Q3 2017 Market update

Press Release

Haaksbergen, the Netherlands

2 Nov 2017

Highlights third quarter

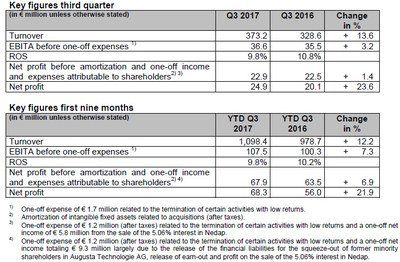

- Turnover up 13.6% at € 373.2 million – organic increase 12.0%.

- Organic increase in turnover Telecom Solutions (13.4%), Building Solutions (9.4%) and Industrial Solutions (14.3).

- High organic growth mainly due to the success of the focus on vertical growth markets.

- EBITA up 3.2% at € 36.6 million – driven by Telecom and Industrial Solutions.

- Due to high start-up costs in the vertical markets Marine & Offshore, Tunnel & Infra and Parking the EBITA declined at Building Solutions.

- Sale of 5.06% interest in Nedap results in one-off net income of € 5.8 million.

- One-off expense of € 1.7 million related to the termination of activities with low returns.

Highlights first nine months

- Turnover increase of 12.2% to € 1,098.4 million – organic increase 10.1%.

- Increase EBITA 7.3% despite higher start-up costs.

Outlook

- Strengthening of focus on core activities and improvement of returns results in one-off expense of around € 4 - 5 million in Q4.

- TKH reiterates its forecast for the full-year 2017: net profit before amortization and one-off income and expenses attributable to shareholders of between € 92 and €97 million (2016: € 94.4 million).

Alexander van der Lof, CEO of technology company TKH: “Our focus on the vertical growth markets and the related building blocks, results in a further increase of our organic growth. This is a clear proof that our strategy works. Where we are still facing start-up costs of new technology and production capacity expansion, this will normalize in 2018, with which turnover growth will also result in an increase of our profitability. In line with the third quarter, one-off expenses will be recognized in the fourth quarter related to the termination of certain activities and the improvement of returns from a number of activities. Because of a strengthening of our focus on core activities and improvement of returns, we create perspective for accelerating the rise in ROS in the medium term.”

Developments third quarter

In the third quarter of 2017, turnover came in € 44.6 million (13.6%) higher at € 373.2 million (Q3 2016: € 328.6 million). Higher raw materials prices accounted for a 1.9% increase in turnover. Acquisitions accounted for 0.7% of the higher turnover. On average weaker foreign currencies against the euro had a negative impact of 1.0% on turnover. On balance, turnover showed organic growth of 12.0%. TKH recorded higher turnover in all segments.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 3.2% to € 36.6 million in the third quarter (Q3 2016: € 35.5 million). The EBITA of both Telecom Solutions and Industrial Solutions increased compared to the same period of 2016, while the EBITA at Building Solutions declined. Although the regular operating expenses as a percentage of revenue declined within this last segment, results in the third quarter continued to be affected by high start-up costs for new technology, production capacity expansion and market positioning within the vertical growth markets, including Marine & Offshore, Tunnel & Infra and Parking. ROS for the TKH-group came in at 9.8% in the third quarter of 2017 (Q3 2016: 10.8%). If the above mentioned start-up costs were excluded, the ROS would have been in line with the ROS of Q3 2016.

In the third quarter, TKH realized a net profit of € 5.8 million on the sale of the 5.06% interest in Nedap. This was counterbalanced by a one-off expense before taxes of € 1.7 million due to the termination of certain activities with low returns.

Net profit before amortization and one-off income and expenses attributable to shareholders came in 1.4% higher at € 22.9 million (Q3 2016: € 22.5 million). Net profit was up 23.6%, partly on the back of the one-off net income.

Net bank debt on 30 September 2017, calculated in accordance with the bank covenants, declined by € 4.1 million compared with 30 June 2017 to € 218.9 million. The net debt / EBITDA ratio came in at 1.2, which means TKH is operating well within the financial ratio agreed with its banks. The sale of the Nedap interest in September 2017 did not have an impact on this, as the value of the interest was deducted from the net bank debt.

