Q3 2013 Market update

Press Release

Haaksbergen, the Netherlands

6 Nov 2013

Highlights third quarter

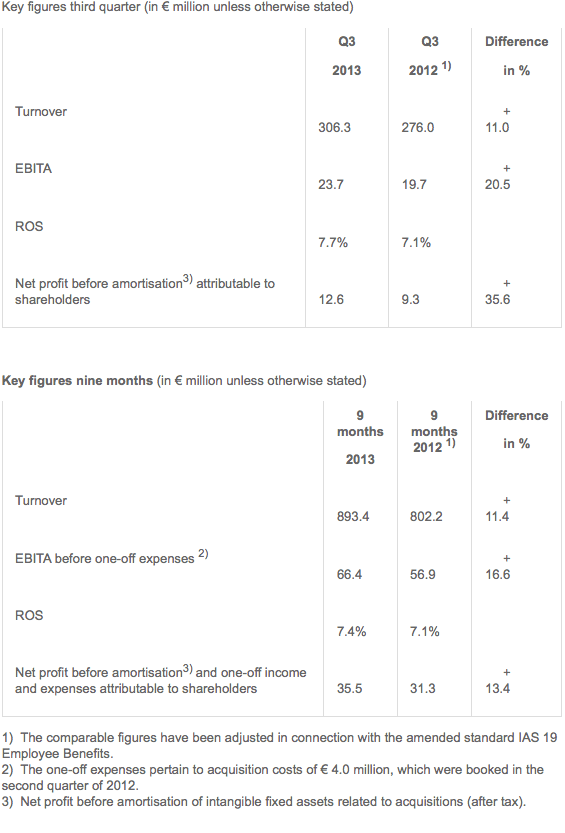

- Turnover increased by 11.0% to € 306.3 million, almost entirely organic.

- Turnover growth in both Industrial Solutions (23.5%) and Building Solutions (5.3%).

- Strong results improvement Building Solutions and Industrial Solutions.

- Record order intake Industrial Solutions, attributable to the sub segment manufacturing systems.

- EBITA increased by 20.5%.

- Renewal of 5 year committed credit facility of € 350 million.

Outlook

- Forecast for full year 2013 maintained: net profit before amortisation and one-off income and expenses attributable to shareholders of between € 52 million and € 57 million.

- Initiation of efficiency program for 2014 with annual cost savings of approx. € 4 – 5 million leads to one-off expenses in Q4 2013 of around € 5 million.

Alexander van der Lof, CEO of technology company TKH:

"Our focus on total solutions in the seven defined growth markets enabled TKH to realise a healthy growth of turnover and results in still worldwide reluctant economic circumstances. The growth we can realise in these markets should result in additional turnover of € 300 to € 500 million in the coming 3-5 years. The new record order intake in the segment manufacturing systems proofs the attractiveness of the technologies of TKH. By striving for a further increase in ROS, combined with growth, we again identified a number of efficiency measures. In the coming months these will be implemented which should improve our profitability in the coming years.”

Developments third quarter

Turnover in the third quarter of 2013 increased by 11.0% to € 306.3 million (Q3 2012: € 276.0 million). The acquired Park Assist contributed 0.4% to turnover. Lower raw material prices, passed on to customers, had a negative effect of 1.4% on turnover. On balance, organic growth was 12.0%.

EBITA rose by 20.5% from € 19.7 million in the third quarter of 2012 to € 23.7 million in the third quarter of 2013.

Operating costs increased in the third quarter of 2013 due to the growth in turnover and the higher activity level in the production facilities. The cost level as a percentage of realised turnover decreased from 35.0% in the third quarter of 2012 to 32.9% in 2013. This is partly the result of the efficiency programmes that were initiated in the second half of 2012. ROS improved compared to the third quarter of 2012 from 7.1% to 7.7%. The net profit before amortisation attributable to shareholders increased by 35.6% to € 12.6 million (Q3 2012: € 9.3 million).

