Q3 2015 Market update

Press Release

Haaksbergen, the Netherlands

5 Nov 2015

Highlights third quarter

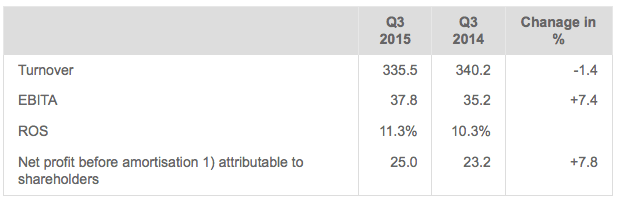

- Turnover 1.4% lower at € 335.5 million, organic decline of 4.0%.

- Turnover 10.7% higher at Building Solutions and 2.3% higher at Telecom Solutions.

- Turnover decline of 11.0% at Industrial Solutions, in line with reduced order intake in previous quarters.

- EBITA 7.4% higher, driven by the sharp increase at Building Solutions, partly due to solid contribution acquisitions.

- Increase ROS to 11.3% due to gross margin improvement in all segments.

- Net profit before amortisation increases 7.8%.

Highlights first nine months

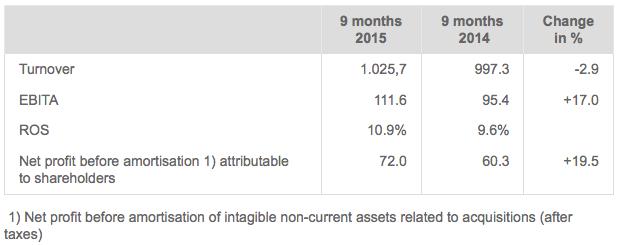

- Turnover 2.9% higher at € 1,025.7 million, organic decline in turnover of 1.3%.

- EBITA 17.0% higher, due to acquisitions and focus on vertical growth markets with higher margins.

Outlook

- Reiterating the forecast for the full year 2015: net profit before amortisation and one-off income and expenses attributable to shareholders, of between € 93 million and € 98 million (2014: € 86.3 million).

Key figures third quarter (in € millions unless otherwise stated)

Key figures first nine months (in € millions unless otherwise stated)

Alexander van der Lof, CEO of technology company TKH:

"Despite the decline in turnover due to the reduced order intake in Industrial Solutions, the overall result of the TKH Group improved. The higher margins realised within the vertical growth markets made a considerable contribution to this. Building Solutions performed well in the third quarter, as a result of both acquisitions as well as healthy organic growth. Due to gross margin improvements in all Solutions segments, the ROS increased to 11.3%. In the manufacturing systems segment the order intake increased in the third quarter, despite continued reluctance in China to invest. Good progress was made in the positioning within the top-5 tyre manufacturers.”

Financial developments third quarter

In the third quarter of 2015, turnover declined by 1.4% to € 335.5 million (Q3 2014: € 340.2 million). Acquisitions (Commend Group) accounted for 3.0% of turnover. Stronger foreign currencies compared to the euro had a positive effect of 2.2% on turnover. Reductions in inventories and average lower raw materials prices had a negative effect of 2.6% on turnover. On balance, turnover declined by 4.0% organically.

The turnover decline was entirely due to Industrial Solutions, where lower order intake in previous quarters led to an 11.0% decline in turnover in the third quarter. However, at Telecom Solutions and Building Solutions turnover increased by 2.3% and 10.7% respectively. Innovations once again made a strong contribution to turnover.

The operating result before amortisation of intangible assets (EBITA) increased by 7.4% to € 37.8 million in the third quarter of 2015 (Q3 2014: € 35.2 million). The increase in result was due to the increase in the gross margin to 46.7%, from 42.8%. The gross margin improved due to the focus on vertical growth markets, an improved product mix and the insourcing of activities.

Operating expenses as a percentage of turnover rose when compared to the third quarter of 2014. The relative increase was due to the insourcing of activities.

