Q3 2014 Market update

Press Release

Haaksbergen, the Netherlands

6 Nov 2014

Highlights third quarter

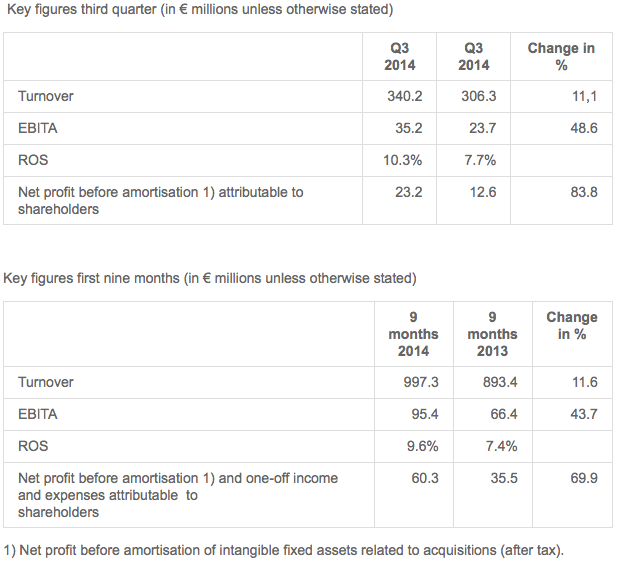

- Turnover up 11.1% at € 340.2 million, rise almost entirely organic.

- Turnover growth from Industrial Solutions (22.3%) and Telecom Solutions (6.5%).

- Turnover down slightly at Building Solutions (-0.1%), but order intake higher.

- Order intake Industrial Solutions continued at high level.

- EBITA up 48.6%, primarily due to Industrial Solutions.

- Significant increase in ROS to 10.3%.

- Net profit before amortisation up by 83.8%, partly due to reduced tax burden and reduced financial expenses.

Highlights first nine months

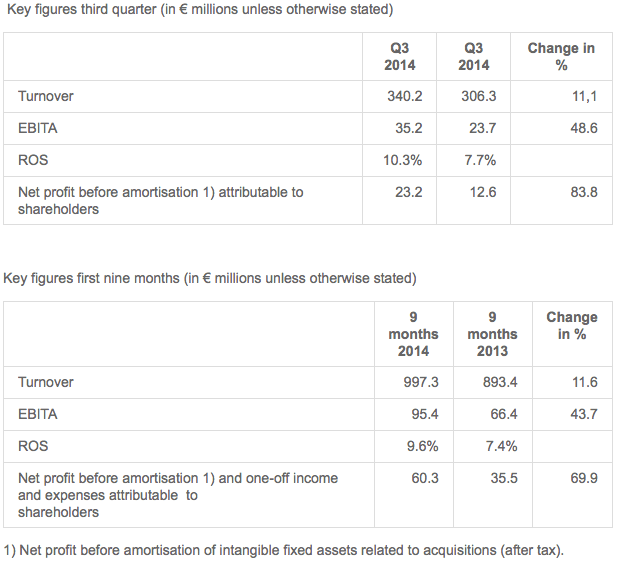

- Turnover up 11.6% at € 997.3 million, rise almost entirely organic.

- EBITA up 43.7%, due to organic turnover growth, strong efficiency improvements and effective cost management.

Outlook

Increase in the expected net profit before amortisation and one-off income and expenses attributable to shareholders for the full year 2014 of the previous forecast bandwidth of between € 75 and € 82 million to between € 80 and € 85 million.

Alexander van der Lof, CEO of technology company TKH: "Both turnover and profit showed solid growth in the third quarter. The markets in which TKH operates did not weaken despite the geopolitical situation and the slowdown of growth in Europe. In addition, our competitive position improved on the back of the previously defined focus on core technologies and vertical growth markets. The order intake increased in most segments or continued at a high level. We are therefore in a solid position to realise continued growth and expand TKH’s international market position on the basis of our innovative technologies and integrated solutions.”

Developments in the third quarter

Turnover in the third quarter of 2014 rose by 11.1% to € 340.2 million (Q3 2013: € 306.3 million). Acquisitions contributed 0.7% to turnover. Reduced raw materials prices charged-on had a negative impact of just 0.1% on turnover. On balance, organic turnover growth came in at 10.5%.

The operating result before amortisation of intangible assets (EBITA) was up 48.6% to a record € 35.2 million in the third quarter of 2014 (Q3 2013: € 23.7 million). In particular the increase in gross margin to 42.8% from 40.6%, thanks to the improved product mix and focus on differentiating technology, contributed to the improvement in the operating result.

