by 8.6% to € 276.0 million (Q3 2011: € 254.2 million). The contribution of acquisitions to turnover was 16.3%. Lower raw materials prices passed on to our customers negatively affected turnover by 0.4%. On balance organic turnover dropped 7.3%.

EBITA decreased by 4.3% from € 20.7 million in the third quarter of 2011 to € 19.8 million in the third quarter of 2012. Organically EBITA decreased by 38.4%. This decline occurred in the segments Building and Industrial Solutions.

Operating costs in the third quarter of 2012 increased as a result of acquisitions, mainly Augusta Technologie AG. Excluding these costs, operating costs of TKH were € 4.2 million lower in the third quarter of 2012, compared to the second quarter of 2012. This is the result of the cost measures implemented in the second quarter. Compared to the third quarter of 2011, ROS showed a decrease from 8.1% to 7.2%. Net profit before amortization, attributable to shareholders, amounted to 9.3 million (Q3 2011: € 12.3 million).

Working capital increased by € 24.8 million in the third quarter compared to 30 June 2012, among others as a result of the acquisition of Augusta. In percentage of turnover, working capital was 15.6%. The net debt/EBITDA-ratio came in at 1.8 and the interest coverage-ratio at 9.7 which shows TKH operates well within the financial covenants agreed upon with its banks. The net bank debt at the end of the third quarter 2012 was € 219.7 million, an increase of € 59.0 million compared to 30 June 2012, mainly as a result of the Augusta acquisition. Solvency stood at 40.9% by the end of September 2012 (30 June 2012: 41.8%).

Telecom Solutions

Telecom Solutions showed a 1.8% increase in turnover in the third quarter, from € 40.7 million to € 41.4 million. Organic turnover growth was 1.7%. Growth was realized in the segments indoor telecom systems and fibre network systems, while the segment copper network systems showed a decline in turnover. In the third quarter EBITA rose compared to the same period last year.

Building Solutions

In Building Solutions turnover rose by 35.7% from € 88.0 million to € 119.4 million, of which 3.2% was organic. Turnover showed an increase in all three sub segments: building technologies, connectivity systems and security systems. Acquisitions contributed significantly to the turnover growth in security systems. The increase in turnover, combined with cost savings, led to an organic improvement of the ROS. EBITA increased compared to the third quarter of 2011.

Industrial Solutions

In the third quarter, turnover in Industrial Solutions showed a decrease of 8.6% compared to Q3 2011, from € 125.5 million to € 114.8 million. This decline, of which 0.4% was attributable to lower raw material prices, was noted both in connectivity systems as well as in manufacturing systems. Organically turnover showed a decrease of 17.6%. In the third quarter, the order intake in manufacturing systems showed an increase compared to the first two quarters. Connectivity systems reported a slight decrease in order intake. EBITA decreased compared to the third quarter of 2011 as a result of the lower order intake in the first half of 2012.

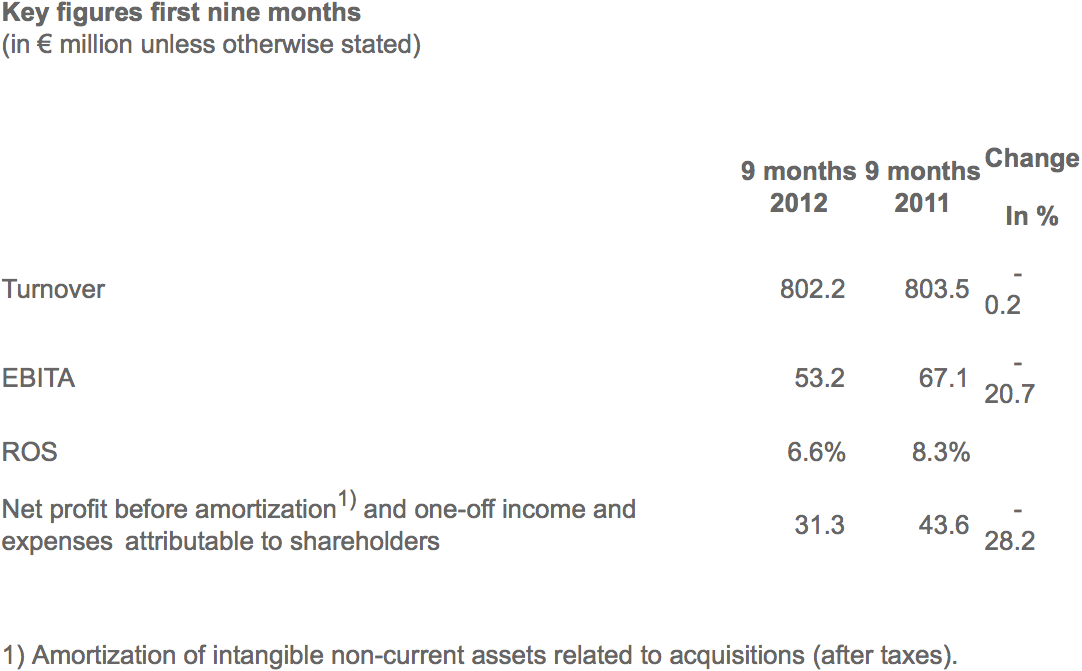

Developments first nine months

Over the first nine months turnover declined 0.2% to € 802.2 million. Lower raw material prices passed on to customers negatively affected turnover by 0.7%. Acquisitions contributed positively 7.7% to turnover. Organically turnover declined 7.2%. EBITA for the first nine months decreased 20.7% to € 53.2 million (9M 2011: € 67.1 million). Net profit before amortization and one-off income and expenses, attributable to shareholders, decreased 28.2% over the first nine months to € 31.3 million (9M 2011: € 43.6 million).

Outlook

Developments are in line with the outlook given during the half year result announcement in August this year. In a number of end markets in Europe in the building and construction sector and the industrial sector market conditions are hesitant and tend to further deteriorate. To counterbalance these developments, an efficiency program was initiated for 2013, reducing annual costs by € 10 million. To this end, in Q4 2012 a one-off expense will be booked of around € 10 million.

Based on the results realized in the first nine months of 2012 and the outlook for the coming months, TKH reiterates that, barring unforeseen circumstances, it expects to realize a net profit before amortization and one-off income and expenses, attributable to shareholders, between € 45 to € 50 million for the full year 2012.