Working capital as a percentage of turnover dropped to 14.8%, compared with 15.8% on 30 September 2016.

Developments per solutions segment

Telecom Solutions

Telecom Solutions comprises two sub-segments: indoor telecom & copper network systems and fiber network systems.

Turnover in the Telecom Solutions segment increased by 12.4% to € 47.6 million (Q3 2016: € 42.4 million). Organic turnover growth came in at 13.4%, while currency exchange rates had a negative impact of 1.0% on turnover. TKH recorded growth in both sub-segments, with the main contribution coming from fiber network systems. In particular, strong growth was realized in Germany, Poland and France. Partly due to strong global demand for optical fiber, TKH was able to realize this growth at improved price levels.

EBITA increased when compared to the same period of 2016, on the back of higher turnover and an improved gross margin.

Building Solutions

Building Solutions comprises two sub-segments: vision & security systems and connectivity systems.

Turnover in the Building Solutions segment came in 11.4% higher at € 160.8 million (Q3 2016: € 144.4 million). Organic turnover growth came in at 9.4%. Acquisitions accounted for 1.6% of the turnover growth. Currency exchange rates had a negative impact of 1.9% on turnover. Higher raw materials prices had an impact of 2.3% on turnover. The organic growth was largely realized in the vertical growth markets Machine Vision, together with Tunnel & Infra and Marine & Offshore due to increasing demand for connectivity systems. In contrast, TKH saw pressure on margins in the security segment. In the third quarter, TKH took measures to improve returns, resulting in a one-off expense of € 1.7 million.

EBITA excluding one-off expenses was down in the third quarter, due to higher costs related to the expansion of production capacity for subsea cable systems and the development of the airfield ground lighting portfolio (CEDD), which are still generating limited turnover.

Industrial Solutions

Industrial Solutions comprises two sub-segments: connectivity systems and manufacturing systems.

Turnover in the Industrial Solutions segment was up by 16.2% at € 164.7 million (Q3 2016: € 141.8 million). Higher average raw materials prices accounted for a 1.9% rise in turnover. Turnover increased organically by 14.3%. The increase in turnover was accounted for by both sub-segments. In manufacturing systems, the third quarter saw a better balance between engineering and production. In the third quarter, the order intake for tire-building systems came in at € 66 million and was therefore at a slightly higher level than in the third quarter of 2016. In the first nine months, order intake stood at € 294 million (first nine months of 2016: € 192 million).

EBITA was higher as a result of the higher turnover.

Developments in the first nine months of 2017

Turnover in the first nine months of 2017 was up by 12.2% at € 1,098.4 million. Higher raw materials prices accounted for a 1.9% increase in turnover, while lower average foreign currency exchange rates against the euro had a slightly negative impact (0.3%). Acquisitions accounted for a 0.5% increase in turnover. On balance, turnover increased organically by 10.1%. TKH realized turnover growth in all segments.

EBITA before one-off income and expenses came in 7.3% higher at € 107.5 million in the first nine months of 2017 (first nine months of 2016: € 100.3 million).

Net profit before amortization and one-off income and expenses attributable to shareholders rose by 6.9% to € 67.9 million in the first nine months of 2017 (first nine months of 2016: € 63.5 million). Net profit rose by 21.9% to € 68.3 million from € 56.0 million.

Outlook

TKH’s activities are developing in line with the forecast the company gave at the announcement of its results for the first half of 2017.

As a result of the strengthening of our strategic focus and the realization of our return targets and in line with the measures initiated in the third quarter, TKH will recognize a one-off expense totaling around € 4 - 5 million, related to the termination of certain activities and to the improvement of the returns from a number of activities mainly within Building Solutions.

Based on the results realized in the first nine months of 2017 and the outlook for the coming months, TKH reiterates its forecast that, barring unforeseen circumstances, net profit before amortization and one-off income and expenses attributable to shareholders for the full year 2017 will be within the previously outlined bandwidth of between € 92 and € 97 million (2016: € 94.4 million).