Operating costs were higher in the third quarter of 2014 due to the growth in turnover and the higher level of activity. Costs as a percentage of turnover realised fell to 32.4% in the third quarter of 2014 from 32.9% a year earlier.

ROS improved in the third quarter of 2014 to 10.3% (Q3 2013: 7.7%).

Net profit before amortisation attributable to shareholders increased by 83.8% to € 23.2 million in the third quarter (Q3 2013: € 12.6 million). In addition to the significant increase in the operating result, a reduced tax burden and lower financial expenses contributed to this increase.

Working capital increased by € 19.2 million in the third quarter compared to 30 June 2014 due to the turnover growth realised. As per 30 September 2014, working capital as a percentage of turnover stood at 16.8% (30 September 2013: 16.2%).

Net bank debt calculated in accordance with the bank covenants stood at € 284.5 million at the end of the third quarter of 2014, an increase of € 61.2 million from 30 June 2014. This increase was due to the expansion of the stake in Augusta Technologie AG ("Augusta") in the third quarter to 91.2% from 62.3%, plus an increase in the working capital. The net debt / EBITDA ratio came in at 1.9 and the interest coverage ratio was 18.4, which means TKH is operating well within the financial ratios agreed with the banks.

Solvency decreased to 35.3% at 30 September 2014 (30 June 2014: 40.8%) due to the fact that under IFRS goodwill paid on the additional stake acquired in Augusta is deducted from equity.

Telecom Solutions

Telecom Solutions saw turnover increase to € 41.3 million, up 6.5% from € 38.8 million in the third quarter of 2013. As in previous quarters, turnover in the copper network systems sub-segment declined strongly. This was due to a continued shift in priorities among telecom operators towards investments in optical fibre network systems and 4G networks. This decline was offset by growth in the sub-segments optical fibre systems and indoor telecom systems.

The increase in turnover combined with a modest increase in costs resulted in an improvement in EBITA in the third quarter of 2014 compared to the same period of last year.

Building Solutions

Turnover in Building Solutions fell slightly, by 0.1% to € 125.5 million in the third quarter of 2014, from € 125.7 million in the year earlier period. Acquisitions accounted for 1.7% growth. While reduced raw materials prices had a negative impact of 0.2% on turnover. On balance, the organic drop in turnover came in at 1.6%. Turnover increased in the sub-segments building technologies and vision & security systems. In the sub-segment connectivity systems, turnover fell due to a continued decline in the building and construction market in the Benelux. However, the business did see an increase in order intake thanks to TKH’s successful international positioning in the oil, gas and marine sector. TKH decided to increase production capacity with specific capabilities for submarine cables in order to boost the company’s position in the oil and gas industry, one of the defined vertical growth markets, and wind turbine parks. The additional production capacity will be available in the fourth quarter of 2015 and will lead to a capex of over € 20 million.

EBITA increased in comparison to the third quarter of 2013 on the back of improvements in the product mix and lower costs.

Industrial Solutions

Turnover in the Industrial Solutions segment came in at € 173.3 million, up 22.3% from € 141.7 million in the third quarter of 2013. Raw materials prices had a negative impact of 0.1% on turnover. On balance, the organic growth in turnover came in at 22.4%. The increase in turnover was realised by the sub-segment manufacturing systems, due to continued growth within the top five of the tyre manufacturing industry and strong demand from Asia. Order intake in manufacturing systems for the year to date totalled more than € 300 million and continued at a high level. Turnover in the sub-segment connectivity systems was in line with the figures from last year.

EBITA increased significantly thanks to the strong increase in turnover and high efficiency levels.

Developments in the first nine months of the year

Turnover in the first nine months of 2014 was 11.6% higher at € 997.3 million. Lower charged-on raw materials prices had a negative impact of 0.9% on turnover. The contribution from acquisitions to turnover was 0.5%. On balance, the organic increase in turnover came in at 12.0%.

EBITA for the first nine months of the year was 43.7% higher at € 95.4 million (first nine months of 2013: € 66.4 million). Net profit before amortisation attributable to shareholders rose by 69.9% to € 60.3 million in the first nine months of 2014 (first nine months of 2013: € 35.5 million).

Outlook

TKH’s activities are developing in line with the outlook published in August 2014, when the company published its half year results for 2014.

Based on the results booked in the first nine months of 2014 and the outlook for the coming months, and barring unforeseen circumstances, TKH expects net profit before amortisation and one-off income and expenses attributable to shareholders for the full year 2014 of between € 80 million and € 85 million.