The ROS improved to 11.3%, from 10.3%, with the strongest increase at Building Solutions.

Net profit before amortisation attributable to shareholders increased by 7.8% to € 25.0 million (Q3 2014: € 23.2 million).

The working capital fell to 16.8%, from 18.3% at 30 June 2015, in line with the third quarter of 2014.

The net bank debt at 30 September 2015, according to the bank covenants, declined compared to 30 June 2015 by € 36.9 million to € 249.1 million, mainly due to the drop in working capital. The net debt/EBITDA ratio was 1.4 and the interest coverage ratio was 23.2, which means TKH is operating well within the financial ratios agreed with the banks.

Telecom Solutions

Turnover in the Telecom Solutions segment increased by 2.3% to € 42.3 million. Currency exchange rates had a positive effect of 1.3% on turnover, while reductions in inventories resulted in a 2.4% decline in turnover. Excluding these effects, Telecom Solutions realised an organic increase in turnover of 3.4%. This growth was booked outside the Netherlands, in both Europe and China. Turnover in the Netherlands was down due to a shift in priorities from investments in fibre optic networks to upgrades of copper networks.

The increase in turnover and improved gross margin resulted in an increase of EBITA in Telecom Solutions in the third quarter of 2015 when compared to the same period of last year.

Building Solutions

Turnover in the Building Solutions segment increased by 10.7% to € 138.9 million. Acquisitions accounted for growth of 8.2%, while currency exchange rates had a positive effect of 3.7% on turnover. Lower raw materials prices had a negative effect of 1.2%, while the reduction of inventories also resulted in a decrease of 4.3%. On balance, turnover increased by 4.3% organically. The vertical growth markets made healthy contributions to the growth realised. The building and construction market in Europe also showed signs of recovery.

Higher turnover and an improved product mix resulted in a sharp increase of EBITA in Building Solutions compared to the third quarter of 2014.

Industrial Solutions

Turnover in the Industrial Solutions segment declined by 11.0% to € 154.2 million. Currency exchange rates had a positive effect of 1.3% on turnover. Turnover declined by 0.7% due to lower average raw materials prices. The organic decline in turnover was 11.6%. This decline was in line with the reduced order intake in the manufacturing systems segment during the previous quarters due to reluctance to invest in the tyre manufacturing industry in China. Order intake in manufacturing systems amounted to € 80 million in the third quarter, an increase compared to the € 60 million in the second quarter of 2015. The order intake from China was limited, however, the deliveries of ordered machines came back on track. The increase in order intake outside China was broadly based, both in terms of customers and geographical distribution. Also, good progress was made in the positioning within the top-5 tyre manufacturers. It was decided to expand the capacity for production of tyre manufacturing systems in Poland.

EBITA in Industrial Solutions showed a decrease compared to the same period last year. However, EBITA in relation to turnover remained at a similar level due to the insourcing of activities and improvements in gross margin.

Developments in the first nine months

Turnover in the first nine months of 2015 increased 2.9% to € 1,025.7 million. Acquisitions accounted for 3.1% of turnover. Strong foreign currencies compared to the euro had a positive effect of 2.1% of turnover. Reductions in inventories reduced turnover by 1.0%. On balance, turnover decreased by 1.3% organically.

EBITA in the first nine months of the year increased 17.0% to € 111.6 million (first 9 months 2014: € 95.4 million). Net profit before amortisation attributable to shareholders increased by 19.5% to € 72.0 million (first 9 months 2014: € 60.3 million).

Outlook

The activities are developing in line with the previous forecast published in August 2015, when TKH reported its 2015 interim results.

Based on the results realised in the first nine months of 2015 and the outlook for the coming months, TKH reiterates its forecast to the effect that, barring unforeseen circumstances, net profit before amortisation and one-off income and expenses, attributable to shareholders, for the full year 2015 will be within the earlier outlined bandwidth of between € 93 million and € 98 million (2014: € 86.3 million).