Working capital rose by € 12.7 million compared to 30 June 2013. As a percentage of turnover working capital was 16.2%. The net bank debts amounted to € 232.6 million at the end of the third quarter, an increase of € 13.2 million compared to the second quarter of 2013. This increase is the result of a higher working capital due to seasonal patterns and the acquisition of Park Assist. The net debt/EBITDA ratio came in at 1.9 and the interest coverage ratio at 9.6, which puts TKH well within the financial ratios agreed with its banks. At 30 September 2013, solvency stood at 39.3% (30 June 2013: 40.6%).

Telecom Solutions

Within Telecom Solutions turnover fell by 6.2% from € 41.4 million at the third quarter of 2012 to € 38.8 million. In the sub segment copper network systems the decrease in turnover was stronger than in previous quarters. This was the result of a further shift in priority at telecom operators to investments in optical fibre networks and 4G networks. Growth in the sub segment fibre network systems could not compensate this drop. Turnover in the indoor telecom systems stabilized on last year’s level. EBITA in the third quarter of 2013 decreased compared to the same period last year due to the lower turnover level.

Building Solutions

Turnover in Building Solutions was up by 5.3%, from € 119.4 million to € 125.7 million in the third quarter of 2013. Acquisitions contributed 0.9%. Lower raw material prices had a negative effect of 1.5% on turnover. On balance, organic turnover growth was 5.9%. Turnover increased primarily in the sub segments connectivity systems and vision & security systems, despite a further decrease in the activity levels in the building and construction market. There was pressure on margins in the sub segment connectivity systems as a result of the lower demand. The margin did stabilize compared to the second quarter of 2013. As a result of the relatively lower costs, EBITA for the whole segment increased at a higher rate than turnover.

Industrial Solutions

The segment Industrial Solutions showed an increase in turnover compared to the third quarter of 2012 of 23.5%, from € 114.8 million to € 141.7 million. Raw material priced had a negative effect of 1.8% on turnover. Organic turnover growth was 25.3%. The increase was mainly within the sub segment manufacturing systems as a result of the high order intake in the first half year. The order intake within manufacturing systems increased further in the third quarter compared to the previous quarters thanks to the leading edge technology, introduced in the past few years and the high priority for efficiency investments in the tyre building industry. Turnover in the sub segment connectivity systems also increased. EBITA rose in line with turnover, but was pressured by a decrease of the margin in the sub segment connectivity systems and higher costs to facilitate the strong growth within manufacturing systems.

Developments first nine months

Over the first nine months of 2013 turnover rose 11.4% to € 893.4 million. Lower raw material prices passed on to customers negatively affected turnover by 1.0%. Acquisitions contributed 7.4% to turnover. Organically turnover increased 5.0%. EBITA for the first nine months increased 16.6% to € 66.4 million (9M 2012: € 56.9 million). Net profit before amortization and one-off income and expenses, attributable to shareholders, increased 13.4% over the first nine months to € 35.5 million (9M 2012: € 31.3 million).

New 5-year committed credit facility

Recently TKH agreed a new 5-year committed credit facility of € 350 million with the existing syndicate. This facility replaces the previous committed credit facility and term loan. This new facility is based on the same financial covenants as the previous facility, a maximum leverage ratio of 3.0 and a minimal interest coverage ratio of 4.0. Under the new credit facility the finance costs will be clearly lower. The capitalized finance costs related to the previous financing agreement that was terminated prematurely on the initiative of TKH, amounting to € 1.6 million, will be written down as a one-off expense in the fourth quarter of 2013.

Outlook

Developments are in line with the outlook given during the half year result announcement in August this year. The strong growth of the production volume in Industrial Solutions, combined with a high level of newly introduced technology, resulted in production inefficiencies, will pressure results. Furthermore market conditions within Building Solutions are still challenging.

Given the further deterioration of the market conditions in the European building and construction sector during the year and the associated margin pressure, TKH decided to implement a new efficiency programme to increase the return on sales, particularly in Building Solutions. This programme will lower the annual operating costs by around € 4 - 5 million. In Q4 2013, a one-off expense of approximately € 6 - 7 million will be booked for the implementation of the efficiency programme as well as the write down of the capitalized financing costs from the terminated credit facility.

Based on the results realized in the first nine months of 2013 and the outlook for the coming months, TKH reiterates that, barring unforeseen circumstances, it expects to realize a net profit before amortization and one-off income and expenses, attributable to shareholders, between € 52 to € 57 million for the full year 2013