Q3 2016 Market update

Press Release

Haaksbergen, the Netherlands

3 Nov 2016

Trading update 3rd quarter 2016

Highlights third quarter

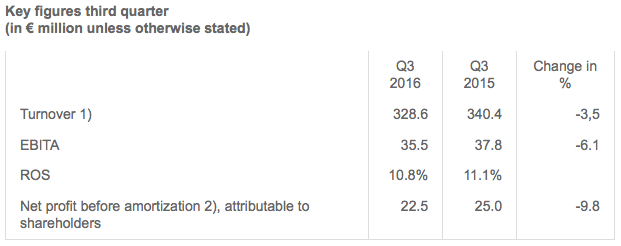

- Turnover decline of 3.5% to € 328.6 million – organic turnover decline 2.1%.

- Organic increase in turnover of 2.3% in Building Solutions.

- Organic decline in turnover of 0.2% in Telecom Solutions.

- Organic decline in turnover 6.7% in Industrial Solutions, in line with previously communicated reduced order intake duo to Chinese reluctance to invest.

- EBITA declined by 6.1% due to reduced turnover at Industrial Solutions, despite increase in EBITA in Telecom Solutions and Building Solutions.

Highlights first nine months

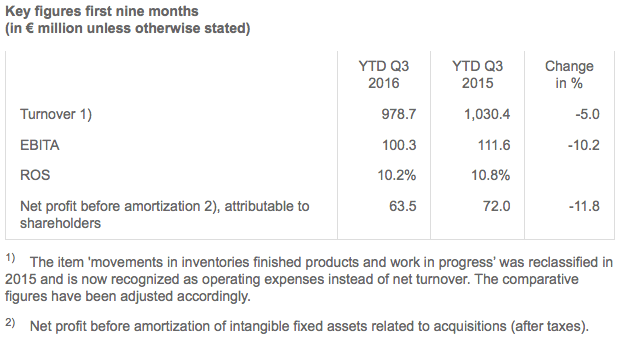

- Decline in turnover of 5.0% to € 978.7 million – organic decline of 2.7%.

- Decline in EBITA of 10.2% largely due to lower turnover in Industrial Solutions.

Outlook

- Reiterating outlook for the full year 2016: Net profit before amortization and one-off income and expenses, attributable to shareholders, of between € 88 million and € 93 million (2015: € 99.9 million).

Alexander van der Lof, CEO of technology company TKH: “The decline in result levelled off in the third quarter when compared to the first half of the year. The improvement came on the back of organic growth in turnover and profit in Building Solutions. In the Industrial Solutions segment, order intake improved in the sub-segment manufacturing systems, but still lagged the targeted intake level based on the increased number of announced projects in the tire building industry. The outlook is positive for higher order intake in the coming quarters.”

Developments in the third quarter

Turnover declined by 3.5% to € 328.6 million in the third quarter of 2016 (Q3 2015: € 340.4 million). The divestment of Parking & Protection resulted in a drop in turnover of 0.4%, while the acquisition of Hella Airfield Ground Lighting resulted in a 0.2% increase in turnover. Weaker foreign currencies vis-à-vis the euro had a negative exchange rate effect of 0.4% on turnover. Lower raw materials prices had a negative effect of 0.8% on turnover. On balance, turnover declined organically by 2.1%.

Industrial Solutions accounted for the majority of the decline in turnover, where the turnover declined organically by 6.7%, as a result of reduced order intake in the sub-segment manufacturing systems in past quarters. In Telecom Solutions, turnover declined organically by 0.2%, while turnover in Building Solutions showed an organic increase of 2.3%.

The gross margin remained stable at 46.1% in the third quarter of 2016 (Q3 2015: 46.0%). Operating expenses were 2.5% lower when compared to the third quarter of 2015. However, as a percentage of turnover, operating expenses rose to 35.3% in the third quarter of 2016, from 34.9% in the third quarter of 2015. The relative increase was largely due to lower turnover levels, where R&D spending, particularly in the Building Solutions segment in preparation for the targeted growth in the vertical growth markets, was higher.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) was down 6.1% at € 35.5 million in the third quarter of 2016 (Q3 2015: € 37.8 million). ROS declined slightly to 10.8% (Q3 2015: 11.1%).

The tax burden remained at a comparable level to the third quarter of 2015.

Net profit before amortization, attributable to shareholders declined 9.8% to € 22.5 million (Q3 2015: € 25.0 million).

The working capital as a percentage of turnover dropped to 15.8%, compared to 16.7% at the end of the third quarter of 2015. The improvement in working capital was largely realized within the manufacturing systems sub-segment. The working capital increased in comparison with 30 June 2016 (14.4%) on the back of seasonal influences.

Net bank debt calculated in accordance with the bank covenants had increased to € 207.9 million on 30 September 2016, up € 0.8 million when compared to 30 June 2016. The net debt/EBITDA ratio stood at 1.3 and the interest cover ratio was 23.1. TKH is operating well within the financial ratios agreed with its banks.

Telecom Solutions

Telecom Solutions comprises two sub-segments: indoor telecom & copper network systems and fibre network systems.

Turnover in the Telecom Solutions segment was down 1.2% at € 42.4 million. Currency exchange rates had a negative impact of 1.0% on turnover. The organic decline in turnover was 0.2%, which was entirely due to the sub-segment indoor telecom & copper networks. The organic turnover in the sub-segment fibre network systems increased due to a strong demand for optical fibre in China and an increase in the number of projects in Germany. De demand for optical fibre in the Netherlands and Poland declined.

High capacity utilization in fibre optics production and a modest increase in added value resulted in an increase in EBITA in Telecom Solutions in the third quarter of 2016 when compared to the same period of the previous year.

Building Solutions

Building Solutions comprises two sub-segments: vision & security systems and connectivity systems.

Turnover in the Building Solutions segment increased by 0.1% to € 144.4 million. The divestment of Parking & Protection resulted in a decline in turnover of 0.9%, while the acquisition of Hella Airfield Ground Lighting added 0.4% to turnover. Currency exchange rates had a negative impact of 0.7%. Lower raw materials prices had an effect of 1.0%. Overall organic growth came in at 2.3%, mainly due to turnover growth in the sub-segment connectivity systems. Turnover in the sub-segment vision & security systems was comparable to the year-earlier period.

The EBITA in Building Solutions increased when compared to the third quarter of 2015, largely due to the higher turnover and higher added value, in percentage terms, in the sub-segment connectivity systems. The improvement in EBITA was realized despite higher spending on R&D.

Industrial Solutions

Industrial Solutions comprises two sub-segments: connectivity systems and manufacturing systems.

Turnover in the Industrial Solutions segment was 7.5% lower at € 141.8 million. Lower raw materials prices had a negative impact of 0.8% on turnover. Turnover declined organically by 6.7%, despite growth in the sub-segment connectivity systems. The decline was recorded in the sub-segment manufacturing systems and was due to lower order intake in previous quarters as a result of the reluctance to invest in the tire building industry in China. The order intake in manufacturing systems was € 62 million in the third quarter of 2016 and was therefore higher than in the previous quarter. The major projects that have been announced in the tire building industry have not yet materialized in the order intake in the third quarter, but provide a positive outlook for higher order intake in the coming quarters.

The EBITA in Industrial Solutions was down when compared to the third quarter of 2015, due to the lower turnover.

Developments in the first nine months

Turnover in the first nine months of 2016 was 5.0% lower at € 978.7 million. The divestment of Parking & Protection had a negative impact of 0.4% on turnover, while the contribution from the acquisition of Hella Airfield Ground Lighting was still limited. In addition, lower raw materials prices and exchange rate effects have a negative impact of 2.0% on turnover. The organic decline in turnover was 2.7%.

EBITA in the first nine months of the year fell by 10.2% to € 100.3 million (first nine month of 2015: € 111.6 million).

Net profit before amortization, attributable to shareholders, was 11.8% lower at € 63.5 million in the first nine months of the year (first nine month of 2015: € 72.0 million).

Outlook

TKH’s activities are developing in line with the outlook given at the announcement of the results for the first half of 2016.

Based on the results realized in the first nine months of 2016 and the outlook for the coming months, TKH reiterates its forecast that, barring unforeseen circumstances, net profit before amortization and one-off income and expenses, attributable to shareholders, for the full year 2016 will be within the previously outlined range of between € 88 million and € 93 million (2015: € 99.9 million).